Class+3+ +quantitative+analysis+exercise+answer+key

•

1 gefällt mir•14,508 views

Melden

Teilen

Melden

Teilen

Downloaden Sie, um offline zu lesen

Empfohlen

Weitere ähnliche Inhalte

Was ist angesagt?

Was ist angesagt? (20)

Case analysis :Gino SA distribution channel management

Case analysis :Gino SA distribution channel management

Aqualisa Quartz - Simply A Better Shower (HBR Case Study)

Aqualisa Quartz - Simply A Better Shower (HBR Case Study)

Clique Pens Pricing: The Writing Implements Division of U.S. Home

Clique Pens Pricing: The Writing Implements Division of U.S. Home

L'Oreal Of Paris: Bringing "Class To Mass" With Plénitude

L'Oreal Of Paris: Bringing "Class To Mass" With Plénitude

Andere mochten auch

Andere mochten auch (20)

Source codes for alerts lovs and reports generation(database)

Source codes for alerts lovs and reports generation(database)

Souce code of validation trigger examples(database)

Souce code of validation trigger examples(database)

Ähnlich wie Class+3+ +quantitative+analysis+exercise+answer+key

Ähnlich wie Class+3+ +quantitative+analysis+exercise+answer+key (20)

Principles_of_Managerial_Economics_-_Yahya_Alshehhi

Principles_of_Managerial_Economics_-_Yahya_Alshehhi

Chapter 11 Cost Volume Profit Analysis : A Managerial Planning Tool

Chapter 11 Cost Volume Profit Analysis : A Managerial Planning Tool

2. Cost Volume Profit Analysis - a tool for decision making

2. Cost Volume Profit Analysis - a tool for decision making

NCV 2 Entrepreneurship Hands-On Support Slide Show - Module 3

NCV 2 Entrepreneurship Hands-On Support Slide Show - Module 3

Mehr von welcometofacebook

Mehr von welcometofacebook (15)

Kürzlich hochgeladen

Richard van der Velde, Technical Support Lead for Cookiebot @CMP – “Artificia...

Richard van der Velde, Technical Support Lead for Cookiebot @CMP – “Artificia...Associazione Digital Days

Kürzlich hochgeladen (20)

Richard van der Velde, Technical Support Lead for Cookiebot @CMP – “Artificia...

Richard van der Velde, Technical Support Lead for Cookiebot @CMP – “Artificia...

2024 WTF - what's working in mobile user acquisition

2024 WTF - what's working in mobile user acquisition

Creating a Successful Digital Marketing Campaign.pdf

Creating a Successful Digital Marketing Campaign.pdf

5 Digital Marketing Tips | Devherds Software Solutions

5 Digital Marketing Tips | Devherds Software Solutions

top marketing posters - Fresh Spar Technologies - Manojkumar C

top marketing posters - Fresh Spar Technologies - Manojkumar C

Content Marketing: How To Find The True Value Of Your Marketing Funnel

Content Marketing: How To Find The True Value Of Your Marketing Funnel

A Comprehensive Guide to Technical SEO | Banyanbrain

A Comprehensive Guide to Technical SEO | Banyanbrain

Unlocking Passive Income: The Power of Affiliate Marketing

Unlocking Passive Income: The Power of Affiliate Marketing

The Evolution of Internet : How consumers use technology and its impact on th...

The Evolution of Internet : How consumers use technology and its impact on th...

Navigating Global Markets and Strategies for Success

Navigating Global Markets and Strategies for Success

Dave Cousin TW-BERT Good for Users, Good for SEOsBrighton SEO Deck

Dave Cousin TW-BERT Good for Users, Good for SEOsBrighton SEO Deck

2024's Top PPC Tactics: Triple Your Google Ads Local Leads

2024's Top PPC Tactics: Triple Your Google Ads Local Leads

Digital Marketing Courses In Pune- school Of Internet Marketing

Digital Marketing Courses In Pune- school Of Internet Marketing

SEO Forecasting by Nitin Manchanda at Berlin SEO & Content Club

SEO Forecasting by Nitin Manchanda at Berlin SEO & Content Club

Class+3+ +quantitative+analysis+exercise+answer+key

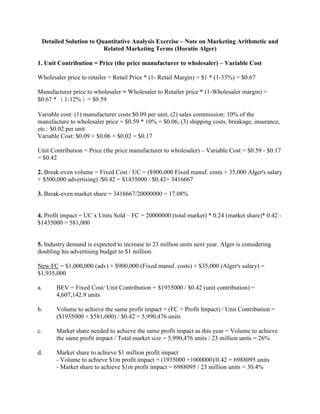

- 1. Detailed Solution to Quantitative Analysis Exercise – Note on Marketing Arithmetic and Related Marketing Terms (Horatio Alger) 1. Unit Contribution = Price (the price manufacturer to wholesaler) – Variable Cost Wholesaler price to retailer = Retail Price * (1- Retail Margin) = $1 * (1-33%) = $0.67 Manufacturer price to wholesaler = Wholesaler to Retailer price * (1-Wholesaler margin) = $0.67 * (1-12%)= $0.59 Variable cost: (1) manufacturer costs $0.09 per unit, (2) sales commission: 10% of the manufacture to wholesaler price = $0.59 * 10% = $0.06, (3) shipping costs, breakage, insurance, etc.: $0.02 per unit Variable Cost: $0.09 + $0.06 + $0.02 = $0.17 Unit Contribution = Price (the price manufacturer to wholesaler) – Variable Cost = $0.59 - $0.17 = $0.42 2. Break-even volume = Fixed Cost / UC = ($900,000 Fixed manuf. costs + 35,000 Alger's salary + $500,000 advertising) /$0.42 = $1435000 / $0.42= 3416667 3. Break-even market share = 3416667/20000000 = 17.08% 4. Profit impact = UC x Units Sold – FC = 20000000 (total market) * 0.24 (market share)* 0.42 - $1435000 = 581,000 5. Industry demand is expected to increase to 23 million units next year. Alger is considering doubling his advertising budget to $1 million. New FC = $1,000,000 (adv) + $900,000 (Fixed manuf. costs) + $35,000 (Alger's salary) = $1,935,000 a. BEV = Fixed Cost/ Unit Contribution = $1935000 / $0.42 (unit contribution) = 4,607,142.9 units b. Volume to achieve the same profit impact = (FC + Profit Impact) / Unit Contribution = ($1935000 + $581,000) / $0.42 = 5,990,476 units c. Market share needed to achieve the same profit impact as this year = Volume to achieve the same profit impact / Total market size = 5,990,476 units / 23 million units = 26% d. Market share to achieve $1 million profit impact - Volume to achieve $1m profit impact = (1935000 +1000000)/0.42 = 6988095 units - Market share to achieve $1m profit impact = 6988095 / 23 million units = 30.4%

- 2. 6. Suppose Alger decided not to raise advertising budget, instead he will raise retailer margins to 40%. a. Raise the retailer margin to 40% and the wholesaler margin remains the same 12%. This means the manufacturer would have to cut their price. Thus the new manufacturer selling price: $1 * (1-40%) * (1-12%) = $0.528. The tricky thing is now VC has changed too because the sales commission is 10% of the manufacturer sales price. So now the new variable cost is $0.09 + $0.0528 + $0.02 = $0.1628. Unit Contribution = Price – VC = 0.528 - 0.1628 = 0.365 Fixed cost remains the same: 900000 + 500000 + 35000 = 1435000 BEV = 1435000 / 0.365 = 3,931,507 units b. Volume for the same profit impact = (FC + Profit impact) / UC = (1435000 + 581000) / 0.365 = 5,523,288 units c. Market share to achieve this profit impact = 5,523,288 units / 23,000,000 units (projected market size next year) = 24% d. Market share to achieve $350,000 profit impact = Volume for $350,000 profit impact / Projected market size next year = (FC + Profit impact) / UC / Projected market size next year = (1435000+$350,000) / 0.365 / 23,000,000 = 21.3%