Tomo Wavelabs I-Corps@NIH 121014

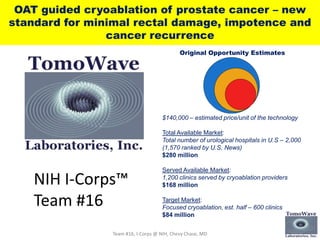

- 1. OAT guided cryoablation of prostate cancer – new standard for minimal rectal damage, impotence and cancer recurrence Original Opportunity Estimates $140,000 – estimated price/unit of the technology Total Available Market: Total number of urological hospitals in U.S – 2,000 (1,570 ranked by U.S. News) $280 million Served Available Market: 1,200 clinics served by cryoablation providers $168 million Target Market: Focused cryoablation, est. half – 600 clinics $84 million Team #16, I-Corps @ NIH, Chevy Chase, MD NIH I-Corps™ Team #16

- 2. Sergey Ermilov (C-level Exec) VP Research and Development Peter Brecht (Industry Exp) Director, Business Development Elena Petrova (PI) Scientist Customer interviews: 126 Instructor engagements: 43 Week 1 Week 10 Team 16 Team #16, I-Corps @ NIH, Chevy Chase, MD Fast Faster

- 3. Original idea $140,000 x 600 = $84,000,000 600 units: High-resolution T-maps Enhanced contrast of ice ball urologist TomoWave, Inc. 37oC Physiological temperature -7oC Freezing -6oC Flipped OA signal -1oC T0 – zero OA signal Temperature Team #16, I-Corps @ NIH, Chevy Chase, MD DIRECT SALE TO PHYSICIANS

- 4. Week 1: Business Model Canvas Team #16, I-Corps @ NIH, Chevy Chase, MD Tech Features Collage of “Customers”

- 5. And next we … GooB Urologic surgeons Hospital specialists Thermal therapy scientists Patient support groups Got out of the Building! Team #16, I-Corps @ NIH, Chevy Chase, MD

- 6. GooB ― first experience Team #16, I-Corps @ NIH, Chevy Chase, MD

- 7. GooB ― solution Well … just walk in to the hospital! Team #16, I-Corps @ NIH, Chevy Chase, MD

- 8. Reality 1: We are doctors! And we need better treatment control and … better money! 1 C accuracy 1 mm spatial resolution 1 frame per second Team #16, I-Corps @ NIH, Chevy Chase, MD Doctor’s Pains Doctor’s Gain

- 9. Reality 2: … and, by the way, we do not buy your equipment!. Mobile service instead! Selling Leasing Team #16, I-Corps @ NIH, Chevy Chase, MD Buyer

- 10. Customer archetypes o 50-75 years old man diagnosed with a localized prostate cancer o Pays in full or splits costs with medical insurance o Values excellent cancer control, fast recovery & min complications o 30-60 years old o Practices cryoablation or just from residency o Mostly rents equipment and buys consumables o Values patient’s satisfaction, fast learning & payment comparable to office dollars TomoWave Cryoablation business Patient Urologist Decision Maker User, Influencer Buyer o Stressed by competition and defiant surgeons o CEO, Director of Marketing, CTO o Buys/licenses monitoring technology or OEM o Values larger servable market & competitive advantage Proposer: academic urologist experimenting with novel prostate cancer treatment techniques Saboteur: prostatectomy guru and radiologist Team #16, I-Corps @ NIH, Chevy Chase, MD

- 11. Reality 3: Customers need market growth! Partnership is unavoidable! Team #16, I-Corps @ NIH, Chevy Chase, MD Texas

- 12. Cryoablation of prostate cancer: Cash flow Team #16, I-Corps @ NIH, Chevy Chase, MD Clinical Technology Ultrasound OEM Patient Cryoablation manufacturer- provider OAT OEM (TWL) Private Insurance Urologist Product/Service Payment Medicare Outpatient facility Cancer treatment & post-treatment activities $1k, annual payments Self-payment per procedure Self-payment per procedure $786 per procedure $800-1k per procedure Federal tax $5.5k per procedure Lease equipment, sell consumables

- 13. Market Size Team #16, I-Corps @ NIH, Chevy Chase, MD $5,500 – price of a single cryoablation procedure Based on HealthTronics pricing 12,000 – current number of annual prostate cryoablation treatments in US Based on HealthTronics estimates 230,000 – number of new prostate cancer cases in US in 2014 http://seer.cancer.gov/statfacts/html/prost.html Total Available Market: 100% market dominance. Fixed price. 50-50 split of the revenue growth $600 million Served Available Market: Double current prostate cryoablation market. Fixed price. 50-50 split of the revenue growth $66 million Target Market: Double prostate cryoablation market for a single major player. Fixed price. 50-50 split of the revenue growth $33 million

- 14. Week 1 Week 2 Week 3 Week 4 Week 5 Week 6 Week 7 Week 8 Week 9 Week 10 NIH I-Corps™ lessons learned Cryo- provider •Better Control •Easy Learning Urologist •Better Control •Easy Learning Cryo- provider •OEM •License •Tech sale Cryo- provider •Partners •Market Growth Urologist •Technical Specs Urologist •Better Control •Easy Learning •Reimbursement Team #16, I-Corps @ NIH, Chevy Chase, MD

- 15. Our Journey LaunchPad Business Model Canvas: Week 1 Team #16, I-Corps @ NIH, Chevy Chase, MD

- 16. Our Journey LaunchPad Business Model Canvas: Week 3 Team #16, I-Corps @ NIH, Chevy Chase, MD

- 17. Our Journey LaunchPad Business Model Canvas: Week 6 Team #16, I-Corps @ NIH, Chevy Chase, MD

- 18. Our Journey LaunchPad Business Model Canvas: Week 8 Team #16, I-Corps @ NIH, Chevy Chase, MD

- 19. Our Journey LaunchPad Business Model Canvas: Week 10 Team #16, I-Corps @ NIH, Chevy Chase, MD

- 20. $ 60M = double of annual revenue Urologist 2 Leasing No complications No cancer 2 Happy patient w/o cancer Technology License OEM Cryoequipment provider Next? … To be continued! TomoWave Laboratories, Inc. Team #16, I-Corps @ NIH, Chevy Chase, MD

- 21. Final Notes Team #16, I-Corps @ NIH, Chevy Chase, MD With respect to submitting an SBIR/STTR Phase II application, we are making the following decision (PICK ONE): •Go with a significant pivot: The feasibility data generated in the Phase I grant provide the appropriate technical foundation for a Phase II application, BUT we are targeting very different customer segments than we had originally anticipated Start Current Investment Readiness Level (IRL) Prior to NIH I-Corps™ – 1 Current – 5

- 22. APPENDIX Team #16, I-Corps @ NIH, Chevy Chase, MD

- 23. Slide A1: Story Telling The World: market/Opportunity – how it operates Characters: Customers/Value Proposition/Product-Market-Fit, pick few examples to illustrate Narrative arc – lessons learned how? Enthusiasm, despair, learning, then insight! Show images and demo to illustrate learning Editing – does each slide advance the characters and plot? Team #16, I-Corps @ NIH, Chevy Chase, MD

- 24. Slide A2: Theater Point audience at what they need to see! Self-explanatory Use analogies Tell a story that others can repeat Use common audience appropriate language Team #16, I-Corps @ NIH, Chevy Chase, MD

- 25. Team #16, I-Corps @ NIH, Chevy Chase, MD OAT guided cryoablation of prostate cancer – new standard for minimal rectal damage, impotence and cancer recurrence Interviews: 123 Sergey Ermilov (C-level Exec) Peter Brecht (Industry Exp) Elena Petrova (PI) Team # 16 OA-US module to visualize ice ball with high contrast and monitor temperature near rectal wall Joseph F. Harryhill, “Cryoablation for Salvage Treatment of Prostate Cancer,” Web: Univ. of Pennsylvania Health System, March 23, 2011

- 26. Original Market Estimates Team #16, I-Corps @ NIH, Chevy Chase, MD $140,000 – estimated price/unit of the technology Source: Estimate is based on known price for some of the components(laser, ultrasound probe, DAQ) and company’s price policy for similar system for small animal imaging Total Available Market: Total number of urological hospitals in U.S – 2,000 (1,570 ranked by U.S. News) Source: http://health.usnews.com/best-hospitals/rankings/urology $280 million Served Available Market: Healthtronics, Inc. - major provider of prostate cryoablation – 600 clinics http://www.healthtronics.com/ GalilMedical, Inc. – another, est. about the same 600 clinics http://www.galilmedical.com/ $168 million Target Market: Focused cryoablation, est. half – 600 clinics $84 million

- 27. Customer archetypes Team #16, I-Corps @ NIH, Chevy Chase, MD o 50-75 years old man diagnosed with a localized prostate cancer o Pays in full or splits costs with medical insurance o Values excellent cancer control, fast recovery & min complications o 30-60 years old o Practices cryoablation or just from residency o Mostly rents equipment and buys consumables o Values patient’s satisfaction, fast learning & payment comparable to office dollars TomoWave Cryoablation business Patient Urologist Decision Maker Influencer Buyer o Stressed by competition and defiant surgeons o CEO, Director of Marketing, CTO o Buys/licenses monitoring technology or OEM o Values larger servable market & competitive advantage Proposer: academic urologist experimenting with novel prostate cancer treatment techniques Saboteur: prostatectomy guru and radiologist

- 28. Customer relationships funnel Team #16, I-Corps @ NIH, Chevy Chase, MD New monitoring algorithms New US co-registration ($100k) Journal publications In person communication Co-development Joint journal articles Software updates Hardware & probe upgrades Awareness Interest Consideration Purchase TV & media promotion Free trials of new technology Up-Selling features Cross-Selling new technology with consumables Referral deal on consumables ($1M) Joint clinical studies Presentations & Demo at conferences & med schools Focus groups Existing social media groups Free educational trainings Free trial lease Joint journal articles Low cost lease Free software updates Free on-site trainings Free tech support Dedicated social media group (active recruiting) Relay success stories to general public through TV & social media ($10k) Clinical brochures Paid links from cancer educational websites Clinical brochures Referral by physicians Paid links from cancer educational websites Get Grow Keep Unbundle Up-Sell Cross-Sell Referrals

- 29. The channel economics (approximate numbers) Team #16, I-Corps @ NIH, Chevy Chase, MD Cost of Goods $60K Direct sales to physicians R&D, Selling Cost, Gen & Admin $80K -5% Profit $78K List Price $230K Our revenue $218K Cost of Goods $60K Indirect sales to cryoproviders R&D, Selling Cost, Gen & Admin $70K -5% Pro- fit $55K List Price $230K Our revenue $185K Reseller 15% COGS OEM to cryomanufacturer SGA -5% Pro- fit List Price $380K Our revenue $220K Reseller License? Sell technology? Direct leasing to physicians -5% Profit $1.5K List Price $9K Our revenue $8.5K COGS/20 $3K SGA/20 $4K Indirect leasing to cryoproviders -5% List Price $9K Our revenue $7.2K Pro- fit $0.7K Resell 15% COGS/20 $3K SGA/20 $3.5K

- 30. Key Activities and Resources Team #16, I-Corps @ NIH, Chevy Chase, MD Freedom to operate Quality data Regulatory approval Final product Sales • Internal financing • Patent lawyer •SBIR/SBA •Internal financing •R&D facility, equipment •R&D personnel •SBIR/SBA •Investment •R&D facility and equipment •R&D personnel •Mentors, advisors •Investment •Assembly facility •Laser, optical, US, electronic parts •Trade secrets, patents, licenses • Engineers, tech- nicians, quality control •Mentor, advisors Finance Physical Intellectual Human Purpose Activity Resource •Investment •Internal financing •Marketing personnel •Sales personnel •Customer service •Mentors, advisors 5 steps to our success •Clinical trials •Negotiation of reimburse- ment •Manufacturing •Licensing •Marketing •Sales/Leasing •Education •TechSupport •Blocking patents on OA imaging •Ultrasound license •R&D •Clinical studies

- 31. Key Resources: IP Team #16, I-Corps @ NIH, Chevy Chase, MD Field IP solution Ice ball IP OA technology Thermal monitoring Ultrasound imaging Cryoablation Block- ing patent Trade secrets Blocking patent / licensing Blocking patent / licensing Partners Partners Service directly to urologists Licensing Open platform Development Electronics Soft- ware Probes

- 32. Original Revenue Models Team #16, I-Corps @ NIH, Chevy Chase, MD CMP TWL Urologist Sale Cash Leasing Cash Reimbursement Licensing TWL – TomoWave Labs CMP – Cryoablation Manufacturer & Provider Sales Leasing CMP TWL Urologist Licensing License Fee Leasing Cash Reimbursement Leasing Cash CMP TWL Urologist Leasing Cash Reimbursement

- 33. Cryoablation of prostate cancer: Cash flow Team #16, I-Corps @ NIH, Chevy Chase, MD Clinical Technology Ultrasound OEM Patient Cryoablation manufacturer- provider OAT OEM (TWL) Private Insurance Urologist Product/Service Payment Medicare Outpatient facility Cancer treatment & post-treatment activities $1k, annual payments Self-payment per procedure Self-payment per procedure $786 per procedure $800-1k per procedure Federal tax $5.5k per procedure Lease equipment, sell consumables

- 34. Market Size Team #16, I-Corps @ NIH, Chevy Chase, MD $60,000 – estimated price/unit of the technology Source: Estimate is based on direct costs + 100% margin. $17k – 805 nm Q-switched OEM laser, $7k proprietary modified OEM ultrasound, $6k – proprietary OAUS probe, $0k – proprietary software. Total Available Market: Total number of urological hospitals in U.S – 2,000 (1,570 ranked by U.S. News) Source: http://health.usnews.com/best-hospitals/rankings/urology 1 unit per hospital – 2,000 units $120 million Served Available Market: Current share of cryoablation in prostate cancer ~ 1% Dominating revenue model (>90%) – mobile service Need 50% less units – 1,000 units $60 million Target Market: Bipolar U.S. market of cryoablation providers: HealthTronics www.healthtronics.com 50% market – 200 units GalilMedical www.galilmedical.com 50% market – 200 units Total number of in-field units – 400, Market growth – 600 units $36 million

- 35. Finance and operation timeline Team #16, I-Corps @ NIH, Chevy Chase, MD OEM to CMP 2 (300 units) R&D, Preclin. studies R&D, Clinical studies (30 patients, 3 units), GMP Exclusive OEM to CMP 1 (20 units) Spending Profit Time OEM to CMP 1 (300 units) 6 months 24 months 42 months Co-development with CMP 1 18 months $200k $1M 20 x $30k = $600k 600 x $30k = $18M

- 36. Evolution of Business Model Canvas Team #16, I-Corps @ NIH, Chevy Chase, MD R$: Now only direct sales revenue stream remains CS: Direct sales to one of two major cryoablation manufacturers and providers C: Direct sales via OEM or acquisition KA: Quality control will be required for in-house assembly of OAT units and probes. KA: Requirements for clinical studies were updated to reflect time frame, available funds, and planned business development

- 37. Key Activities and Resources/Partners Team #16, I-Corps @ NIH, Chevy Chase, MD Partner Activity Resource •Clinical trials •Negotiation of reimbursement •Manufacturing •Licensing •Marketing •Sales/Leasing •Education •TechSupport •Patents on OA imaging •Ultrasound license •R&D •Clinical studies Cryoablation provider Clinicians Ultrasound machine producer •R&D personnel •R&D facility, equipment •Consultants •Marketing personnel •Sales personnel •Investment •SBIR/SBA •Assembly facility •Laser, electronics and parts Trade secrets, patents, licenses •Engineers, technicians •Quality control Customer service