NACHA PAYMENTS 2014 Conference Brochure

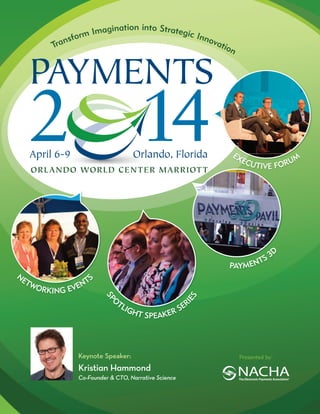

- 1. gination into Strategi c Inn m Ima r ov a nsfo ti o Tra n EX E D ORLANDO WORLD CENTER MARRIOTT UM CUT IVE FOR N SP S ET NT WO RKING EVE O TL IE S 3 TS PAYMEN R IGH SE T SPEAKER Keynote Speaker: Kristian Hammond Co-Founder & CTO, Narrative Science Presented by:

- 2. PAYMENTS 2014 offers a comprehensive examination of the most pressing topics in the payments ecosystem. Experience the PAYMENTS advantage: • More than 130 educational sessions meticulously designed with executives and payments professionals in mind • Demonstrated thought leadership with insightful plenary and concurrent sessions and hands-on workshops • Thousands of payment system experts from financial institutions, established and emerging solution providers and business end users who are driving innovation forward • A dynamic and interactive exhibit hall that includes innovative kiosks and an enhanced PAYMENTS 3D Theater experience • Incomparable networking opportunities tailored especially for executives and payments professionals at all levels Follow. Join. Watch. Follow us on Twitter: @NACHA_PAYMENTS with hashtag: #PAYMENTS2014 Join us on LinkedIn: Search for NACHA, subgroup PAYMENTS 2014 Watch us on YouTube: Search for NACHA 2 I Follow us on Twitter @NACHA_PAYMENTS Hashtag: #PAYMENTS2014 PAYMENTS 2014

- 3. ? Who Should Attend • • • • • • • CEOs Presidents Strategists Retail Bank Executives Solutions Providers Payment Processors Information and Security Officers • • • • • • Risk Management and Compliance Executives Corporate Treasury Managers Payments Operations Directors Innovators and Technologists Consultants Legal Counsel Change is Inevitable. Learn from and network with thousands of key contacts from the enterprises and entities that provide, purchase, support and regulate the payments business. • Inform and enrich your strategic outlook and execution • Gain insights and information from those who are driving change and moving the industry forward • Find the innovative solutions you need to compete in today’s ever-evolving marketplace • Engage current and prospective clients • Understand the implications of legal and regulatory churn https://payments.nacha.org I 1-800-487-9180 3

- 4. Conference Highlights NETWORKING LUNCHES PAYMENTS offers several opportunities for networking including a special lunch in the exhibit hall and the renowned Awards Luncheon where NACHA recognizes industry innovators. Sponsored by Back by popular demand, this exciting event brings together forward thinking, out-of-the-box disrupters from all over the world. PAYMENTS 3D offers a glimpse into the next wave of payments industry innovations and challenges, and you’ll get the chance to ask questions and talk directly to these new consumer and business solution providers. Held in the buzzing exhibit hall, PAYMENTS 3D offers fast paced, interactive demonstrations of new technologies and concepts – up close and in person. 2014 NACHA Payments System Awards Luncheon NACHA’s annual Payments System Awards recognize the highest degree of achievement in the development, implementation and advancement of electronic payments. These prestigious awards celebrate outstanding accomplishments and superior leadership. Join us for this entertaining luncheon as we unveil this year's recipients. EVENING RECEPTIONS Monday Night Celebration CALLING ALL INNOVATORS Get on board and show us what you’ve got. Limited spots are available in the PAYMENTS 3D Theater. The Theater sold out early for last year’s event so sign on today. Contact Joshua Maze at 703-561-3960 or email him at jmaze@nacha.org. Sponsored by Co-Sponsored by Get ready for one of the most anticipated events of the conference— a fun-filled extravaganza that fills four different clubs and takes over the streets of Universal CityWalk® at Universal Orlando® Resort. Take a trip to New Orleans at Pat O’Brien’s® or explore the home of the king of reggae at Bob Marley–A Tribute to FreedomSM. Enjoy three themed rooms and a huge dance floor at the grooveSM and take the stage at CityWalk’s Rising Star (hosted by EastPay). It’s an entire evening of fun, food and celebration. This event is open to all conference attendees. Be there! Pat O’Brien’s, Hurricane Glass logo, Have Fun! and Iron Grill Design ® Pat O’Brien’s Bar, Inc. © 2014 Pat O’Brien’s Bar, Inc. All rights reserved. Universal elements and all related indicia TM & © 2014 Universal Studios. All rights reserved. Tuesday Evening Reception in the Exhibit Hall You won’t want to miss this opportunity to make those critical last minute connections. Enjoy refreshments surrounded by cutting-edge technology providers, payment service experts and organizations poised to offer the solutions you’re looking for. 4 I Follow us on Twitter @NACHA_PAYMENTS Hashtag: #PAYMENTS2014 PAYMENTS 2014

- 5. UNIQUE EDUCATION EVENTS Industry Agenda Sponsored by New this year, the Spotlight Speaker Series focuses on the challenges and opportunities that will shape the payments space of tomorrow. See page 7 for details. Gamifying Financial Services: The Millennials, Gen X and Institutions Day: Time: Spotlight Speaker Series Monday, April 7 2:45 p.m. – 3:45 p.m. Everything we know about the financial services is about to be turned upside down by the Millennial generation. They’re more concerned with the environment, cost and social impact of everything than ever before, but what they really want is fun and engagement. While we’ve been mining behavioral and econometric data and working hard to improve technology, now we need to consider how to get the customer of the future off their phones for long enough to care about finance and the future. The solution: gamification – a powerful new approach to driving loyalty and engagement that is changing the financial employee, customer and strategic landscape with extraordinary speed. Join author and designer Gabe Zichermann for this fastpaced session that will show you how, when and why gamification will revolutionize the top and bottom line, and everything in between. Sponsored by Solution Circles Start your day off right and join industry colleagues for breakfast, networking and thought-provoking conversations at these open forum roundtable discussions. Choose from multiple discussion topics and gain the insight and knowledge of current industry trends. Full conference participants only. Seating is limited. Get involved in the conversation. Use hashtag: #PAYMENTS14SC for the Solution Circles. Invitation-only Events: AAP RECEPTION Sponsored by All Accredited ACH Professionals are invited to this lively reception where they can network with other AAPs and enjoy hors d’oeuvres and cocktails. AAPs only. CHAIRPERSON’S LEADERSHIP RECEPTION Sponsored by The NACHA leadership gathers for this invitation-only event to commemorate another year of progress in the payments industry. Location to be communicated via email invitation. EXECUTIVE FORUM Sponsored by New this year, C-level executives from financial institutions are offered an exclusive education and networking opportunity to examine critical topics and engage in philosophical discussion. Seating is limited for this invitation-only experience. Solution Circles topics include: • Monitoring ACH Risk: What Trends Matter Most • Steps to ACH Origination: What are the Benefits for Credit Unions? • The Rules & Originators: How Do We Keep it Simple, While Keeping Them Informed • Data Breaches & Security: What New and Different in Today’s Environment? • Payments System Improvements: What are the Industry's Next Steps? https://payments.nacha.org I 1-800-487-9180 5

- 6. General Sessions KEYNOTE PRESENTATION INDUSTRY AGENDA Banking on Artificial Intelligence Gamifying Financial Services: The Millennials, Gen X & Institutions Day: Time: Monday, April 7 8:15 a.m. – 9:15 a.m. Big data tells a story that links customer behavior with business opportunities. However, it is only as good as its speed to insight. In the payments industry, organizations will live and die by their ability to translate big data into decisive, actionable insights in the midst of an everincreasing competitive landscape, regulatory uncertainty, evolving technology and constantly shifting consumer behavior. Kris Hammond, CTO of Narrative Science, challenges you to let your data tell your story, think about the data analysis model of today, and explore how you can leverage artificial intelligence to create business opportunities. Kris explains how the next step in the evolution of data analysis – Narrative Analytics – is already helping companies better understand their story, improving compliance processes, providing better insight to merchants and customers and generating revenue through new products. Kristian Hammond Co-Founder & CTO Narrative Science Day: Time: Monday, April 7 2:45 p.m. – 3:45 p.m. Sponsored by Everything we know about the financial services is about to be turned upside down by the Millennial generation. They’re more concerned with the environment, cost and social impact of everything than ever before, but what they really want is fun and engagement. While we’ve been mining behavioral and econometric data and working hard to improve technology, now we need to consider how to get the customer of the future off their phones for long enough to care about finance and the future. The solution: gamification - a powerful new approach to driving loyalty and engagement that is changing the financial employee, customer and strategic landscape with extraordinary speed. Join author and designer Gabe Zichermann for this fast-paced session that will show you how, when and why gamification will revolutionize the top and bottom line, and everything in between. 2014 NACHA PAYMENTS SYSTEM AWARDS LUNCHEON Making Lemonade: Creating a Competitive Advantage When the Chips Are Down Day: Time: Tuesday, April 8 11:30 a.m. – 1:15 a.m. Sponsored by Sometimes the best ideas come from left field, when we least expect them, and often under challenging circumstances. These days, we are constantly moving into uncharted waters. Even the best plans can unravel in an instant. Our defining moments happen when life goes off course. In this presentation, Anat Baron explains how making lemonade is about the choices you make when life takes a turn in an unexpected direction. An innovative leader, Baron has worked with top tier brands including Four Seasons Hotels, Holiday Inn, KLM, CBS, Warner Bros. and Conde Nast. She was also a Hollywood executive, a management consultant and a successful entrepreneur. She is currently the Founder and CEO of StashWall, a technology startup that provides one place for curating and organizing people's information, memories, and belongings. This disruptive company will be launching to the public in early 2014. Gabe Zichermann 6 I Anat Baron Chair, GSummit Founder & CEO, StashWall Follow us on Twitter @NACHA_PAYMENTS Hashtag: #PAYMENTS2014 PAYMENTS 2014

- 7. SPOTLIGHT SPEAKER SERIES Are Bank Innovations Meeting Salient Consumer Needs? What’s Next for P2P: Today’s Lessons for the Future Payment System Priorities: What the Fed Has Learned Day: Time: Level: Day: Time: Level: Day: Time: Level: Tuesday, April 8 8:00 a.m. – 9:00 a.m. Advanced In a candid conversation about retail banking innovation, this distinguished panel examines changes in consumer payments habits, the evolution of electronic payments, and the strategic implications for banks. The discussion is based on insights from GCI’s latest research survey on consumer financial behavior and payment habits. Superior to public information, data include (geographically and seasonally adjusted) timely information on U.S. consumer bill payment methods, economic circumstances, use of credit cards, and banking relationships. The true drivers of changes in payment habits and latest trends can be derived from this data. Tuesday, April 8 3:15 p.m. – 4:15 p.m. Advanced Since forming the clearXchange joint venture, Wells Fargo, Bank of America and J.P. Morgan have gathered customer insights that have transformed person-to-person (P2P) payments. Branded by each bank, the P2P customer experience has become more seamless, easy and secure. With only an email or mobile number, customers can send and receive money. Participants gain insights into the clearXchange approach and how it is moving beyond today’s traditional payments mindset to meet higher customer expectations. Learn how it is positioning its P2P experience to solve customer pain points on the competitive payments playing field. Moderator: David Stewart David Godsman Senior Expert, McKinsey & Company Online & Mobile Solutions Executive, Bank of America Wednesday, April 9 8:30 a.m. – 9:30 a.m. Advanced Sponsored by Over the past year, the Federal Reserve has engaged in a vigorous industry outreach and research effort to better understand U.S. payments system stakeholder needs, desires and priorities. Learn the outcomes of primary research on the demand for faster payments by consumer and corporate end-users and secondary research on specific gaps and opportunities related to payments safety and security. Find out what the Fed has learned so far about what's missing in today’s payments landscape and what’s needed to achieve the payments system of the future. Hear about the latest insights on alternatives for improving the speed of payments and about industry feedback on the Fed’s Payment System Improvement – Public Consultation Paper. Sean J. Rodriguez Senior Vice President, Federal Reserve Bank of Chicago Michael Kennedy CEO & Co-Founder, ClearXChange Cheryl L. Venable SVP, Retail Payments Product Manager, Federal Reserve Bank of Atlanta Jim Reuter President, Support Services, FirstBank https://payments.nacha.org I 1-800-487-9180 7

- 8. Executive Forum Sponsored by EXECUTIVE FORUM By Invitation Only The Evolution of the U.S. Payments System Day: Time: Level: Monday, April 7 1:15 p.m. - 1:45 p.m. Advanced The next generation of our U.S. payments system will require new thinking and cooperation that here to fore has not been demonstrated across the myriad players that make up today’s payments ecosystem. Initiatives introduced over the last couple of years have not achieved game changing results due in large part to the silo approach that most players employ. Benefiting just one group of the ecosystem or even creating negative impacts to other players will not give us the kind of change that can be sustained and is required to address the needs of our joint business and consumer users. In order for solutions to be successful, they must meet new criteria: developed through open collaboration with consideration of the full ecosystem, must benefit both payers and payees and create no additional burdens for payment system members. Ather Williams Global Head of Payments & Strategy, Global Treasury Services, Bank of America Rethinking Payments Innovation Day: Time: Level: Monday, April 7 1:50 p.m. – 2:20 p.m. Advanced Financial institutions are constantly concerned with the changing payments landscape and determining how best to face competition. The competition stems from both those within the traditional bank sector and non-banks infiltrating the marketplace. Financial institution executives are tasked with expanding their offerings to include new ways to advance payments systems and working with their existing clientele and stakeholders to innovate using limited capital, resources in the face of an evolving regulatory environment. Ebru Pakcan, global payments head from Citi shares her opinion on how her organization should prepare to shape the payments industry. Ebru Pakcan Global Payments Head, Citi Payment System Improvement: Implications for Financial Institutions Day: Time: Level: Monday, April 7 4:30 p.m. – 5:30 p.m. Advanced The questions posed in the Federal Reserve’s Payment System Improvement – Public Consultation Paper pointed to key perceived gaps and opportunities in the U.S. payment system, as well as desired outcomes to close these gaps and capture these opportunities. Responses received from a broad spectrum of stakeholders provide an array of perceptions that support or challenge this vision, offer potential paths to realize the expressed destination, and highlight the practical realities of getting there. This session engages participants in dialogue with a Federal Reserve executive on the significance of this vision — and in light of responses received — to financial institutions and the products, services and platforms they support, the infrastructures in which they have invested, and the business model, macro-economic, and customer/societal considerations. Marie Gooding First Vice President & COO, Federal Reserve Bank of Atlanta How KeyBank is Using Data to Enhance Customer Relationships Day: Tuesday, April 8 Time: 10:00 a.m. – 11:00 a.m. Level: Advanced Big data and analytics have become popular buzzwords in banking, and discussions about these topics frequently focus more on rhetoric than practice. However, at KeyBank, a push to become data-driven over the past year has successfully materialized. Data now drives improvements in decision-making as it relates to business development, marketing and risk. Participants in this session gain: an understanding of the key elements that made such a drastic transformation a reality; and about executive commitment, data centralization and changes in human resources that, beyond reflecting new decision-making processes and relationships with business leaders, increase their perceived importance in the organization. An overview of key lessons that KeyBank learned could help participants drive such change in their own organizations while assessing the quality of analytics at various financial institutions. This is especially important as analytics become crucial for efficient marketing spend and account generation in a changing payments landscape. David Bonalle Executive Vice President, KeyBank 8 I Follow us on Twitter @NACHA_PAYMENTS Hashtag: #PAYMENTS2014 PAYMENTS 2014

- 9. Tracks Hall Rates Exhibit Sponsored by Card-Based Opportunities Explores developments in card-based solutions for payments. Sessions focus on the business paradigm within the card industry from both business process and payment operations viewpoints. Corporate Payments Solutions Sponsored by Examines evolving risks surrounding payment mechanisms, along with the rules and laws governing compliance. Sessions focus on current trends in fraud activity, fraud prevention and related laws, rules and regulations. Sponsored by Features information for small and large business professionals who learn about implementing, operating and evaluating financial services solutions. Sessions focus on payment and treasury interests of corporate users, and range from analyzing sound business practices, metrics, challenges and trends to practical experiences and application. Sponsored by Mobile & Digital Payments Risk, Compliance & Fraud Prevention Addresses innovation across the mobile landscape for the payments industry. Sessions cover mobile payments approaches, emerging technological innovations, market analysis and revenue potential. Payment Strategies The ACH Network & the NACHA Operating Rules Sponsored by Highlights core topics related to the ACH Network and the NACHA Operating Rules and their users including existing and emerging applications. Sessions focus on innovation, operational issues, rules, compliance and enforcement, risk management, fraud prevention, security, authentication and authorization and sound business practices. World Payments Viewpoint Addresses current global payments opportunities and obstacles for corporate and financial institution professionals. Sessions offer insights and perspectives from the U.S. community and stakeholders from around the globe. Focuses on the actions and applications shaping today’s payments systems. Sessions are interactive, and engage participants in high-level, “blue sky” discussions regarding future developments and advances in payments. https://payments.nacha.org I 1-800-487-9180 9

- 10. Workshops, Sessions and Special Events Sunday, April 6 Building a Corporate Fraud Prevention Toolkit ACH 101 Time: Track: Level: Time: Track: Level: 1:00 p.m. – 3:00 p.m. Pre-Conference Workshops Fundamental Understanding Payment Cards Time: Track: Level: 1:00 p.m. – 3:00 p.m. Pre-Conference Workshops Intermediate 1:00 p.m. – 3:00 p.m. Pre-Conference Workshops Fundamental This workshop provides corporate practitioners with specific tools and practices to identify and prevent fraud. Participants gain insight into liability exposure, requirements and responsibilities under UCC 4A and how to implement security measures internally and externally. Participants in this workshop gain a comprehensive understanding of card-based payments. The workshop provides insights from the issuing and acceptance perspectives on types of cards, applications, authorization requirements, and evolving regulatory and technological factors that impact business decisions. This workshop provides novices with an introduction to the ACH Network and the NACHA Operating Rules that they can build upon to maximize their educational experience. Participants gain a foundational knowledge of how the Network operates, its key attributes and the roles and responsibilities of those who utilize it. Shirley A. Banks, AAP Paul Tomasofsky Electronic Banking Risk Analyst, Canandaigua National Bank & Trust President, Two Sparrows Consulting, LLC Debbie Barr, AAP, CTP Jay McLaughlin ACH 201 Senior Director, ACH Network Rules Process, NACHA - The Electronic Payments Association SVP, Chief Security Officer, Q2ebanking Time: Track: Level: Gina D. Carter, AAP AVP, Risk Management, EastPay, Inc. International Payments Primer Time: Track: Level: 1:00 p.m. – 3:00 p.m. Pre-Conference Workshops Intermediate New to international payments? This workshop immerses participants in the world of global payments. Corporate and financial institution practitioners learn key concepts, terms, principles and regulatory requirements preparing them to support the business needs of their organizations and customers. Alan S. Koenigsberg Managing Director, Bank of America Merrill Lynch Mobile & Digital Payments Ecosystem Time: Track: Level: 1:00 p.m. – 3:00 p.m. Pre-Conference Workshops Fundamental Mobile and digital payments offer financial institutions, businesses and solution innovators tremendous opportunity to engage, enable and transact with customers in new ways. As new technologies, risks and players are infused into the mix, business models are evolving and customer expectations and behavior are changing. Related business decisions are becoming even more consequential. Participants in this workshop delve into the burgeoning mobile and digital payments ecosystem and emerge with a solid understanding of the players, approaches and opportunities upon which to learn more. Jane Hennessy Global Banking Consultant Stephen Mott Principal, BetterBuyDesign The Legal Structure of Payments Time: Track: Level: 1:00 p.m. – 3:00 p.m. Pre-Conference Workshops Fundamental The legal framework of payments is comprised of laws, regulations and private sector rules that work in concert to define obligations and protect parties to transactions. This workshop provides participants with an overview of how this framework applies across existing and emerging payment methods. This workshop builds on content addressed in ACH 101. Participants learn complex concepts and examine nuances of the NACHA Operating Rules as they apply to payment origination and receipt, risk management, rules compliance and enforcement, and exception processing. Sean Carter, AAP VP, Risk and Compliance, NEACH Kimberly W. Rector, AAP Senior Director, Education, MACHA - The MidAtlantic Payments Association Impact of Proposed Prepaid Access Rules Time: Track: Level: 3:30 p.m. – 5:30 p.m. Pre-Conference Workshops Fundamental Rules proposed by the (FInCEN seek to combat money laundering related to prepaid cards. Participants in this workshop gain an understanding of what FinCEN is proposing and the potential impact on issuing merchants and cardholders. Planning for Disaster Recovery Time: Track: Level: 3:30 p.m. – 5:30 p.m. Pre-Conference Workshops Intermediate 1:00 p.m. – 3:00 p.m. Pre-Conference Workshops Intermediate Moderator: Terry Maher Richard M. Fraher Are you confident in your financial institution's business continuity plans? The FFIEC Guidance on business continuity focuses on IT, but there is more to disaster recovery and business continuity than technology infrastructure. Participants take away a checklist of items to better prepare for an unplanned disaster or business interruption. VP & Counsel to the RPO, Federal Reserve Bank of Atlanta Michael Spafford Jeanette Hait Blanco Disaster Recovery, Business Continuity, EPCOR Senior Product, Regulatory Counsel, PayPal, Inc. Gary Kindle Azba Habib VP, Operations, Elevations Credit Union Associate Counsel, Federal Reserve Bank of Atlanta 10 I Partner, Baird Holm LLP Liz Nutting SVP, Strategic Partnerships & Network Relations, BofI Federal Bank Donald J. Mosher Partner, Schulte Roth & Zabel LLP Bookmark and visit the PAYMENTS website often to check for updated session information. Follow us on Twitter @NACHA_PAYMENTS Hashtag: #PAYMENTS2014 PAYMENTS 2014

- 11. ACH Security Procedures on Trial Time: Track: Level: Become Fluent in the Language of IAT Using real court cases and other case studies, this workshop puts security procedures on trial. Participants learn to analyze agreements, determine how they align with NACHA's ACH Security Framework and how courts of law have defined commercially reasonable. Monday, April 7 Time: Track: Level: 3:30 p.m. – 5:30 p.m. Pre-Conference Workshops Intermediate Continental Breakfast 3:30 p.m. – 5:30 p.m. Pre-Conference Workshops Fundamental Partner, Adams & Reese, LLP Does your financial institution fully grasp the intricacies of supporting International ACH Transaction (IAT) Entries? Deciphering the NACHA Operating Rules and OFAC regulations is easier than you think. Participants in this workshop take away an in-depth understanding of the rules related to the receipt and origination of these ACH transactions. Fred Laing, II, AAP, CCM Priscilla C. Holland, AAP, CCM President, Upper Midwest ACH Association Senior Director, ACH Network Rules, NACHA – The Electronic Payments Association Paul A. Carrubba Mary M. Gilmeister, AAP, NCP President, WACHA - The Premier Payments Resource Harvesting Big Data for Positive Impact ACH Origination: Effective Due Diligence & Onboarding Time: Track: Level: Time: Track: Level: 3:30 p.m. – 5:30 p.m. Pre-Conference Workshops Intermediate ACH origination offers financial institutions lucrative opportunities to grow their business. Along with those opportunities lie the challenges of knowing your customer and your customer's customer. Increased scrutiny and evolving threats demand constant reevaluation of onboarding of Originators and third parties. In this workshop, participants explore the due diligence process and obtain guidance to make informed decisions. 3:30 p.m. – 5:30 p.m. Pre-Conference Workshops Intermediate 7:00 a.m. - 8:00 a.m. Solution Circles Time: Sponsored by 7:00 a.m. - 8:00 a.m. Opening General Session Time: 8:15 a.m. - 9:15 a.m. See page 6 for details. Five Steps to Optimizing Payables & Growing Financial Returns Time: Track: Level: 9:30 a.m. – 10:30 a.m. Corporate Payments Solutions Intermediate Many large organizations use big data to drive revenue, provide more personalized interactions with customers and mitigate fraud. This workshop explains what big data consists of, how to conduct experiments, starting points for usage and the emerging role of data scientists to succeed. The benefits of payables automation are clear, yet only one in five organizations makes the majority of its B2B payments electronically. Deploying the right mix of payment methods, each with their own benefits, ensures maximum efficiency and financial gains. Learn how to develop a strategy for the best payables mix for your enterprise in five key steps. Speakers to be announced Wayne Zeiler Director, Financial and Management Reporting, ITG Miguel Rodriguez Regional Director, Paymode-X, Bottomline Technologies, Inc. John M. Curtis, AAP, NCP VP, Director of Education & Communications, Western Payments Alliance Deposit Account Takeover: The Legal Landscape Melissa C. Blair, AAP, CTP VP, Treasury Management Consultant, Umpqua Bank Time: Track: Product Innovation in a Changing World Time: Track: Level: Time: Sponsored by Level: 3:30 p.m. – 5:30 p.m. Pre-Conference Workshops Fundamental 9:30 a.m. – 10:30 a.m. Risk, Compliance & Fraud Prevention Advanced How do you creatively rethink product innovation to succeed amidst regulatory, technological and cultural change? Participants in this workshop experience hands-on training to drive product innovation informed by customer perspectives and preferences. Over the past few years, there has been much litigation where businesses sue their financial institutions to recover losses caused by a hacker's theft of the client's online credentials, resulting in fraudulently originated wire transfers and ACH credits. Judicial opinions diverge. Participants in this session hear an examination of the legal theories, significance of judicial outcomes and measures to protect their institutions from litigation. Jeff Lauterer Mark Hargrave Manager, Product Operations, Digital Insight Partner, Stinson Leonard Street LLP Kimberly Prieto Barkley Clark Group Manager, Business Development, Digital Insight Partner, Stinson Leonard Street LLP https://payments.nacha.org I 1-800-487-9180 11

- 12. Sessions and Special Events Keeping the Financial Institution Central to Consumer Payments Holistically Managing High-Risk Origination Risk Management for Mobile Remote Deposit Capture Time: Track: Level: Time: Track: Time: Track: Level: 9:30 a.m. – 10:30 a.m. Payments Strategies Advanced As emerging providers seek a share of retail payments space, many financial institutions struggle with how to remain at the top of the consumer's mind for payment services. There are a number of opportunities on which institutions can capitalize as they position and promote both existing and new FIcentric money movement solutions. Participants in this session hear research results surrounding consumer perceptions of money movement services and the financial institution, including the provision of specific recommendations that can improve adoption, usage and perceived value of such services. Chris Burfield Product Marketing Director, ePayments, FIS Best Practices in Establishing Automated Origination & Tracking Time: Track: Level: 9:30 a.m. – 10:30 a.m. Corporate Payments Solutions Intermediate As corporates increasingly electronify payments from check to ACH, the importance of accurate, automated origination and tracking is vital to achieving straight-through processing (STP). Participants in this session learn how STP can be achieved through the integration of the proper level and type of payment tracking information, minimizing manual reconcilement of exceptions. Best practices for aligning payment reconcilement are shared, as well as insight on how ERP systems can provide best practices that formalize the payment lifecycle. David Repking Information Reporting Product Manager, J.P. Morgan U.S. Smart Card Migration: Ready or Not, Here It Comes! Time: Track: Level: 9:30 a.m. – 10:30 a.m. Card-Based Opportunities Advanced U.S. debit, credit and prepaid cards are migrating from magnetic stripe to EMV smart chip technology. What is the impact on merchants, issuing banks and their card-holding customers? Participants hear from a diverse group of panelists on card issuance and adoption rates along with implications for stakeholders. Level: 9:30 a.m. – 10:30 a.m. Risk, Compliance & Fraud Prevention Intermediate Financial institutions make business decisions to originate ACH transactions for clients, and it is incumbent on them to conduct appropriate due diligence and related risk management. With what could be considered to be high-risk activity, it is imperative that the institution implements a robust and holistic risk management program throughout the life cycle that has active involvement and commitment across the organization. Participants in this session learn from the experience of a financial institution that has adopted a holistic approach. Hear what constitutes high risk and the types and magnitude of transactions that give rise to such risks. Understand who needs to be involved and why, what process elements need to be considered, and what are potential client showstopper questions. Moderator: Marcie J. Haitema SVP, ACH & eCommerce Operations, PNC Bank 9:30 a.m. – 10:30 a.m. Mobile Banking & Payments Advanced Mobile remote deposit capture is rapidly becoming a game changer for financial institutions. However, like with any other payments innovation, it also entails certain risks. Participants in this session learn about the chief areas of concern, applicable rules and regulations, and measures they can take to mitigate risk and reap the benefits. Moderator: Kevin Olsen, AAP, NCP, MCSE AVP, Education & IT Manager, EastPay, Inc. Paul Phillips Attorney, Adams & Reese, LLP David Brock President & CEO, Community Credit Union Automating Healthcare Payments: Updates from an Evolving Industry Time: Track: Norman Harkleroad 9:30 a.m. – 10:30 a.m. The ACH Network & the NACHA Operating Rules Intermediate Senior Vice President, PNC Bank Level: Linda Hogan The healthcare industry has experienced a transformation as it transitions to electronic payments and complies with the Affordable Care Act (ACA). Against the backdrop of 1.3 billon claims, participants in this session learn about the industry’s reaction to the ACA mandates, lingering barriers to adoption and alternative payment methods used by the healthcare industry. A large healthcare provider shares its experiences and how it is collaborating with vendors and financial partners to ensure seamless electronic payments and remittances. Vice President, PNC Bank Serving the Financially Underserved: The Value Proposition Time: Track: Level: 9:30 a.m. – 10:30 a.m. Payments Strategies Intermediate Addressing the needs of the financially underserved holds great potential to benefit such consumers and the companies serving them. Developing successful, high-quality products depends upon deep consumer knowledge and innovative business models. Participants in this session learn what consumer and industry research reveals about the financial behaviors and preferences of these consumers, as well as the size and state of the under banked marketplace. A case study highlights opportunities, challenges and lessons learned by one of the largest banks, and offer an overview of a comprehensive suite of under banked products. Eva Wolkowitz Erin Richter CORE Senior Manager, CAQH Mona Reamers Director, Revenue Services, Ortho Northeast Mobile ACH Payments: A PostDurbin Opportunity Time: Track: Level: 9:30 a.m. – 10:30 a.m. Payments Strategies Advanced AVP, Treasury, Costco Wholesale As U.S. financial institutions seek to cultivate new revenue streams in the post-Durbin world, mobile payments offer an interesting value proposition. Consumer adoption is growing and merchant enablement is occurring. The ACH Network offers financial institutions the opportunity to remain central to these retail payments and cultivate new, unrealized revenue. Participants in this session hear how financial institutions in the U.S. can apply lessons from abroad to make the ubiquitous and cost-effective ACH system here an even greater source of value to consumers, merchants and their own bottom lines in a mobile world. Randy Gibbons Lonny Byers Manager, Payment Strategies, Southwest Airlines Managing Director, Consult Hyperion Analyst, Insights and Analytics, Center for Financial Services Innovation Deborah Matthews Phillips, AAP Director, Payments Strategies, Jack Henry & Associates Moderator: Claudia S. Swendseid Timothy Thorson, AAP, CTP Senior Vice President, Federal Reserve Bank of Minneapolis VP, Manager ACH Operations, Regions Financial Corporation Margot Carter SVP, Senior Product Manager, Bank of America Merrill Lynch Rue A. Jenkins 12 I Follow us on Twitter @NACHA_PAYMENTS Hashtag: #PAYMENTS2014 PAYMENTS 2014

- 13. SEPA - The Buzz after Three Months Live Time: Track: Level: Developing an Open Standard to Protect Customer Account Information 9:30 a.m. – 10:30 a.m. World Payments Viewpoint Fundamental Time: Track: Level: Migration to the Single Euro Payments Area (SEPA), which replaces national schemes with an integrated and harmonized means of exchanging Euro credit transfers and direct debits has been a top priority in the European Union for the past decade. Three months after the deadline for full implementation in February 2014, participants in this session hear about the initial impact, what remains to be accomplished and the significance of the schematic to financial institutions and their customers. The payments industry has been working on a new dynamic credentialing solution to improve the safety and soundness of the emerging digital payments ecosystem. In this era of cyber attacks and data breaches, financial institutions and merchants want to ensure sensitive account information is protected to increase consumer confidence and encourage widespread adoption of digital payments. Participants in this session hear the vision, key objectives and progress of the initiative, including the development of an open standard to enable payments innovators to bring secure solutions to market. Michael Steinbach CEO & Chairman, Board of Directors, Equines SE Etienne Goosse Secretary General, European Payments Council (EPC) Refreshment Break and Exhibit Hall Grand Opening Time: David Fortney 10:30 a.m. – 11:15 a.m. Level: 11:15 a.m. – 12:15 p.m. Corporate Payments Solutions Intermediate Is migration to electronic business-to-business (B2B) payments on your radar? These payments are rapidly growing in the ACH Network and many tools now exist to assist with conversion. Participants in this session hear how Cox Enterprises partnered with its bank and trading partners on a recent conversion and gain valuable insight from their experience that other companies could adopt to eventually tell their own success stories. Alan R. Dupree, AAP Retail Payments Director, Federal Reserve Bank of Atlanta John A. Fabrizio SVP, Treasury Management Sales Consultant, Wells Fargo SVP, Product Development & Management, The Clearing House Anita S. Patterson, CTP Monitoring for Abusive ACH Debit Practices Time: Track: Level: 10:35 a.m. – 11:05 a.m. Adapting Lessons from Retail Payment Security for Commercial Clients Time: Track: Time: Track: Level: Meeting Small Business Customer Needs with an Integrated Business Banking Solution Sponsored by Education Session in the Exhibit Hall Time: 11:15 a.m. – 12:15 p.m. Mobile Banking & Payments Intermediate A B2B Payments Success Story 11:15 a.m. – 12:15 p.m. Risk, Compliance & Fraud Prevention Intermediate Advancements in financial technology typically migrate from retail banking to commercial banking at a slow but steady pace. The continuing threat of account takeover and the potential for substantial associated losses have revealed that currently relied upon solutions are ineffective and that improvement is undoubtedly necessary. Participants in this session hear strategies that financial institutions can implement to successfully transition different commercial client segments to modern payment security solutions, while controlling costs and maintaining strong customer satisfaction. 11:15 a.m. – 12:15 p.m. Corporate Payments Solutions Intermediate Small business customers represent significant revenue generation and cross-sell opportunities to add fuel to grow your financial institution. Targeting the small business market with the right set of tools and capabilities gives financial institutions the ability to differentiate their message, pursue untapped markets and grow revenue as small business owners frequently turn to their financial institution for financial management needs. Participants in this session hear about the benefits of implementing integrated banking solutions designed to meet the needs of the small business market. John Balose Principal Market Manager, ACI Worldwide Christine Barry Research Director, Aite Group Meggin Nilssen Director, Treasury Services, Cox Enterprises, Inc. Time: Track: Level: 11:15 a.m. – 12:15 p.m. Risk, Compliance & Fraud Prevention Advanced Historically, the focus on monitoring ACH transactions has been on the ODFI's debit Originators. However, media and regulatory attention has redirected the spotlight to receiving banks and their obligations to protect customers from unauthorized or abusive payment practices. Participants in this session learn how RDFIs can help protect consumer and business account holders by monitoring received debit transactions, identifying trends and taking steps to minimize abusive practices. Recent and ongoing proposals and initiatives to help RDFIs ensure the continued, positive reputation of the ACH Network are discussed. Beth Anne Hastings Vice President, J.P. Morgan Alicia Treadway, AAP, CTP First Vice President, Treasury & Payment Solutions, SunTrust Bank VP, Treasury Management Sales, Bank of Blue Valley Alphonse Pascual Senior Analyst, Security, Risk & Fraud, Javelin Strategy & Research Chuck Rogers Vice President, Greenwich Associates https://payments.nacha.org I 1-800-487-9180 13

- 14. Sessions and Special Events Recent Developments in Electronic Payments Law Time: Track: Level: 11:15 a.m. – 12:15 p.m. The ACH Network & the NACHA Operating Rules Intermediate Staying abreast of the numerous and often complex developments in the legal and regulatory framework surrounding payments can be daunting and understanding the implications to an organization’s ACH activities is crucial. Participants in this session are provided with a review of significant legal issues raised by current developments in electronic payments law, including recent amendments to the NACHA Operating Rules. Benefits of Bank Co-Opetition Time: Track: Level: 11:15 a.m. – 12:15 p.m. Payments Strategies Intermediate Collaboration is imperative in business, but its benefits do not stop at the individual level. Participants in this session gain a pragmatic view, drawn from real experience and hard facts, of how financial institution collaboration and co-opetition can deliver transformative value for the involved institutions and their clients. Hear how two financial institutions created a mutually beneficial business case by working together in a way that is distinct from sourcing solutions from traditional vendors, and how they continue to evolve the governance structure to exceed customer expectations. Customer Research: Small Business Owner Views on Payment Options Time: Track: Level: 11:15 a.m. - 12:15 p.m. Payment Strategies Intermediate Professor of Law, University of Washington Bobby Carney Jane E. Larimer Director, Citi Understanding how small business clients view electronic payments is critical to successfully engaging them and influencing their behavior. Get a glimpse into the minds of small business owners regarding their payment practices and how they view new electronic alternatives in this session. Participants gain insights from recently conducted in-depth focus groups on which payment methods small business owners use and when, emotional ties to paper checks, the top reasons they would use an eCheck option, and how they perceive the “anytime, anywhere” promise. EVP, ACH Network Administration, General Counsel, NACHA - The Electronic Payments Association Joyce O'Connor Christopher Clausen Vice President, State Street Corporation, N.A. Director, North American Payments & Transactional Solutions, Deluxe Corporation Mash Up at the POS: Transforming the Retail Experience Cross-Border P2P: Embracing Change Time: Track: Level: Time: Track: Level: Jane K. Winn 11:15 a.m. – 12:15 p.m. Mobile Banking & Payments Intermediate Retailers, advertisers, card networks and terminal manufacturers are investing heavily in changing the commerce experience, leveraging mobile technology, POS innovations, and “big data" based marketing and loyalty solutions. In this environment, financial institutions, processors and other traditional players need a deep understanding of the changing environment and coherent strategies to compete. Participants in this session gain a deeper understanding of the changing retail environment and insights to apply to their respective strategies. Margaret Weichert Principal, Financial Services, Ernst & Young Supply Chain Fraud Necessitates Authentication for Everyone Time: Track: Level: 11:15 a.m. – 12:15 p.m. Risk, Compliance & Fraud Prevention Advanced A new fraud scheme targets business associates of financial institution customers. A fraudster compromises the email account of a vendor and sends a legitimate-looking invoice to a company. The company initiates a payment through a channel that authenticates the payer, yet the outgoing payment is nonetheless the result of fraud. These transactions are difficult to identify as fraudulent until it's too late. Participants in this session learn about the expanding need for authentication, usefulness of relatively lowtech factors to authenticate payment requests and use cases for implementing these factors. 11:15 a.m. – 12:15 p.m. World Payments Viewpoint Advanced Many treasurers find cross-border payments confusing, inefficient and expensive, particularly with new regulatory compliance and associated costs. However, these payments carry great opportunity, and the key lies in innovation and cooperation among banks, mature networks and private markets. Learn how global networks can be leveraged in light of enhanced regulatory focus on consumer protection and the critical importance of form factor for customer experience. Hear a unique perspective on how cross-border payments are being enabled downstream through correspondent banking relationships and corporate credit unions. Attendees are encouraged to share their experiences with cross-border payments. Jorge Jimenez Director, Retail Payments Office, Federal Reserve Bank of Atlanta Jon Budd SVP, Business Development, LendingTools.com Sean Carter, AAP VP, Risk & Compliance, NEACH Networking Lunch in the Exhibit Hall Time: 12:15 p.m. – 1:30 p.m. Education Session in the Exhibit Hall: The Payments Map: A Profit Pools Model for the Payments Industry Time: Level: 12:45 p.m. – 1:15 p.m. Intermediate Join experts from GCI, McKinsey’s payments intelligence group, as they lead a discussion around the latest trends in retail payments. This interactive session will draw on GCI's proprietary market research, including the most recent Consumer Financial Life Survey and the Payments Map model. Taken together, they provide an unmatched comprehensive view of the payments industry, with details on specific consumer payment habits and data on volumes, flows, revenues, and costs across payment types. Participants will walk away with an understanding of how to use the Payments Map to evaluate strategic payments initiatives, benchmark industry volumes and profitability, understand market potential, and hold candid conversations about retail payments innovation based on the latest industry trends. Aaron Caraher Expert, McKinsey & Company Evan Long Senior Analyst, McKinsey & Company Devon Marsh SVP, Treasury Management & Internet Services Risk and Compliance, Wells Fargo 14 I Follow us on Twitter @NACHA_PAYMENTS Hashtag: #PAYMENTS2014 PAYMENTS 2014

- 15. Walking the Fine Line of Innovation in Payments Advancements in Mobile Payment Technologies & Authentication Keeping the Bank Account at the Center of Payments Time: Track: Level: Time: Track: Level: Time: Track: Level: 1:30 p.m. – 2:30 p.m. Payments Strategies Intermediate The payments ecosystem continues to undergo dramatic change. Participants in this session hear how a solution provider and regional bank view the environment as they explore payment innovations that have been adopted as well as those on the horizon. Speakers juxtapose the technological possibilities of payment innovation against the operational realities. Uma Wilson, AAP, CTP SVP, Director of Product Management & Development, UMB Bank, N.A. John Wilson Vice President, Retail & Commercial Payment Solutions, FIS State Licensing Issues for ACHBased Payment Products Time: Track: Level: 1:30 p.m. – 2:30 p.m. Mobile Banking & Payments Intermediate A myriad of technologies have emerged to support mobile payments including competing technologies such as NFC, QR codes and sound wave. Widespread adoption is highly dependent on ease of use by all stakeholders. Further complicating the choice is the imperative to support dynamic authentication as data security and fraud protection grow to paramount importance for online transactions. Multifactor authentication is endorsed by the FFIEC guidelines as best practices for risk mitigation. Yet, usability remains a key factor in determining which method of authentication to implement. Participants in this session learn about the latest developments in technologies supporting mobile payments and efforts to promote secure transactions using dynamic authentication. Peter Tapling 1:30 p.m. – 2:30 p.m. World Payments Viewpoint Intermediate Payment methods are evolving and prove challenging to financial institutions. As consumer behavior changes, new players enter the payments market, and new technologies arise, the payments industry as a whole is undergoing a dramatic shift. This shift threatens the financial institutions account’s hold at the center of payments. If financial institutions are not flexible enough to provide the innovative services that future generations require, bank accounts could lose their relevancy to consumers and businesses. Financial institutions need to understand the impact that payments convergence, alternative accounts, mobile payments, automated account switching, and real-time payments have on consumer and corporate expectations, and they will need to leverage these trends to keep the bank account central. President & CEO, Authentify, Inc. SVP, Sales, Mobile Authentication Corporation Partner, Sidley Austin LLP Casey H. Wilcox President & CEO, Avenue B Consulting, Inc. David E. Teitelbaum Senior Director, Advanced Payments Solutions, NACHA - The Electronic Payments Association Maria Arminio Much of payments innovation is driven by collaborative relationships between technology providers and financial institutions. The mere involvement of a financial institution in a product is not sufficient to insulate technology providers from the impact of payments regulation, including state licensing. Care must be taken in structuring products and relationships so that all parties understand where regulatory lines are drawn. Participants in this session are provided with a review of various models for payments ventures and the implications these models have for regulatory oversight. Moderator: Samantha Carrier Wade Edwards 1:30 p.m. – 2:30 p.m. Risk, Compliance & Fraud Prevention Intermediate SVP, Head of Payables & International Product Management, Capital One Lessons in Disaster Recovery: A Corporate & Financial Institution Partnership Dr. Leo J. Lipis Time: Track: Level: 1:30 p.m. – 2:30 p.m. Risk, Compliance & Fraud Prevention Intermediate Disaster recovery and business resiliency planning are critical to a company’s risk management strategy and require close cooperation and planning between a business and its financial institution in the area of payments. In 2012 alone, there were several natural disasters that affected numerous businesses and citizens in the U.S. and across the globe. Participants in this session hear how one organization planned and executed against its disaster recovery plan, learning how the pieces of the plan came together and how it was designed to ensure resiliency across internal and external clients and employees. Participants gain an understanding of how planning played out in the successful deployment of two organization's business continuity plans. Managing Director, Lipis & Lipis GmbH Mary Ann Francis Executive Advisor, Wipro, LTD Strategic Perspectives on Serving the Unbanked & Underbanked Time: Track: Level: 1:30 p.m. – 2:30 p.m. Payments Strategies Advanced There are many theories as to why individuals use financial institutions versus pawnshops and payday lenders. The Office of Community Development of the Federal Reserve Bank of St. Louis, in conjunction with the Social System Design Lab at Washington University in St. Louis undertook a study to understand what decisions made St. Louis households use or not use financial institutions. Participants in this session hear what the study reveals of how financial institutions, community members and alternative financial services providers interact in ways that seem rational when considered separately, yet together create unintended consequences. Adi Raviv EVP & CFO, Strategic Funding Source, Inc. Moderator: Ann-Marie Bartels, AAP Colleen J. Taylor Chief Executive Officer, EPCOR EVP, Head of Treasury Management & Enterprise Payments, Capital One Paul Woodruff VP, Community Development, St. Louis Community Credit Union Yvonne S. Sparks Community Development Officer, Federal Reserve Bank of St. Louis Suzanne Hough Community Development Officer, Carrollton Bank, Illinois https://payments.nacha.org I 1-800-487-9180 15

- 16. Sessions and Special Events Beyond EMV: Security Through Analytics 2014: The Year to Clean Up Consumer Bill Payment Time: Track: Level: Time: Track: 1:30 p.m. – 2:30 p.m. Card-Based Opportunities Intermediate By leveraging multiple sources of data including deposit activity, card activity and ATM transactions, high profile card issuers can efficiently and accurately pinpoint compromised accounts. Participants in this session learn how new analytics go beyond EMV to reveal a more comprehensive profile of consumer activity. The alternative security approach offers benefits to financial institutions, merchants and consumers. Robert Hill VP, Market Strategy, Early Warning Services, LLC Virtual Identity, Anonymous Payments & the Shadow Internet Time: Track: Level: 1:30 p.m. – 2:30 p.m. Risk, Compliance & Fraud Prevention Advanced Virtual identity, social media and ubiquitous connectivity are reshaping the world and a new paradigm of perceived anonymity has emerged. This phenomenon is disrupting the financial space globally by changing relationships and destroying risk models through the creation of mobile, alternative and often anonymous, payment systems. While fostering innovative and sometimes positive societal change, it can be used by criminal and extremist elements as exemplified by the international dismantling of Liberty Reserve. Participants in this session learn how the good and bad aspects of this new frontier are changing the payments business, and what it means to their organizations. Scott Dueweke Senior Associate, Virtual Identity & Anonymous Payments, Booz Allen Hamilton Empowering Customers with Billing, Payment & Usage Alerts Time: Track: Level: 1:30 p.m. – 2:30 p.m. Corporate Payments Solutions Intermediate Today’s customers demand actionable information at their fingertips. When billers empower and inform customers, they can increase customer loyalty and satisfaction and low-cost behavior. Participants in this session learn how to deliver relevant billing, payment and usage alerts to customers using the appropriate form of contact at just the right time. Phil Spradlin Product Marketing Manager, ACI Worldwide Level: 1:30 p.m. – 2:30 p.m. The ACH Network & the NACHA Operating Rules Intermediate Consumer bill payment exceptions (defined as a biller’s inability to properly apply a payment credit to a customer’s account) are bad for customer service and they cost the industry nearly $800 million per year according to a study commissioned by NACHA. Worse, both the volume and the rate of bill payment exceptions are increasing. The majority of these exception payments are originated by banking and related third party channels. Over the years, banks and third parties have developed practices to help mitigate exceptions. These typically require bilateral agreements between the originating and biller parties and are labor intensive. The purpose of this session is discuss the goals and status of a new proposal – the Bill Payment Exception (BPE) Convention – and the opportunity for implementing a standardized industry approach – leveraging the ACH Network – to mitigate bill payment exceptions. Moderator: Robert Unger, AAP Senior Director, E-Billing & Payments, NACHA - The Electronic Payments Association Industry Agenda Gamifying Financial Services: The Millennials, Gen X and Institutions Time: Track: 2:45 p.m. – 3:45 p.m. General Session Sponsored by Everything we know about the financial services is about to be turned upside down by the Millennial generation. They’re more concerned with the environment, cost and social impact of everything than ever before, but what they really want is fun and engagement. While we’ve been mining behavioral and econometric data and working hard to improve technology, now we need to consider how to get the customer of the future off their phones for long enough to care about finance and the future. The solution: gamification a powerful new approach to driving loyalty and engagement that is changing the financial employee, customer and strategic landscape with extraordinary speed. Join author and designer Gabe Zichermann for this fast-paced session that will show you how, when and why gamification will revolutionize the top and bottom line, and everything in between. Gabe Zichermann Chair, GSummit Andy Branch Senior Product Manager, Electronic Payments, Capital One Kathy Romano Executive Director, Bill Print, Payment & AR Operations, Verizon Steve Hooper, AAP, CTP SVP, Payment Strategy, iPay Solutions Smart Approaches to Reach Smart-Enabled Customer Time: Track: Level: Refreshment Break in the Exhibit Hall Time: 3:45p.m. – 4:30p.m. Education Session in the Exhibit Hall: How to Improve Your Organization’s Social Media Profile Time: Level: 3:50 p.m. – 4:20 p.m. Intermediate 1:30 p.m. – 2:30 p.m. Mobile Banking & Payments Intermediate With an average of 3.5 credit cards plus two other accounts, and increasingly equipped with smart mobile devices with numerous payment and commerce apps, consumers are on the go and ready to transact. To get past the noise of the countless email offers and mobile alerts, new capabilities supported by the latest versions of the Apple iPhone and Google Nexus enable merchants to couple Bluetooth Low Energy with geo-targeting to cut through the noise and reach truly “mobile” customers with relevant, real-time deals. Participants in this session discover how these innovations can be leveraged to generate sales for their companies. Companies are turning to Twitter, Facebook, LinkedIn and other social marketing platforms to offer deals, promote products and services, and reach out to customers old and new. But, in the fast-moving internet world can these platforms continue to serve over the long haul, and what will be the next platform? Participants in this session hear directly from a Social Media Strategist on how the next generation of social media can help foster your organizations profile. Matthew A. Goldman Co-Founder & CEO, Wallaby Financial April Bingham Customer Service Manager, Billing, DC Water 16 I Follow us on Twitter @NACHA_PAYMENTS Hashtag: #PAYMENTS2014 PAYMENTS 2014

- 17. Tips for Cutting Edge ePayments & eRemittance Solutions Mobile Bill Payment & Presentment (MBPP) Insights for Billers Data Monetization in the Payments Industry Time: Track: Level: Time: Track: Level: Time: Track: Level: 4:30 p.m. – 5:30 p.m. Corporate Payments Solutions Intermediate Businesses that rely on checks are pleasantly surprised to learn how easy and beneficial it is to switch to electronic payments and remittance alternatives. Participants in this session hear firsthand from corporate practitioners about decisions that improved accounts payable systems, streamlined customer remittances, sped up incoming receipts and resulted in innovative disbursement practices. Case studies outline the actions businesses took and highlight the lessons they learned, while talking about cost and other benefits they realized. Efforts by the allvolunteer, grassroots Remittance Coalition to overcome barriers and educate B2B trading partners are discussed. Moderator: Claudia S. Swendseid Senior Vice President, Federal Reserve Bank of Minneapolis 4:30 p.m. – 5:30 p.m. Corporate Payments Solutions Intermediate Adoption of mobile bill payment doubled last year and yet only one-third of company's surveyed report having a mobile bill pay strategy. Many billers view mobile as an enabler of customer self-service, eBilling and bill payment via ACH. With this rapid growth in mobile transactions and dynamic technological changes, it requires companies in all industries to understand what consumers want and what leading firms are providing today and tomorrow. Participants in this session benefit from a discussion of the comprehensive findings from the Second Annual Mobile Bill Pay Benchmark Study and the Sixth Annual Consumer Household Survey, which feature key observations on consumer adoption and actionable insights for biller strategies and deployment. Edward Bachelder Sandra Roth Director, Research, Blueflame Consulting, LLC Manager, Trade Financial Management, Johnson & Johnson Eric Leiserson Senior Research Analyst, Fiserv Carole M. Hunt Assistant Treasurer, Director, Ameren Services Center, Ameren Corporation Leveraging Mobile to Bring Financial Services to the Underbanked Leveraging the ACH Network for P2P Payments Time: Track: Level: Time: Track: 4:30 p.m. – 5:30 p.m. The ACH Network & the NACHA Operating Rules Intermediate 4:30 p.m. – 5:30 p.m. Payments Strategies Intermediate 4:30 p.m. – 5:30 p.m. Payments Strategies Intermediate The payments industry continues to be ripe for disruptive innovation. The ability to monetize data may be one of the major disruptors going forward and those who fail to capitalize on this opportunity may soon be at a disadvantage. Participants in this session learn about opportunities and challenges for various parties holding data, key drivers for success, critical considerations and the potential for monetizing data into discreet revenue streams. George Warfel Director, PwC (PricewaterhouseCoopers LLP) Dimpsy Teckchandani Director, PwC (PricewaterhouseCoopers LLP) The Gatekeeper Paradigm Time: Track: Level: 4:30 p.m. – 5:30 p.m. Risk, Compliance & Fraud Prevention Advanced The payments system in the U.S. relies upon financial institutions to serve as gatekeepers. Regulations and payment system rules require financial institutions to know their customers and third parties and warrant that the payments they introduce are authorized. Is this paradigm working? After some level setting of the current legal and regulatory regime that is designed to prevent misuse of the payment system, participants in this session hear panelists discuss recent media events, regulatory actions and legislative proposals that suggest the gatekeeper paradigm may not be sufficient. Panelists share their views on whether the gatekeeper paradigm needs to be changed, and if so, how and what the business and policy implications of such changes would be. Person-to-person (P2P) payments offer financial institutions solutions that leverage the ACH Network, while expanding the portfolio of services they offer clients. Participants in this session learn the benefits of offering P2P services, how to mitigate risk management and security challenges and the WEB credit for ACH P2P payments rule. Nearly one-third of the American population relies on alternative financial services for check cashing, payday loans, money transfers and similar products. The impact on the consumer has been higher fees, limited access to funds and credit, all of which contribute to persistent poverty levels. Participants in this session learn how one credit union is using mobile banking and mobile deposit capabilities to provide access to high-quality financial products and services to underserved consumers and how mobile technology is combatting poverty. Moderator: Kathy Levin, AAP Moderator: Andrew Tilbury EVP, Corporate Products & Services, TD Bank, N.A. Senior Director, Advanced Payment Solutions, NACHA - The Electronic Payments Association Chief Marketing Officer, Bluepoint Solutions Karen Hobbs Richard Campbell Attorney, Federal Trade Commission Terri P. Sands, AAP Chief Financial Officer, HOPE Credit Union Joe W. Hussey SVP, Payments Oversight & Fraud Management, State Bank & Trust Company Scot Slay Executive Director, J.P. Morgan Vice President, Marketing and Communications Director, HOPE Credit Union Paul K. Holbrook Level: Louise C. Clynes Moderator: Alaina Gimbert SVP & Associate General Counsel, The Clearing House Richard W. Burke, Jr., CCM Associate General Counsel, HSBC Bank USA, N.A. Group VP, Money Movement Products & Digital Channel Management, SunTrust Bank https://payments.nacha.org I 1-800-487-9180 17

- 18. Sessions and Special Events Increasing Customer Engagement in Authentication The Apps Have It: Accelerating Cash Flow for Small Business The Changing Face of Cross Border Payments Time: Track: Level: Time: Track: Level: Time: Track: Level: 4:30 p.m. – 5:30 p.m. Card-Based Opportunities Intermediate Customers’ desires have changed in terms of safety when using bank-issued credit or debit cards in virtual channels. Participants in this session explore how issuers can leverage rewards programs to engage customers in authentication in the post-EMV world. Michael A. Keresman III Chief Executive Officer, CardinalCommerce Corporation Janet L. Kapostasy VP, Financial Institution Services, CardinalCommerce Corporation The Case for Debit Card Remittance Time: Track: Level: 4:30 p.m. – 5:30 p.m. Card-Based Opportunities Intermediate The Durbin Amendment has fundamentally changed the revenue model on interchange for financial institutions, but has also brought about opportunities to enhance customer payment channels and capabilities for billers. Consumers do not usually have their routing and account numbers handy when setting up a bill payment and are increasingly frustrated when billers cannot accept their “account number” on their debit card. Participants in this session hear the case for accepting debit card remittance in the new Durbin world — the hurdles, key assumptions and ultimate outcomes for adding it as a payment option across all customersegments. Brandee Bevan Director, Card Payment Services Intent, Capital One Ryan Cope Expert, McKinsey & Company Brett Dickey Card Payment Analysis and Services, Capital One 4:30 p.m. – 5:30 p.m. Mobile Banking & Payments Intermediate Getting paid and making payments keep small businesses going. Financial institutions that can make the process easier can keep payments revenue from small businesses in-house and out of the pockets of non-bank competitors. Participants in this session hear what research tells us about how small businesses want to interact with financial institutions and the tools and channels they are likely to use now and into the future. Learn how to keep payments bank-centric while speeding up settlement, leveraging loyalty programs and managing receivables and payables from anywhere, at any time. 4:30 p.m. – 5:30 p.m. World Payments Viewpoint Intermediate The traditional world of cross-border payments is rapidly evolving as regulatory change affects the landscape in various countries, regions and economic blocks and more consistent best practices are adopted globally. Participants in this session learn about the dynamics in cross-border payments today and their significance to financial institutions and their customers in our increasingly interconnected world. Kunal Bist Cross Border Payments Product Manager, North America, Citi Transaction Services Vicki O'Connor Monday Night Celebration VP, Product Management Business Services, Fiserv Time: David Keenan General Manager, ACCEL/Exchange Network, Fiserv Brian Collins SVP, eBanking & Payments Services Director, Enterprise Bank Corporate Priorities for Payments Time: Track: Level: 4:30 p.m. – 5:30 p.m. Corporate Payment Solutions Intermediate Financial institutions and other payment service providers need to understand what their customers want. Participants in this session hear panelists delve into the top priority issues to provide insights for improving existing services and identifying potentially new services of value to corporates. Learn what the results of recent surveys and other activities indicate about payment priorities from the corporate perspective. Gain deeper understanding as corporate practitioners share personal experiences with current treasury and related initiatives within their companies, and offer additional insights into how corporates prioritize their own time in managing the bank and vendor. 6:30 p.m. – 8:30 p.m. Get ready for one of the Co-Sponsored by most anticipated events of the conference—a fun-filled extravaganza that fills four different clubs and takes over the streets of Universal CityWalk® at Universal Orlando® Resort. Take a trip to New Orleans at Pat O’Brien’s® or explore the home of the king of reggae at Bob Marley–A Tribute to FreedomSM. Enjoy three themed rooms and a huge dance floor at the grooveSM and take the stage at CityWalk’s Rising Star (hosted by EastPay). It’s an entire evening of fun, food and celebration. This event is open to all conference attendees. Be there! Pat O’Brien’s, Hurricane Glass logo, Have Fun! and Iron Grill Design ® Pat O’Brien’s Bar, Inc. © 2014 Pat O’Brien’s Bar, Inc. All rights reserved. Universal elements and all related indicia TM & © 2014 Universal Studios. All rights reserved. Moderator: Chrystal Pozin Principal, Treasury Strategies, Inc. Anita S. Patterson, CTP Director, Treasury Services, Cox Enterprises, Inc. Daniel W. Ellecamp, AAP, CTP Treasury Consultant, AAA NCNU Rue A. Jenkins AVP, Treasury, Costco Wholesale 18 I Follow us on Twitter @NACHA_PAYMENTS Hashtag: #PAYMENTS2014 PAYMENTS 2014

- 19. Tuesday, April 8 Cruising Toward Payroll Efficiency with Payroll Cards Enterprise Risk Management in Today’s Global Business Landscape Continental Breakfast Time: Track: Level: Time: Track: Time: 7:30 a.m. – 8:00 a.m. Are Bank Innovations Meeting Salient Consumer Needs? Time: Track: Level: 8:00 a.m. – 9:00 a.m. Spotlight Speaker Series Advanced n a candid conversation about retail banking innovation, this distinguished panel examines changes in consumer payments habits, the evolution of electronic payments, and the strategic implications for banks. The discussion is based on insights from GCI’s latest research survey on consumer financial behavior and payment habits. Superior to public information, data include (geographically and seasonally adjusted) timely information on U.S. consumer bill payment methods, economic circumstances, use of credit cards, and banking relationships. The true drivers of changes in payment habits and latest trends can be derived from this data. Senior Expert, McKinsey & Company In today’s world, global-level risk assessment is a concern for all major organizations – especially those involved in any form of money movement. A risk profile that serves as the framework for how key critical risks are identified and managed is critical. Participants in this session receive a holistic view of an enterprise risk management model and framework for global money movement and compliance; encompassing the development process to the identification of risks from operational, legal and compliance, information technology, strategy and financial and reporting perspectives. Joe W. Hussey Kristin S. Walle, AAP, CTP Executive Director, J.P. Morgan VP, Global Money Movement & Compliance, ADP, Inc. Lourdes Suarez Senior Director & Assistant Treasurer, Carnival Case Study: Automating Renewals of ACH Origination Agreements Level: Adoption of ISO 20022 Standards in the Global Payments Markets: What is the U.S. Doing? Time: Track: Level: 8:00 a.m – 9:00 a.m. The ACH Network & the NACHA Operating Rules Advanced Key global markets are implementing ISO 20022 messaging standards in their payments market infrastructures. The U.S. has taken initial steps in using ISO 20022 — e.g., the NACHA International ACH Transaction (IAT) format and the Fedwire/CHIPS Extended Remittance Information fields. In 2013, the Federal Reserve Banks, TCH, NACHA and ASC X9 funded a business case analysis to assess the potential adoption of ISO 20022. Hear the conclusions of this assessment and provide your own view on the roadmap the U.S. community should develop when considering adoption of ISO 20022 message formats in the payments market. Level: 8:00 a.m. – 9:00 a.m. Risk, Compliance & Fraud Prevention Advanced Managing payroll for organizations with globally dispersed employees can be a tremendous challenge, particularly when requirements such as limited access to bank accounts or maintaining compliance with local regulations complicate matters. Participants in this session gain insight and best practices from Carnival Corporation’s experience in implementing a customized payroll card program in order to pay its employees around the world. Learn how payroll cards can be used to mitigate risk and provide convenient access to funds with streamlined payments that meet regional compliance mandates for employee payments. Time: Track: Moderator: David Stewart, 8:00 a.m. – 9:00 a.m. Corporate Payments Solutions Intermediate 8:00 a.m. – 9:00 a.m. The ACH Network & the NACHA Operating Rules Advanced Automating renewals of ACH origination agreements not only expedites the process significantly, it can result in an enhanced customer experience, error reduction and better internal and external audit reports. Participants in this session learn from the experience of a financial institution that has automated agreement renewals and is successfully meeting due diligence requirements to ensure that Originators and Third-Party Senders are able to fulfill their obligations in compliance with the NACHA Operating Rules. Gain an understanding of the operational challenges of completing the due diligence process, the steps taken and the lessons learned in automating the ACH service renewal and the new customer setup process. Whatever You Do, Wherever You Go, Somebody is Watching You Time: Track: Level: 8:00 a.m. – 9:00 a.m. Mobile Banking & Payments Advanced Security for mobile retail payment models that use NFC, cloud, barcode and hybrid technologies is perhaps the least understood area of security among parties in the value chain. Examining the transaction lifecycle end-to-end offers a holistic way to understand the security concerns and measures one should consider. Participants in this session gain insight into the role that all of the parties play in the transaction as they are lead through various use cases to understand the threats and vulnerabilities throughout the transaction lifecycle, the probability of these vulnerabilities and potential mitigations. Moderator: Susan M. Pandy, Ph.D. Director, Payment Strategies, Federal Reserve Bank of Boston Javed Chaundry Director, Global Mobile Payments, Citigroup Joseph Casali, AAP, NCP Sébastien Taveau Vice President, NEACH Chief Evangelist, Synaptics, Inc. Ravi Vakacherla First Vice President, Treasury Management and Digital Channels, People's United Bank Roy C. DeCicco, CCM Managing Director, J.P. Morgan Richard Dzina Senior Vice President, Federal Reserve Bank of New York Russ Waterhouse EVP, Product Development & Strategy, The Clearing House https://payments.nacha.org I 1-800-487-9180 19