Staff at vc firms

•

28 likes•29,186 views

If you want to understand how decisions are made at a VC firm it is important to understand the staff who work there. Here is a guide but you can also read more at this blog post: https://bothsidesofthetable.com/how-to-improve-your-odds-of-getting-to-yes-with-a-vc-land-and-expand-b46a0a102a07

Report

Share

Report

Share

Download to read offline

Recommended

More Related Content

What's hot

What's hot (20)

VC Fundraising Deck Template: Carta x Kauffman Fellows

VC Fundraising Deck Template: Carta x Kauffman Fellows

Venture Builder / Start-up Factory Model One-slider Infographic

Venture Builder / Start-up Factory Model One-slider Infographic

Decision Analysis in Venture Capital workshop for Stanford Angels and Entrepr...

Decision Analysis in Venture Capital workshop for Stanford Angels and Entrepr...

Similar to Staff at vc firms

Similar to Staff at vc firms (20)

20150416 Board and Advisors: how to get real value

20150416 Board and Advisors: how to get real value

Home run: strategies & tactics to maximize your selling price

Home run: strategies & tactics to maximize your selling price

Roles & Responsibilities: A Primer (Series: Board of Directors Boot Camp 2020...

Roles & Responsibilities: A Primer (Series: Board of Directors Boot Camp 2020...

Mesut Yavas | Begrijp bedrijfseigenschappen en bedrijfsactiviteiten

Mesut Yavas | Begrijp bedrijfseigenschappen en bedrijfsactiviteiten

A consulting career: The good, bad and ugly (focused on senior roles)

A consulting career: The good, bad and ugly (focused on senior roles)

How to do Fundamental Analysis in Stock market - 1

How to do Fundamental Analysis in Stock market - 1

More from Mark Suster

More from Mark Suster (20)

Fundstrat Bitcoin & Blockchain presentation for Upfront Summit

Fundstrat Bitcoin & Blockchain presentation for Upfront Summit

Upfront LP Survey of the Venture Capital & Startup Industry

Upfront LP Survey of the Venture Capital & Startup Industry

There is Something Going on in the LA Tech Market by Upfront Ventures

There is Something Going on in the LA Tech Market by Upfront Ventures

The Changing Structure of the Venture Capital Industry

The Changing Structure of the Venture Capital Industry

Recently uploaded

Recently uploaded (20)

New from BookNet Canada for 2024: BNC CataList - Tech Forum 2024

New from BookNet Canada for 2024: BNC CataList - Tech Forum 2024

"LLMs for Python Engineers: Advanced Data Analysis and Semantic Kernel",Oleks...

"LLMs for Python Engineers: Advanced Data Analysis and Semantic Kernel",Oleks...

Nell’iperspazio con Rocket: il Framework Web di Rust!

Nell’iperspazio con Rocket: il Framework Web di Rust!

DevEX - reference for building teams, processes, and platforms

DevEX - reference for building teams, processes, and platforms

WordPress Websites for Engineers: Elevate Your Brand

WordPress Websites for Engineers: Elevate Your Brand

Powerpoint exploring the locations used in television show Time Clash

Powerpoint exploring the locations used in television show Time Clash

Scanning the Internet for External Cloud Exposures via SSL Certs

Scanning the Internet for External Cloud Exposures via SSL Certs

DevoxxFR 2024 Reproducible Builds with Apache Maven

DevoxxFR 2024 Reproducible Builds with Apache Maven

Vector Databases 101 - An introduction to the world of Vector Databases

Vector Databases 101 - An introduction to the world of Vector Databases

Kotlin Multiplatform & Compose Multiplatform - Starter kit for pragmatics

Kotlin Multiplatform & Compose Multiplatform - Starter kit for pragmatics

Dev Dives: Streamline document processing with UiPath Studio Web

Dev Dives: Streamline document processing with UiPath Studio Web

Staff at vc firms

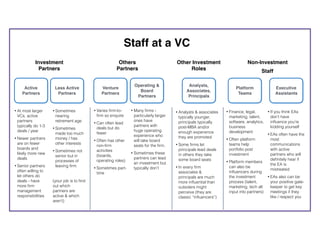

- 1. Active Partners Less Active Partners Venture Partners Analysts, Associates, Principals • At most larger VCs, active partners typically do 1-3 deals / year • Newer partners are on fewer boards and likely more new deals • Senior partners often willing to let others do deals - have more firm management responsibilities Staff at a VC Investment Partners Others Partners Operating & Board Partners Other Investment Roles Non-Investment Staff Platform Teams Executive Assistants • Sometimes nearing retirement age • Sometimes made too much money / has other interests • Sometimes not senior but in processes of leaving firm (your job is to find out which partners are active & which aren’t) • Varies firm-to- firm so enquire • Can often lead deals but do fewer • Often has other non-firm activities (boards, operating roles) • Sometimes part- time • Many firms - particularly larger ones have partners with huge operating experience who will take board seats for the firm. • Sometimes these partners can lead an investment but typically don’t • Analysts & associates typically younger, principals typically post-MBA and/or enough experience they are promoted • Some firms let principals lead deals in others they take some board seats • In every firm associates & principals are much more influential than outsiders might perceive (they are classic “influencers”) • Finance, legal, marketing, talent, software, analytics, business development • Often platform teams help portfolio post investment • Platform members can also be influencers during the investment process (talent, marketing, tech all input into partners) • If you think EAs don’t have influence you’re kidding yourself • EAs often have the most communications with active partners who will definitely hear if the EA is mistreated • EAs also can be your positive gate- keeper to get key meetings if they like / respect you