Intro to Value at Risk (VaR)

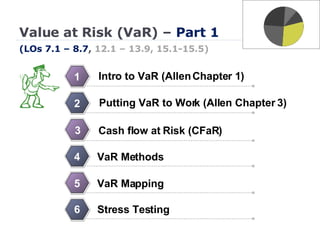

- 1. Value at Risk (VaR) – Part 1 (LOs 7.1 – 8.7 , 12.1 – 13.9, 15.1-15.5) Intro to VaR (Allen Chapter 1) 1 VaR Mapping 4 VaR Methods 5 Cash flow at Risk (CFaR) 2 Putting VaR to Work (Allen Chapter 3) 3 Stress Testing 6

- 2. Value at Risk (VaR) in the Readings We are reviewing here (Sec II) Was reviewed in Quant (Sec I) To be reviewed in Investments (Sec V) Learning Outcome Location in Study Guide Reading LO 7.1 to 7.6 II. Market 1.A. Intro to VaR Allen Ch. 1 LO 7.7 to 7.15 II. Market 1.B. Putting VaR to work Allen Ch. 3 LO 8.1 to 8.7 II. Market 6.A. Firm-wide Approach to Risk Stulz Ch. 4 LO 9.1 to 9.11 V. Investment 6.A. Portfolio Risk Jorion Ch. 7 LO 10.1 10.7 I. Quant 3.A. Forecasting Risk and Correlation Jorion Ch. 9 LO 11.1 to 11.10 I. Quant 1. Quantifying Volatility Allen Ch. 2

- 3. We are reviewing here (Sec II) Was reviewed in Quant (Sec I) To be reviewed in Investments (Sec V) Value at Risk (VaR) in the Readings Learning Outcome Location in Study Guide Reading LO 12.1 to 12.6 II. Market 3.A. VaR Methods Jorion Ch. 10 LO 13.1 to 13.9 II. Market 3.B. VaR Mapping Jorion Ch. 11 LO 14.1 to 14.7 I. Quant 3.B. MCS Jorion Ch. 12 LO 15.1 to 15.5 I. Market 3.C Stress Testing Jorion Ch. 14 LO 16.1 to 16.3 I. Quant 4. EVT Kalyvas Ch. 4 LO 17.1 17.13 V. Investment 6.B. Budgeting in I/M Jorion Ch. 17

- 12. Value at Risk (VaR) - % Basis -1.645 One-Period VaR (n=1) and 95% confidence (5% significance)

- 13. Value at Risk (VaR) – Dollar Basis -1.645 One-Period VaR (n=1) and 95% confidence (5% significance)

- 14. 10-period VaR @ 5% significance -1.645 10 10-Period VaR (n=10) and 95% confidence (5% significance)

- 15. 10-period (10-day) VaR 5% significance, annual = +12% $100(1+ ) +0.48 ($95.30)

- 16. Absolute versus Relative VaR $100(1+ ) $100 $5.20 $4.73

- 17. Absolute VaR $100(1+ ) $100

- 18. VaR Re-cap

- 95. VaR of nonlinear derivative

- 96. VaR of nonlinear derivative

- 97. VaR of nonlinear derivative

- 98. Taylor approximation AIM: Explain how the addition of second-order terms through the Taylor approximation improves the estimate of VAR for non-linear derivatives 1. Constant approximation 2. First-order (linear) approximation 3. Second-order (quadratic) approximation

- 99. Taylor approximation AIM: Explain how the addition of second-order terms through the Taylor approximation improves the estimate of VAR for non-linear derivatives

- 105. Scenario Analysis Evaluate Correlation Matrix Under Scenarios ERM Crisis (92) Mexican Crisis (94) Crash Of 1987 Gulf War (90) Asian Crisis (’97/8)

- 106. Scenario Analysis AIM: Discuss the implications of correlation breakdown for scenario analysis Severe stress events wreak havoc on the covariance matrix

- 108. Scenario Analysis Historical events + Can inform on portfolio weaknesses - But could miss weaknesses unique to the portfolio Stress Scenarios + Gives exposure to standard risk factors - But may generate unwarranted red flags - May not perform well in regard to asset-class-specific risk AIM: Describe the primary approaches to stress testing and the advantages and disadvantages of each approach

- 110. Probability

- 111. Random Variables + + + Short-term Asset Returns Probability distributions are models of random behavior + + + - - - - - - - ? ? ?

- 131. Covariance & correlation X Y (X-X avg )(Y-Y avg ) 3 5 0.0 2 4 1.0 4 6 1.0 Avg = 3 Avg = 5 Avg = .67 s.d. = SQRT(.67) s.d. = SQRT(.67) Correl. = 1.0

- 136. Bayes’ Formula

- 137. Bayes’ Formula

- 144. Discrete Variables

- 145. Continuous Variables

- 146. PDF

- 149. Comparison Probability Density Function (pdf) Cumulative Distribution Discrete variable Continuous variable

- 152. Uniform Distribution

- 153. Uniform Distribution

- 156. Binomial

- 157. Binomial

- 158. Binomial

- 159. Binomial – con’t

- 161. Normal Distribution

- 162. Also Normal

- 163. A Big Problem with Normal

- 164. Normal

- 165. Normal

- 169. Poisson

- 175. Lognormal Transform x-axis To logarithmic scale

- 176. Student’s t

- 183. Geo & Arithmetic mean 2003 5.0% 2004 8.0% 2005 (3.0%) 2006 9.0% Geo. Arith.

- 184. Geo & Arithmetic mean 2003 5.0% 1.05 2004 8.0% 1.08 2005 (3.0%) 0.97 2006 9.0% 1.09 1.199 Geo. 4.641% Arith. 4.75%