Intro in taxation.pptx

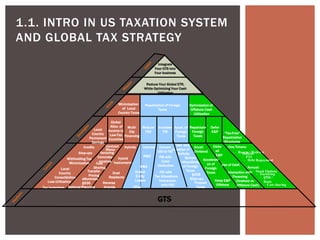

- 1. 1.1. INTRO IN US TAXATION SYSTEM AND GLOBAL TAX STRATEGY Integrate Your GTS Into Your business Repatriation of Foreign Taxes Minimization of Local Country Taxes Increase FSI Reduce FSE Local Country Permanent Savings Global Alloc. of Income to Low-Tax Countries Multi- Dip Financing Convert USI to FSI FSI with Tax Allocations FSI with Local Deduction Interest Use and Creation of Deficits Credits Contract Hybrids R&D Special Allocations of Foreign Taxes Step-ups Commiss- ionaires Hybrid Instruments G&A Prepaid Taxes Withholding Tax Minimization Local Country Consolidation Loss Utilization Cost Sharing Deferral Planning Dual Residents Reverse Hybrids Tax Incentives Interaction with FSC Transfer Pricing Optimization of Offshore Cash Utilization Defer E&P Repatriate Foreign Taxes “Tax-Free” Repatriation Structures Small Dividend Accelerati on of Foreign Taxes Keep E&P Offshore Defer all E&P Use of Cash One Timers: – Reorgs / Redemp Interaction with Financing (Onshore vs Offshore Cash) Hybrid Entity Losses OFLs Reduce Your Global ETR, While Optimizing Your Cash Utilization §338 Step-ups Manu- facturing - Accel. of Foreign Taxes – Deficits – PTI – Debt Repayment Annual: – Stock Options – Factoring – §956 / Basis – Cost sharing eBusiness §936 GTS

- 2. The extraterritorial approach of the United States tax system creates the risk of double taxation 1.1. INTRO IN US TAXATION SYSTEM AND GLOBAL TAX STRATEGY (CONTINUED) EXEMPTION CREDIT DEDUCTION Systems for Avoiding Double Taxation: CREDIT VS. DEDUCTION IN REG ARDS TO FOREIGN TAX FOREIGN TAX? Credit: elective, dollar-for-dollar Deduction: business expenditure, reduces taxable income Exception: FTC limitation significantly reduces the benefit of the credit The taxpayer is in an NOL position that is expected to last beyond the 5 year FTC carry forward period

- 3. Inbound transaction: non-U.S. persons, non-U.S. entities with U.S. income and/or U.S. activities. Example: a foreign corporation has income and/or activities in U.S. – Toyota – selling ‘into’ the U.S., and Toyota would generally be considered in the inbound category. Form 1120F if a corporation – branch profits tax may apply Form 1065 if a foreign partnership Form 1040NR if Foreign Trust with U.S. ECI Form 5472 - Information return of a 25% Foreign Owned US Corporation or a Foreign Corporation Engaged in a US Trade or Business 1.1. INTRO IN U.S. TAXATION SYSTEM AND GLOBAL TAX STRATEGY (CONTINUED) Outbound transaction: U.S. persons, U.S. entities with NON-U.S. income and/or NON- U.S. activities. Example: U.S. headquartered corporation has income and/or activities in other countries – Walmart – sells many of its products outside of U.S. FBAR – FinCEN Report 114 to report foreign financial accounts Form 8938 to report certain financial assets owned by a U.S. person – Specified Individual

- 4. 1.1. INTRO IN U.S. TAXATION SYSTEM AND GLOBAL TAX STRATEGY (CONTINUED) Many companies seek to expand into the United States for a variety of reasons. Key initial considerations Where to set-up (state and city considerations) Type of Entity (Branch, Partnership, C-Corp and others) Business and strategic reasons for setting up in the United States Management Logistics, book and record keeping Short term & long term strategy for the business (exit strategy?) Related Party payments- Transfer Pricing, Subpart F Income Human Capital Considerations and Employee Mobility Setting up business in the United States has important federal and state tax implications.

- 5. State and Local tax considerations 1.1. INTRO IN U.S. TAXATION SYSTEM AND GLOBAL TAX STRATEGY (CONTINUED) Overview Nexus Income Taxes Sales Taxes Payroll Taxes / Personal Income Taxes

- 6. A. Non-Resident Alien – Not a “Resident Alien” B. Resident for Income Tax Purposes 1. Green Card 2. Substantial Presence Test 3. Voluntary Election, Net Investment Income Tax for dual residents Exceptions: 4. The Closer Connection 5. Treaties: Tie Breaker C. Foreign Corporations 1.2. DEFINING THE FOREIGN INVESTOR: STATUS FOR TAX PURPOSES

- 7. 2. Substantial Presence Test You must pass both the 31-day and 183-day tests. -31 day test: Were you present in United States 31 days during current year? -183 day test. A. Current year days in United States x 1 =_____days B. First preceding year days in United States x 1/3 =_____days C. Second preceding year days in United States x 1/6 =_____days D. Total Days in United States =_____days (add lines A, B, and C) If line D equals or exceeds 183 days, you have passed the183-day test. 1.2. DEFINING THE FOREIGN INVESTOR: STATUS FOR TAX PURPOSES (CONTINUED)

- 8. Foreign taxpayer (both Alien Individuals and Foreign Corporations) pay U.S. tax on U.S. Income in two entirely different ways depending upon • whether the income the Foreign Taxpayer earns is from “passive” sources or • whether the income results from the Foreign Taxpayer’s conduct of an “active trade or business” in the U.S. Passive (Non Business Income) Active Trade or Business Income 1) 30% Flat Tax Rate – Gross Income 1) Graduated Corporate Tax Rates 2) Withholding Obligations and Contingency 2) Graduated Income Tax Rates 3) Effectively Connected Income 1.2. DEFINING THE FOREIGN INVESTOR: STATUS FOR TAX PURPOSES (CONTINUED)

- 9. 1) Graduated Corporate Tax Rates 1.2. DEFINING THE FOREIGN INVESTOR: STATUS FOR TAX PURPOSES (CONTINUED)

- 10. 1.2. DEFINING THE FOREIGN INVESTOR: STATUS FOR TAX PURPOSES (CONTINUED) 2) Graduated Income Tax Rates 3) Effectively Connected Income – foreign source income that is attributable to a Foreign taxpayer’s U.S. trade or business activity may be taxed by the U.S.

- 11. 1.2. DEFINING THE FOREIGN INVESTOR: STATUS FOR TAX PURPOSES (CONTINUED) U.S. residents are taxed on worldwide income U.S. nonresidents are taxed on U.S. source FDAP (Fixed, Determinable, Annual, Periodic Income) ECI (Effectively Connected Income) Dispositions of U.S. real property

- 12. 1.2. CHECK-THE BOX-ELECTION How can these rules be used to my advantage? Are there disadvantages associated with “checking-the-box” in an international context? Four-factor entity classification rules Continuity of life Centralization of management Limited liability Free transferability of interest

- 13. Foreign Disregarded Entity 1.2. CHECK-THE BOX-ELECTION (CONTINUED) US Co Sale for $90 AUS Branch Resale for $100 Results: - $90 is disregarded - US Co includes branch’s $100 of gross receipts and expenses on its Federal income tax return Foreign Corporation US Co Sale for $90 AUS Co Resale for $100 Results: - US has $90 of sales income - Absent Subpart F, AUS Co net income is not taxable in the US - AUS Co expenses are not deductible by US Co

- 14. 1.2. CHECK-THE BOX-ELECTION (CONTINUED) 80 foreign limited liability business entities, including: German, Austrian & Swiss Aktiengesellschaft French & Luxembourgian Societe Anonyme Most Latin American countries’ Sociedad Anonima Australian, Indian, Cypriot, Hong Kong & UK Public Limited Company Nova Scotia ULC not listed PER SE FOREIGN CORPORATIONS

- 15. International Tax Planning 1.2. CHECK-THE BOX-ELECTION (CONTINUED) Utilize foreign losses Trigger utilizable “excess” foreign taxes without dividend formalities and difficulties Expand foreign sales corporation (FSC) benefit to profit earned by foreign affiliates on U.S. manufactured product Eliminate most forms of tainted related party Subpart F income (i.e., intercompany dividends, interest, royalty, or sales) Strip cash out of certain foreign jurisdictions without withholding tax “Step up” foreign assets and achieve other foreign tax reductions Facilitate worthless stock write-offs without executing formal liquidation process Eliminate “prepaid” tax on intercompany profit in inventory Obtain U.S. tax free step ups for complete or partial acquisitions of foreign companies Eliminate fourth and lower tier foreign tax credit problems Obtain U.S. tax deduction for foreign employee stock option spreads (Caution: issue of voluntary foreign tax.) Eliminate passive foreign investment company status at lowest tier (“naked”) subsidiary

- 16. General Disadvantages of “Check-the-Box” Branch/Partnership Election: Triggers Section 1248 with first tier subsidiary elections Earlier tolling of unutilized excess FTCs of first tier subsidiaries Inadvertent application of subpart F manufacturing or sales branch rule for elections below first tier level Default rule may produce unintended results Triggers FTC dilution if high-taxed entities are “branched” with lower-taxed entities Dual consolidated loss compliance Five-year irrevocable election All shareholders or officers must elect Converts de minimus passive income to passive income for FTC purposes 1.2. CHECK-THE BOX-ELECTION (CONTINUED)

- 17. 1.3.1. Income Tax – Unites States source income, limited types of foreign Source income (found in §861 - §865) 1.3.2.Estate Tax - Unites States Situs assets only (includes real estate) 1.3.3. Gift Tax – real and tangible personal property with a Unites States Situs 1.3.4.** Branch Tax – Corporations only (§ 884) Sourcing rules: 1. U.S. Source Income 2. Foreign Source Income 3. Deductions 1.3. TYPE OF TAX AND SOURCING RULES

- 18. Interest: Place of residence (incorporation of payor) Rents and royalties: Place of use Personal services: Place where services are performed Sale of real property: Place where property is located Dividends: Place of incorporation (generally residence) of payor Sale of personal property: Inventory vs. non-inventory 1.3.1.INCOME TAX (CONTINUED) SOURCE OF INCOME

- 19. Exceptions: 1.3.1.INCOME TAX (CONTINUED) SOURCE OF INCOME Interest income Foreign banking branches Dividends 25% look-through rule Personal services income Commercial traveler exception

- 20. Rental income is sourced according to the location or place of use of the leased property 861(a)(4) – rental income from property located or used in the US is USI 862(a)(4) – rental income from property located or used outside the US is FSI Rental income is to be withheld at source under 1441(a) and 1442(a) at a tax rate of 30% 1445(a) – in the case of a disposition of a US real property interest by a foreign person, the transferee is required to withhold 10 percent of the transferor’s amount realized. No withholding applies if rental income is effectively connected with the conduct of a US trade or business, W -8ECI must be provided to withholding agent (exception, a partnership must withhold on portion of ECI allocable to a foreign partner at a 35% tax rate). Election available to treat real property income as effectively connected with a US trade or business – 871(d) and 882(d). Taxed at regular rates on a net basis. 1.3.1.INCOME TAX (CONTINUED) SOURCE OF INCOME - RENTS

- 21. 15% and can be as high as 35% for both corporations and individuals Source of Income – Royalties 1.3.1.INCOME TAX (CONTINUED) SOURCE OF INCOME - ROYALTIES US Co CFC Manufacturer License of Foreign IP Royalties Patents, copyright, secret processes or formulas, trademarks and other intangible property outside the US constitute foreign source income. Most countries subject royalty payments to withholding tax, which may be reduced by a tax treaty

- 22. Interest – the source of interest income is generally determined by reference to the residence of the debtor; interest paid buy a resident of the United States constitutes U.S. source income, while interest paid by foreign residents is generally foreign-source income. Dividends – the source of dividend income generally depends on the nationality or place of incorporation of the corporate payer; that is, distributions by U.S. corporations constitute domestic-source income. 1.3.1.INCOME TAX (CONTINUED) SOURCE OF INCOME – INTEREST, DIVIDENDS There are, however, several impor tant exceptions to these rules.

- 23. Source of Income – Title Passage 1.3.1.INCOME TAX (CONTINUED) SOURCE OF INCOME – TITLE PASSAGE RULE AUS Distributor US Co US Factory “50/50 Rule for manufactured property. See § 863(b), Treas. Reg. § 1.863-3 - Property factor - Sales factor Title passage is important for both U.S. and foreign taxpayers. Source of Income – gain or loss on sale of property - Real Property - Personal Property

- 24. 1.3.1.INCOME TAX (CONTINUED) APPORTIONMENT RULES Interest expense -------------- R&E expenditures State income taxes Net operating losses Stewardship expenses Losses from sale of property Legal and accounting expenses SPECIAL APPORTIONMENT RULES 1) Fungibility principle Allocate interest to all gross income, even if borrowing relates to specific asset 2) Apportionment base Must use assets per §864(e)(2) 3) Measuring the asset base Classification: Based on type of income produced (U.S. versus foreign source) Valuation: Tax book value, but may elect market value 4) Af filiated groups Treated as single corporation for purposes of apportioning interest expense 5) CFC Netting Rules

- 25. 1.3.1.INCOME TAX (CONTINUED) SOURCE OF INCOME CHART Form W-8EXP No Withholding 1042-S Reporting Form W-8ECI No Withholding(1) 1042-S Reporting Form W-8IMY QI FWP Non-US Persons Form W-8BEN NQI NWFP No Withholding No Withholding 1042-S Reporting Form W-8BENs from Beneficiaries Statutory Exemption Income Withholding Requirements Non-Treaty Claim No EIN/TIN 3-year Form W-8 BEN Treaty Claim(1) 1042-S Reporting No 1042-S Reporting EIN/TIN 1042-S Reporting EIN/TIN Form W-8 BEN Indefinite US Persons Form W-9 (1) If no EIN/TIN, 30% WHT unless statutory exempt. US Source Income Paid to No Withholding

- 26. Bank deposit interest Portfolio interest OID* (until redemption)/ short term OID Capital gains (some exceptions exist) ECI *original issue discount Income tax treati e s with foreign countries may exempt or reduce the amount of tax due on items such as interes t or dividen d s 1.3.1.INCOME TAX (CONTINUED) STATUTORY EXEMPTIONS FROM WITHHOLDING TAX

- 27. Treasury Regulation 1.861-18: Transfer of one or more “EULA” (End User License Agreement), with no rights to reverse engineer or copy and distribute to the public = sale of goods. Transfer of “OEM” (Original Equipment Manufacturer) - type rights=royalty–bearing license EULA with a limited term = lease of tangible property. 1.3.1.INCOME TAX (CONTINUED) SOURCE OF INCOME – SOFTWARE REGULATIONS *The regulations do not provide specific guidance on several software / e-commerce transactions (e.g., cloud computing, software maintenance agreements). FP Sale of Goods USD Ships pre- packed copies Royalties Resells copies to customers USP FD Master Program Files with Right to Copy and Distribute Purchase Price of Goods Makes copies and sells to customers License of Software IP

- 28. Non resident alien individual dies owning U.S. real estate or shares of certain types of entities that own U.S. real estate. Apply to transfers of both tangible and intangible property situated or deemed situated in the U.S. upon a non-resident alien’s death (Qualified Domestic Trust appropriate for a married couple when one of the spouses is a non -citizen) Stock in foreign corporations and proceeds for a policy insuring the life of a non -resident alien – are not considered to have a U.S. situs. 1.3.2.ESTATE TAX U.S. situs assets: Any tangible and intangible property located in the U.S. at death Real Estate located in the U.S. Generally shares of stock owned in U.S. Generally partnership interest in U.S. assets Generally debt obligations of U.S. persons, states and government authorities *debt exceptions: - bank deposits – FBAR requirement - life insurance proceeds - portfolio debt

- 29. FBAR (Report of Foreign Bank and Financial Accounts ) A U.S. person (defined below) that has a financial interest in or signature authority over foreign financial accounts must file an FBAR (Report of Foreign Bank and Financial Accounts) if the aggregate value of the foreign financial accounts exceeds $10,000 at any time during the calendar year. Rule for penalties: The civil penalties for a non-willful violation can not exceed $12,459 per violation. Civil penalties for a willful violation can not exceed the greater of $124,588 or 50% of the amount in the account at the time of the violation. Issue: The individual foreign investor that invest in U.S. real estate in equity amounts of $1,000,000 or more is going to be forced to use a corporation formed outside of the United States (Foreign Corporations) somewhere in their investment structure if they are going to avoid the U.S. estate tax. *Tax Treaty can help to solve the problem. 1.3.2.ESTATE TAX (CONTINUED)

- 30. Non-resident aliens are subject to gift tax on gifts of property situated in the U.S. and generally are not taxed on gifts they make of intangible property even though it may be considered located in the U.S. Intangible U.S. property: U.S. bank accounts (the account is not connected with a U.S. trade or business); Cash in U.S. brokerage accounts; Bonds issued in the U.S.; Stock in domestic corporations; Interest in partnership or LLCs (Might go into different category) 1.3.3. GIFT TAX

- 31. Enforced by withholding at source: withheld and remitted to the IRS by withholding agent who has “control, receipt, custody, disposal, or payment” of income subject to the tax. Tax imposed on the gross amount of the payment. Rate of withholding tax may be reduced or eliminated by an income tax treaty. 1.4. WITHHOLDING TAXES Withholding Agent AUS Co US Co Royalties License of sof tware U.S. Co. would be required to withhold tax on royalties paid to use of sof tware in the Unites States. Australia treaty would generally provide for a reduced rate of withholding if Australia Co provided a properly completed IRS Form W8-BEN. - §871 and §881 impose US tax on foreign individuals and entities - §1441(Non-resident aliens), §1442 (Foreign corporations), §1446 (Foreign partners) are the administrative sections regarding the withholding tax - §1462 – tax withheld at source under §1441 & §1442 is credited against payee’s liability under §871 & §881

- 32. 1.4. WITHHOLDING TAXES (CONTINUED) FC B FC A QI US Portfolio Co.s US Fund B US Portfolio Co.s US Fund A Foreign Fund A NWFP W-8BEN (2) W-9(1) W-9(1) NRA NRA (1) No US Withholding tax (2) US Withholding

- 33. 1.4. WITHHOLDING TAXES (CONTINUED) US Op. Entity US Fund Foreign Fund US Foreign Corp. W-9 W-9 50% 50% 60% 40% ECI 1,000 Form 1065 & Form 8804 Form 1065 Form 8804 Form 1120-F Form 8813 500 * 60% * 35% 500 * 40% * 39.6% Foreign Individual -The fact that the payor did not withhold does not excuse the foreign recipient from paying tax -The IRS can proceed against either the payor or the foreign recipient for withholding tax due.

- 34. FIRPTA is a law dating back to the 1980s, a time when foreign purchases of iconic American real estate fed widespread anxiety that foreign investors could dominate the U.S. real estate market. FIRPTA addressed those fears by erecting barriers to foreign ownership of U.S. real estate, most notably by requiring foreign investors to pay a 30% withholding tax on real estate investments in the U.S. However, this requirement didn't apply to foreign investors who owned shares in real estate investment trusts (REITs), provided they owned less than 5% of the REIT's stock. 1.5. FIRPTA (FOREIGN INVESTMENTS IN U.S. REAL PROPERTY) RULES

- 35. Fixed or determinable annual or periodical income. U.S. source fixed or determinable annual or periodical income that is not effectively connected with the conduct of a U.S. trade or business is subject to a 30% tax. 1.6. FDAP CONCEPT

- 36. Generally, in the case of passive capital gains caused by a Non Resident Alien or Foreign Corporation, there is no taxation. Therefore, there was no need to devise a taxing structure*. *This is not the case for Foreign Investors that invest in U.S. real estate or Foreign Investors that are not governed by “gains income” tax treaty and have “effectively connected capital gains income”. Source of Gain from the Disposition of Real Property Interests § 861(a)(5) – gains, profits and income from the disposition of a US real property interest is USI § 862(a)(5) treats gain from the disposition of real property located outside the US as FSI US Property Interest § 897(a)(1) treats a foreign person’s gain or loss from the disposition of a US real property interest as if the foreign person were engaged in a US trade or business and as if the gain or loss were effectively connected with such trade or business. 1.7. INVESTING IN U.S. REAL ESTATE

- 37. TAX DEFERRAL VIA § 1031 § 1031 of the Internal Revenue Code provides tax deferral for certain exchanges of property held for investment or used in a trade or business. To qualify for deferral, the property relinquished in the exchange must be exchanged for a “like -kind” replacement property. 1.7. INVESTING IN U.S. REAL ESTATE (CONTINUED) DISPOSITION AND TAX DEFERRAL Many equity, real estate, and hedge funds organized as partnerships. GP P LP1 LP3 LP2 GP: - determine investment strategy - solicit capital contributions - acquire, manage, and sell assets - arrange loans - administrative support LP: - contribute capital to the partnership but do not participate in the fund's management *can invest their own capital in the par tnership as well, but such investments usually represent a small share (between 1 percent and 5 percent) of the total capital invested.

- 38. When investors is not interested in direct ownership of property: 1.7. INVESTING IN U.S. REAL ESTATE (CONTINUED) DISPOSITION AND TAX DEFERRAL - Cycle 10-18 years - Subject to SEC regulations and requirements - Publicly available option for all investors if it’s publicly traded. - Funds are fairly liquid if publicly traded and can be bought and sold on the market as frequently as desired - In general, REITs typically pay out at least 90% of income to shareholders in order to secure exemption from taxation. From there, dividend payments made to shareholders are taxed as ordinary income, unless certain extenuating circumstances apply. - Returns with a time horizon of 6 -10 years. - Not publicly traded and therefore not subject to SEC regulations and requirements - Only available to accredited investors - Funds are less liquid and generally require that capital be invested in properties over a term of at least six years - Performance is based on the performance of the real estate market funds are invested in and not the stock market - Fund operates tax-free; when funds are distributed to investors, gains and losses are taxed at the individual level at either long-term capital gains rates or short-term capital gains rates. REIT (Real Estate Investment Trust) Private Equity Funds: (Equity + Debt investment in real estate):

- 39. Real Estate Tax Planning Tools Liquidation of corporation after sale The portfolio loan (Foreign person(s) capitalize domestic corporation par t debt under por tfolio interest rules and equity) Like king Exchange Sale of Stock in foreign corporation 1.7. INVESTING IN U.S. REAL ESTATE (CONTINUED) DISPOSITION AND TAX DEFERRAL Advantages Corporate Liquidation Portfolio Loans 1 one single tax paid deduction of interest on loans made to acquire the real estate 2 proceeds of sale transferred free of tax foreign seller will be receiving tax free interest from the note 3 (deal-by-deal basis) the property can be used to secure the note until its full payment 4 Distribution upon liquidation return basis first any excess is capital gain, not subject to US tax, not ECI Foreign Investor (if owns< 10% of the real estate) will receive the interest that is deductible by the Foreign Co free of any U.S. tax Advantages Like-Kind Exchange (sec. 1031) Sale of Stock in a Foreign Co (with a use of sec. 1031) 1 tax deferred more cash to seller versus sale of asset 2 leverage and increased CF for reinvestment 3 wealth and asset accumulation

- 40. 1.9. CONCEPT OF PFIC Passive Foreign Investment Company (PFIC) (§§1291-1298) • Taxation of U.S. shareholders QEF election: Current taxation or Excess distribution: Pay deferred tax + interest charge or Mark-to-Market Election PFIC Stock Bond

- 41. 2.1. INTERNATIONAL TAX AGREEMENTS: TREATY Tax resident in other country Taxable on the income in other country •Treaty rules •IRC Section 894 US citizens subject to US tax no matter what

- 42. General Purpose: Tax treaties provide benefits to both governments by setting out clear rules that will govern tax matters relating to trade and investment between the two countries. 2.1. INTERNATIONAL TAX AGREEMENTS: TREATY (CONTINUED) General Function: to provide certainty on “threshold” question – weather the taxpayers cross -boarded activities will subject it to taxation by two or more countries protection from double taxation. Reduction of “excessive” taxation by reducing withholding taxes that are imposed at source. To regulate provisions coordinating the pension rules of the tax systems of the two countries , child support and employee stock options “Saving clause” : treaty does not af fect the taxation by either treaty countr y of its residents or its citizens. “Treaty -shopping” prevention – “limitation of benefits" USP NZ Hold Co Australian Co Royalties Royalties License Sub Licenses

- 43. 2.2. PERMANENT ESTABLISHMENT: DEFINITION AND IMPORTANCE Fixed place of business: - Place of management - Branch or an office - Factory - Workshop - A mine, oil, or gas well, quarry, other place where natural resources are extracted Using target country sales agent An enterprise of one country shall not be deemed to have a permanent establishment in the other country merely because it carries on business in that other contracting state through a broker, general commission agent, or an other agent of an independent status, provided that such persons are acting in the ordinary course of their business. US multi-national corporations doing business in foreign countries (and foreign based multi-national corporations doing business inside the US or foreign countries other than their own) are typically subject to the domestic tax laws of the countries where they engaged in business activities.

- 44. $ 3 5 U.S. Co rporate T a x -$ 10 Fo reign T a x Credi t $ 2 5 Net U.S. T a x D ue 2.3. FOREIGN TAX CREDIT AND ITS LIMITATIONS US Co $100 Foreign Source Income ($10 Foreign tax) US Co : - Co rporation - Pa rtnershi p - D i sregarded Enti ty Advantage Disadvantage LLC Graduated Individual Income Estate tax applies Partnership Tax only on U.S. source income Gift Tax applies to Transfer of Interest Capital Gains Tax Rate at 15% Pass Through to the members - single tax Limited Personal Liability No Disclosure of Ownership No branch tax LLC formed as 1) Disregarded Separation between business assets and personal finances (Single Member LLC) Ignored for federal income tax purposes Separate legal entities under state law Advantage of swapping appreciated real estate for a replacement property C Corporation Graduated Corporate Tax Rates Capital Gains Taxed as Ordinary Income No Branch tax and No Gift tax on Transfer of Shares Dividend and/or Interest Tax(Double Tax) Limited Personal Liability and no disclosure of ownership Fo reign Co : - no t w/T a x T rea ty Co unty - w/ T a x T reaty Co unty

- 45. Foreign Source Gross Income US Tax - - Foreign Source Expenses X Liability = FTC Limit Worldwide Taxable Income 2.3. FOREIGN TAX CREDIT AND ITS LIMITATIONS (CONTINUED) § 904 provides a foreign tax credit limitation § 902: when a foreign corporation pays a dividend, shareholder is entitled to claim a “deemed paid” foreign tax credit for a proportionate amount of the foreign corporation’s foreign income taxes. Indirect credit (available to 10% corporate shareholders) Direct credit § 901: a credit for taxes imposed on and paid by the U.S. taxpayer (e.g. withholding tax) § 78 gross-up income (equals amount of deemed paid credit) Deemed paid credit = Foreign corporation’s foreign income taxes x Dividend received by shareholder Foreign corporation’s undistributed E&P

- 46. Lesser of: U.S. tax on net foreign-source income or foreign taxes paid or accrued Applied separately to FTC “baskets” Excess FTC: Carryback 2 years Carryforward 5 years 2.3. FOREIGN TAX CREDIT AND ITS LIMITATIONS (CONTINUED) How to increase limitation? Gross income: Recharacterize as foreign source for U.S. tax purposes Deductions: Recharacterize as U.S. source for U.S. tax purposes

- 47. 2.3. FOREIGN TAX CREDIT AND ITS LIMITATIONS (CONTINUED) U.S. parent corporation 1st tier foreign sub 2nd tier foreign sub Qualification requirements - Minimum 10% direct ownership at each level - Minimum 5% indirect ownership through chain - Dividend distributions up to U.S. parent Number of qualifying tiers - Historically, limited to 1st, 2nd and 3rd tiers - TRA 1997: Extended to 4th, 5th and 6th tiers (but only if CFCs) Tracing foreign taxes to dividends $ $

- 48. 2.3. FOREIGN TAX CREDIT AND ITS LIMITATIONS (CONTINUED) 48 Facts: Domestic corporation has a foreign branch (Note: Branches include legal entities that are “disregarded” under check-the-box regulations) Total income of $100 is attributable entirely to foreign branch U.S. tax rate = 35% Foreign tax return Taxable income . . . $100 Tax rate . . . . . . . . . .20 Foreign tax. . . . . . . $ 20 CASE 1: 20% foreign tax rate “Excess limitation” U.S. tax return Taxable income . . . $100 Tax rate . . . . . . . . . .35 Pre-credit tax . . . . . 35 Credit (foreign tax) . (20) U.S. tax. . . . . . . . . . $ 15

- 49. Foreign tax return Taxable income . . . $100 Tax rate . . . . . . . . . .50 Foreign tax . . . . . . $ 50 CASE 2: 50% foreign tax rate “Excess credits” U.S. tax return Taxable income . . . $100 Tax rate . . . . . . . . . .35 Pre-credit tax . . . . . 35 Credit (limitation) . . (35) U.S. tax. . . . . . . . . . $ 0 $15 Excess credit 2.3. FOREIGN TAX CREDIT AND ITS LIMITATIONS (CONTINUED)

- 50. CROSS CREDITING—EXAMPLE Case 1: Domestic corporation has a branch in country X Total income of $100 is attributable entirely to branch in X Tax rates: U.S. = 35%, X = 50% Foreign income taxes (50% x $100) . . . . . . . . . . . . . . . . $50 Average foreign tax rate . . . . . . . . . . . . . . . . . . . . . . . . . 50% Limitation: (A) Total taxable income $100 (B) Precredit U.S. tax ($100 x 35%) $ 35 (C) Foreign source taxable income $100 Limitation (line B x C ÷ A) . . . . . . . . . . . . . . . . . . . . . . . . . $35 Excess credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 15 Question: Amount of excess credits? 2.3. FOREIGN TAX CREDIT AND ITS LIMITATIONS (CONTINUED)

- 51. CROSS CREDITING —EXAMPLE (CONT’D) Case 2: Domestic corporation also has branch in country Y Branch in Y generates $100 profit Y tax rate = 25% Foreign income taxes (50% x $100) + (25% x $100) . . . $75 Average foreign tax rate ($75 ÷ $200) . . . . . . . . . . . . . . 37.5% Limitation: (A) Total taxable income ($100 + $100) $200 (B) Precredit U.S. tax ($200 x 35%) $ 70 (C) Foreign source taxable income $200 Limitation (line B x C ÷ A) . . . . . . . . . . . . . . . . . . . . . . . . . $70 Excess credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5 Question: Amount of excess credits? 2.3. FOREIGN TAX CREDIT AND ITS LIMITATIONS (CONTINUED)

- 52. 2.3. STRATEGIES AND TACTICS RELATED TO FOREIGN TAX CREDIT 1) BIFURCATING EARNINGS AND TAXES Consolidation systems Biddle opportunities German OHG structure German stock dividend Reverse Hybrid Vulcan Using US partnership rules Generating High & Low Tax Pools

- 53. 2.3. STRATEGIES AND TACTICS RELATED TO FOREIGN TAX CREDIT (CON’T) Pre-tax Income CFC1 CFC2 Consolidated Year 1 100 (50) 50 Year 2 100 100 200 Total 200 50 250 Foreign Tax (40%) Year 1 20 0 20 Year 2 40 40 80 Total 60 40 100 Effective Tax Rate 30.0% 80.0% 40.0% 1. CONSOLIDATION SYSTEMS

- 54. 2.3. STRATEGIES AND TACTICS RELATED TO FOREIGN TAX CREDIT (CONTINUED) 1. CONSOLIDATION SYSTEMS (CONTINUED) AUSTRALIAN CONSOLIDATION REGIME U.S. Parent owns an Australian group All members are corporations for purposes of U.S. and Australian tax Group is either (A) Single Entry Group (Head Company (“HC”) is the Australian HoldCo); USP Head Company Subsidiary Member (A) HC becomes the “taxpayer” for all Australian income tax purposes. All other wholly owned entities in the group are treated as divisions of HC. Intercompany transactions within the group are ignored for Australian income tax purposes. HC is fixed with all liability for Australian tax. Legal liability to pay Australian income tax rests solely with the Head Company unless and until the Head Company defaults.

- 55. 2.3. STRATEGIES AND TACTICS RELATED TO FOREIGN TAX CREDIT (CONTINUED) 1. CONSOLIDATION SYSTEMS (CONTINUED) HC becomes the “taxpayer” for all Australian income tax purposes. All other wholly owned entities in the group are treated as divisions of HC. Intercompany transactions within the group are ignored for Australian income tax purposes. HC is fixed with all liability for Australian tax.

- 56. 2. BIDDLE OPPORTUNITIES 2.3. STRATEGIES AND TACTICS RELATED TO FOREIGN TAX CREDIT (CONTINUED) GERMAN OHG (GENERAL PARTNERSHIP) STRUCTURE OHG’s partners pay federal tax OHG pays trade tax U.S. borrows to make investment in OHG U.S. German Subs Organschaft (German Corporation) Capital Loan OHG

- 57. 2. BIDDLE OPPORTUNITIES (CONTINUED) 2.3. STRATEGIES AND TACTICS RELATED TO FOREIGN TAX CREDIT (CONTINUED) GERMAN STOCK DIVIDEND Regular dividend for German purposes Reduces German rate to 30% Refund of German tax at hold- co level Avoids US DCL (Dual consolidated losses) rules GmbH Stock Dividend US German Subs Debt Organschaft

- 58. 2. BIDDLE OPPORTUNITIES (CONTINUED) REVERSE HYBRID Taxes paid at F1 E&P remains at F2 US F1 F2 Nature of liability Primary and sole at partner level? Can local tax authorities go against assets of the partnership for payment of tax, or only against partner’s interest in the partnership? Does funding mechanism for payment of taxes make a difference? 2.3. STRATEGIES AND TACTICS RELATED TO FOREIGN TAX CREDIT (CONTINUED)

- 59. 3. VULCAN 2.3. STRATEGIES AND TACTICS RELATED TO FOREIGN TAX CREDIT (CONTINUED) SA Individual 50% 50% SA government only taxes US corp’s 50% Vulcan case §902 regulations US SA Corp Pre-tax 100 Tax 25 After tax 75

- 60. 4. USING US PARTNERSHIP RULES 2.3. STRATEGIES AND TACTICS RELATED TO FOREIGN TAX CREDIT (CONTINUED) US <80% Step 1: CTB Partnership election for Foreign JV Step 2: Section 754 election Result: US investor obtained stepped-up basis for share of partnership assets for US tax purposes Foreign JV Foreign Shareholders

- 61. 2.3. STRATEGIES AND TACTICS RELATED TO FOREIGN TAX CREDIT (CONTINUED) 4. USING US PARTNERSHIP RULES FMV 100 BASIS 0 FMV 100 BASIS 100 CFC2 US CFC1 P/S §704(C) ALLOCATIONS

- 62. 2.3. STRATEGIES AND TACTICS RELATED TO FOREIGN TAX CREDIT (CONTINUED) 4. USING US PARTNERSHIP RULES E&P AND TAX POOLS Foreign US Foreign US Income 13 13 13 13 Depreciation (5) 0 (5) (10) Taxable Income 8 13 8 3 Foreign Tax 3 3 3 3 E&P 10 0 Effective Rate 23% 100% CFC 1 CFC 2

- 63. 2.4. DEFINITION OF CFC AND SUBPART F INCOME CONCEPT U.S. shareholders Controlled foreign corporation SUBPART F (§§951-964) CFC defined* U.S. shareholders own > 50% of stock, by vote or value U.S. shareholder: U.S. person that owns 10% or more of stock Subpart F inclusion (deemed dividend) Subpart F income Investments in U.S. property *Rule of thumb = 5 or fewer shareholders owning > 50% Stock Bond Factory

- 64. 2.4. DEFINITION OF CFC AND SUBPART F INCOME CONCEPT (CONTINUED) Deemed dividend U.S. shareholders Controlled foreign corporation Year in which CFC has Subpart F income U.S. shareholder is taxed on deemed dividend (§951) U.S. shareholder can claim §902 credit (§960) FTCL basketing rule: Same character as underlying Subpart F income Actual dividend distributions in subsequent years (§959) Traced first to CFC’s “previously taxed income” (PTI) Receipt of PTI is a tax-free return of capital

- 65. 2.4. DEFINITION OF CFC AND SUBPART F INCOME CONCEPT (CONTINUED) Insurance income Income from insuring risks outside the CFC’s country of incorporation Foreign base company sales income Income from the sale of goods Goods are purchased from or sold to a related person Goods are neither manufactured nor sold for use in CFC’s country of incorporation Foreign base company services income Fees for services performed outside CFC’s country of incorporation for a related person Foreign personal holding company income Passive investment income such as dividends, interest, rents, royalties and capital gains Foreign base company shipping income Foreign base company oil-related income

- 66. U.S. Taxation of U.S. persons on worldwide income Absent subpart F income, s foreign subsidiary earnings are not subject to U.S. tax until distributed to the U.S. shareholder. Subpart F was enacted by Congress to limit the deferral of U.S. taxation of certain income outside the U.S. by foreign corporations controlled by U.S. persons (CFC - controlled foreign corporations). 2.4. DEFINITION OF CFC AND SUBPART F INCOME CONCEPT (CONTINUED) US Co US Co AUS Branch AUS Co Income earned by Australian Branch flows into US return Interest, dividends, rents and royalties. Certain sales income. Certain service income.

- 67. Under the tax rate test, the selling of products by the Cayman branch has substantially the same effect as if the Cayman Branch were a subsidiary corporation. 2.4. DEFINITION OF CFC AND SUBPART F INCOME CONCEPT: “BRANCH RULE” Under § 954(d)(2), the Cayman branch is treated as a separate CFC and has Foreign Base Company Sales Income. US shareholder CFC Australia Cayman Manufactures products Sales NZ Customers Sells for use in New Zealand 12.5% 0%

- 68. 2.5. CFC INVESTING IN U.S. PROPERTY AND SECTION 956 INVESTMENT Concept: Constructive dividend of active foreign business profits Treatment: Current inclusion under Subpart F Transactions triggering §956 inclusions CFC makes loan to U.S. shareholders (includes guarantees) CFC purchases stock issued by U.S. shareholders CFC purchases tangible property located in U.S. CFC purchases right to use intangible property in U.S. Certain pledges and guarantees Controlled foreign corporation U.S. shareholders Loan $

- 69. 2.5. CFC INVESTING IN U.S. PROPERTY AND SECTION 956 INVESTMENT (CONTINUED) U.S. CFC $100,000 loan Foreign Bank Pledge assets as security on loan CFC E&P = $200,000 Is this a Section 956 investment in U.S. property? If so, what is the amount of the inclusion? What other scenario is possible? Pledge of CFC Assets

- 70. 2.5. CFC INVESTING IN U.S. PROPERTY AND SECTION 956 INVESTMENT (CONTINUED) Agreement to buy note at maturity for $100,000 if U.S. fails to pay loan. Separate arrangements made for payment of interest. Is this a Section 956 investment in U.S. property? If so, what is the amount of the inclusion? U.S. CFC $100,000 loan Foreign Bank

- 71. § 956 treats investments by a CFC in certain “United States property” as giving rise to a deemed dividend: - Obligations of related U.S. persons - Stock in related U.S. persons - Most tangible property physically located in U.S. - U.S. property - Intangible property acquired or developed for use in the U.S . 2.5. CFC INVESTING IN US PROPERTY AND SECTION 956 INVESTMENT (CONTINUED) § 956 is intended to prevent a CFC from indirectly repatriating earnings to its U.S. shareholders without incurring residual U.S. tax. Public USP CFC Buys back USP stock Deemed dividends $900 E&P $100 Foreign Taxes CFC’s acquisition of U.S. Parent stock would cause it to hold a U.S. property investment that is taxable under § 956. USP would include earnings and be liable for residual U.S. tax (i.e., 25% of the deemed dividend).

- 72. 2.6. FOREIGN PERSONAL HOLDING COMPANY (FPHC) Concept: Incorporated pocketbook of wealthy U.S. citizens Definition of FPHC 5 or fewer U.S. citizens or residents own 50% or more of stock 60% or more of gross income is FPHC income Deemed dividend = Undistributed FPHC income FPHC Stock Bond U.S. citizens or residents

- 73. § 954(c) - FPHC income includes many types of passive income: Dividends, interest, royalties, rents and annuities Certain property transactions (generally, gains from the sale of property which ( i) gives rise to passive income, (ii) is a partnership interest, or (iii) which does not give rise to income) Generally excludes property that is used in a trade or business. Commodities transactions, foreign currency, gains, etc. 2.6. FOREIGN PERSONAL HOLDING COMPANY (FPHC) (CONTINUED) US shareholder CFC (Bermuda) Passive Income Third Party OEMs Software Royalties Exception: - Interest, dividends, rents and royalties from related CFCs generally are not subpart F income under § 954(c)(6) (the CFC “look-through rule). - Same-Country exception

- 74. EXAMPLE: SAME COUNTRY 2.6. FOREIGN PERSONAL HOLDING COMPANY (FPHC) (CONTINUED) AUS 1 U.S. AUS 2 Dividends Interest AUS 2 must have a substantial part of its trade or business assets in Australia and deductible payments cannot reduce subpart F income of the payor.

- 75. 2.6.FOREIGN BASE COMPANY SALES INCOME (FBCSI) Theory: Sales income that should be earned by U.S. parent Conditions (all three required for income to be subpart F): Purchase from or sale to related party Not manufactured in country of incorporation Sold for use outside country of incorporation EXAMPLE: TAINTED ACTIVITIES U.S. Australia Packaging Operations Packaged Product Sales to related or unrelated customers outside Australia Unpackaged Product

- 76. CFC ahs FBCSI since the income is derives from the purchase of personal property from a related person, the property is sold for use outside of Australia and the property is manufactured outside of Australia. 2.6.FOREIGN BASE COMPANY SALES INCOME (FBCSI) (CONTINUED) US Parent CFC Australia U.S. sells to CFC Resells for use in NZ NZ Customers Manufactures microprocessors Manufacturing exception: Income that would otherwise be FBCSI is excluded from subpart F income if the CFC. Deriving the income satisfies the manufacturing exception, through on of three tests: 1) Substantial transformation of the proper ty by the CFC; 2) The CFC per forms manufacturing activities that are (1) substantial in nature and (2) generally considered to constitute manufacturing; 3) The CFC’s own employees make a “substantial contribution” to the manufacture of proper ty by another person. The intent is that subpart F should not apply where the CFC’s own activities. Add substantial value to the property being sold.

- 77. CFC-1 would qualify under the “ substantial transformation”: test and not have subpart F income. CFC-2 might qualify for the exception for activities that are substantial in nature and generally considered to constitute manufacturing . 2.6.FBCSI (CONTINUED) : EXAMPLE OF MANUFACTURING EXCEPTION US shareholder CFC-1 CFC-2 Semiconductor Equipment Customers Assembly & Testing Raw materials Microprocessors Finished Product

- 78. CFC-1 would not have subpart F income if CFC-1’s employees make a “substantial contribution” to the manufacturing of property by the contract manufacturer. 2.6.FBCSI (CONTINUED) : EXAMPLE OF CONTRACT MANUFACTURING US shareholder CFC-1 CFC-2 (Distributor) Contract Manufactur er Consigns raw materials Finished Product Sells Finished Product Quality control, Product design, Logistics, etc.

- 79. No treaty between the U.S. and a foreign country will exempt any foreign corporation from the branch profits tax UNLESS: - Income treaty in effect; - Foreign corporation is a qualified resident of the foreign country (resident of this country in the year which it has a dividend equivalent amount) 2.7. APPLICATION OF TREATY PROVISIONS TO BRANCH PROFIT TAX

- 80. 3.1. TRANSFER PRICING: POLICY BACKGROUND AND DEFINITION U.S. rules are designed to prevent the improper shifting of income, deductions, credits, and allowances among related persons Concern that multinationals have a strong incentive to shift income to low-tax jurisdictions or shift deductions to high-tax jurisdictions through transactions with related parties SECTION 482 Goal: Clearly reflect income of affiliated corporations engaged in intercompany transactions Standard: Arm’s-length price (or market value) standard for evaluating transfer prices Practical difficulty: Market values are often highly judgmental and fact dependent Result: Transfer pricing is most contentious area of audit and litigation controversy in international taxation

- 81. 3.1. TRANSFER PRICING: POLICY BACKGROUND AND DEFINITION (CONTINUED) • Group profit = $25 ($100 - $60 -$15) • Impact of alternative transfer prices: – Transfer price of $60 would allocate entire $25 profit to foreign subsidiary – Transfer price of $85 would allocate entire $25 profit to U.S. parent – Transfer price between $60 and $85 splits profit between USP and FSUB Export sale of widget Resale of widget Transfer price = ? Foreign customer Resale price =$100 Manufacturing cost = $60 Marketing expense = $15 U.S. parent corporation Foreign marketing subsidiary Good, Services $

- 82. REG. § 1.482-4 •Problem No comparables due to uniqueness of intangibles •Congressional response Commensurate with income requirement •Pricing methods Comparable uncontrolled transaction method Comparable profits method Profit split method U.S. parent corporation Foreign manufacturing subsidiary PATENT $ Royalty? 3.1. TRANSFER PRICING: POLICY BACKGROUND AND DEFINITION (CON’T) Intangibles

- 83. Establishing prices for transactions between related companies in different tax jurisdictions Section 482 grants broad powers to the IRS to reallocate income and deductions to prevent tax evasion or to reflect income clearly Applicable standard is that of an uncontrolled taxpayer dealing at arm’s length with another uncontrolled taxpayer Foreign countries often have their own transfer pricing provisions OECD guidelines (Organization for Economic Co-operation and Development) 3.1. TRANSFER PRICING: POLICY BACKGROUND AND DEFINITION (CONTINUED) WHAT IS TRANSFER PRICING?

- 84. Arm-length principle: what would happen of transaction will occur with unrelated party Pricing Methods (Treas. Reg. § 1.482-3) 3.2.1. Comparable uncontrolled price 3.2.2. Resale price 3.2.3. Cost plus 3.2.4. Comparable profits 3.2.5. Profit split 3.2. ARM-LENGTH PRINCIPLE AND ITS METHODS (Treas. Reg. § 1.482-1): Taxpayer must identify and apply method that provides most reliable result. Reliability is determined by (i) quality of comparables and (ii) quality of data regarding comparables - Functions performed by the parties involved - Contractual terms governing transaction - Risks assumed by each party - Economic or market conditions in which parties conduct business - Nature of property or services transferred in transaction

- 85. 3.2.1. COMPARABLE UNCONTROLLED PRICE METHOD 1. Determine which affiliate will be the tested party 2. Obtain data regarding comparable uncontrolled parties 3. Choose profit level indicator, such as operating profit/sales or operating profit/operating assets 4. Construct arm’s-length range of comparable profits for tested party 5. Make adjustment if reported profit lies outside arm’s-length range A taxpayer had to present evidence of the transactions of unrelated, uncontrolled companies in order to make the required comparison with an arm's– length transaction.

- 86. 1. Determine arm's length price - Applicable resale price - Appropriate gross profit - Arm's length range 2. Consider degree of comparability and reliability 3. Consider data and assumptions The resale price method measures the value of functions performed, and is ordinarily used in cases involving the purchase and resale of tangible property in which the reseller has not added substantial value to the tangible goods by physically altering the goods before resale. 3.2.2. RESALE PRICE METHOD

- 87. 1. Determine arm's length price: appropriate gross profit and arm’s length range 2. Consider degree of comparability and reliability 3. Consider data and assumptions Used in cases involving the manufacture, assembly, or other production of goods that are sold to related parties. 3.2.3. COST PLUS METHOD

- 88. 1. Consider degree of comparability and reliability 2. Consider data and assumptions 3. Determine Arm's length range 4. Analyze indirect evidence of comparable uncontrolled transactions. The comparable profits method (CPM) evaluates if the amount charged in a controlled transaction is arm's length based on objective measures of profitability derived from uncontrolled taxpayers that engage in similar business activities under similar circumstances. 3.2.4. COMPARABLE PROFITS METHOD

- 89. 1. Determine Appropriate share of profits and losses 2. Consider degree of comparability and reliability The profit split method evaluates whether the allocation of the combined operating profit or loss attributable to one or more controlled transactions is arm's length by reference to the relative value of each controlled taxpayer's contribution to that combined operating profit or loss. 3.2.5. PROFIT SPLIT METHOD

- 90. 3.4. ADVANCED PRICING AGREEMENT AND ITS IMPLICATIONS Entered into by the IRS and a taxpayer Used to avoid expensive and time-consuming controversies related to §482 issues Intended to lessen the uncertainties and enhance the predictability of the tax consequences of intercompany transactions

- 91. Benefits of Transfer pricing: Lowering duty costs by shipping goods into high-tariff countries at minimal transfer prices so that duty base and duty are low. Reducing income taxes in high-tax countries by overpricing goods transferred to units in such countries; profits are eliminated and shifted to low-tax countries. Facilitating dividend repatriation when dividend repatriation is curtailed by government policy by inflating prices of goods transferred. 3.6. BENEFITS AND CHALLENGES

- 92. Challenges of Transfer pricing: Performance Measurement the clouding effect of manipulating intra corporate prices on a subsidiary’s apparent and actual profit performance difficulty in maintaining relationships with subsidiaries that are negatively impacted by transfer pricing. Taxation - Tax and regulatory jurisdictions contribute to and compound transfer pricing problems. Pricing that is justified and reasonable in the home country may not be perceived as such in the host country. 3.6. BENEFITS AND CHALLENGES (CONTINUED)

- 93. REVIEW – U.S. TAXATION OF FOREIGN SUBSIDIARIES Tax Jurisdiction - Taxed only on U.S. source income - Excluded from U.S. consolidated return Profit Repatriations - U.S. parent can not claim dividend received deduction - U.S. parent can claim a §902 credit - FTCL basketing rules: 10/50 company or CFC look-through rule Transfer Pricing - Must use arm’s-length prices

Hinweis der Redaktion

- CFC treated as holding the loan as an obligation of a US person (i.e., an investment in US property). CFC’s aggregate investment in US property equals the unpaid principal amount of the obligation.

- CFC’s agreement to buy note at maturity is a guarantee of US’s loan. CFC treated as holding the loan as an obligation of a US Person (i.e., an investment in US property). CFC’s aggregate investment in US property equals the unpaid principal amount of the obligation. See Priv. Ltr. Rul. 89-12-037 (Dec. 23, 1988).