Q1 2017 - Downtown Chicago Office Reports

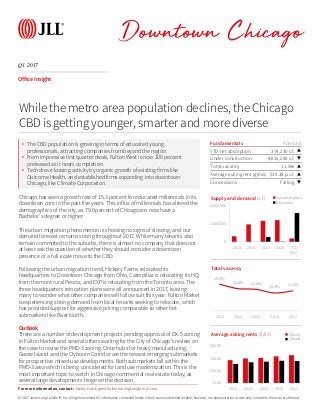

- 1. © 2017 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Q1 2017 Downtown Chicago Office Insight Chicago has seen a growth rate of 15.3 percent for educated millennials in its downtown core in the past five years. This influx of millennials has altered the demographics of the city, as 79.0 percent of Chicagoans now have a Bachelor’s degree or higher. The urban migration phenomenon is showing no signs of slowing, and our demand forecast remains strong throughout 2017. While many tenants also remain committed to the suburbs, there is almost no company that does not at least ask the question of whether they should consider a downtown presence or a full-scale move to the CBD. Following the urban migration trend, Hickory Farms relocated its headquarters to Downtown Chicago from Ohio, Caterpillar is relocating its HQ from the more rural Peoria, and EXP is relocating from the Toronto area. The three headquarters relocation plans were all announced in 2017, leaving many to wonder what other companies will follow suit this year. Fulton Market is experiencing strong demand from local tenants seeking to relocate, which has provided support for aggressive pricing comparable to other hot submarkets like River North. Outlook There are a number of development projects pending approval of DX-5 zoning in Fulton Market and several others waiting for the City of Chicago’s review on the case to revise the PMD-3 zoning. Once hubs for heavy manufacturing, Goose Island and the Clybourn Corridor are the newest emerging submarkets for prospective mixed-use developments. Both submarkets fall within the PMD-3 area which is being considered for land use modernization. This is the most important topic to watch in Chicago commercial real estate today, as several large developments hinge on the decision. Fundamentals Forecast YTD net absorption 374,230 s.f. ▲ Under construction 4,815,290 s.f. ▼ Total vacancy 11.5% ▲ Average asking rent (gross) $39.38 p.s.f. ▲ Concessions Falling ▼ 0 2,000,000 4,000,000 2013 2014 2015 2016 YTD 2017 Supply and demand (s.f.) Net absorption Deliveries While the metro area population declines, the Chicago CBD is getting younger, smarter and more diverse 15.3% 12.8% 12.4% 10.3% 11.5% 2013 2014 2015 2016 2017 Total vacancy $0.00 $20.00 $40.00 $60.00 2013 2014 2015 2016 2017 Average asking rents ($/s.f.) Class A Class B For more information, contact: Hailey Harrington| hailey.harrington@am.jll.com • The CBD population is growing in terms of educated young professionals, attracting companies from beyond the region. • From impressive first quarter deals, Fulton West is now 100 percent preleased as it nears completion. • Tech drove leasing activity by organic growth of existing firms like Outcome Health, and established firms expanding into downtown Chicago, like Climate Corporation.

- 2. Chicago Q1 2017 Office Statistics Class Inventory (s.f.) Total net absorption (s.f.) YTD total net absorption (s.f.) YTD total net absorption (% of stock) Direct vacancy (%) Total vacancy (%) Average direct asking rent ($ p.s.f.) YTD completions (s.f.) Under construction (s.f.) West Loop Totals 48,606,523 512,399 512,399 1.1% 12.8% 13.8% $43.11 3,127,164 1,257,500 Central Loop Totals 37,160,358 -294,516 -294,516 -0.8% 10.1% 11.0% $37.27 0 0 East Loop Totals 24,346,395 28,129 28,129 0.1% 11.4% 11.8% $35.61 0 0 South Loop Totals 1,163,943 7,502 7,502 0.6% 2.8% 2.8% $25.92 0 2,450,000 North Michigan Avenue Totals 11,145,481 72,257 72,257 0.6% 10.1% 10.9% $38.08 0 0 River North Totals 16,330,258 5,488 5,488 0.0% 5.2% 6.1% $40.14 0 50,000 Kennedy West Totals 5,304,298 42,971 42,971 0.8% 10.9% 11.0% $32.93 0 1,057,790 Far West Loop Totals 1,709,818 -15,534 -15,534 -0.9% 13.5% 13.7% $31.47 0 0 Fulton Market Totals 2,947,999 63,879 63,879 2.2% 9.4% 9.6% $33.89 0 1,057,790 River West Totals 646,481 -5,374 -5,374 -0.8% 10.4% 10.4% $32.54 0 0 CBD Totals 144,057,256 374,230 374,230 0.3% 10.6% 11.5% $39.38 3,127,164 4,815,290 Eastern East-West Totals 22,831,285 -24,315 -24,315 -0.1% 15.2% 17.3% $25.49 228,000 0 Western East-West Totals 14,611,686 -101,272 -101,272 -0.7% 18.1% 20.3% $24.15 0 0 North (Cook County) Totals 10,217,404 -35,652 -35,652 -0.3% 15.6% 16.0% $28.22 0 0 North (Lake County) Totals 15,931,526 -430,423 -430,423 -2.7% 25.8% 26.8% $25.71 0 0 O'Hare Totals 12,393,927 -1,578 -1,578 0.0% 16.2% 16.8% $24.98 0 0 Northwest Totals 27,167,960 -124,379 -124,379 -0.5% 21.2% 22.5% $23.45 0 368,000 Suburbs Totals 103,153,788 -717,619 -717,619 -0.7% 19.0% 20.4% $24.91 228,000 368,000 Chicago Totals 247,211,044 -343,389 -343,389 -0.1% 14.1% 15.2% $31.26 3,355,164 5,183,290 West Loop A 31,957,041 471,211 471,211 1.5% 13.1% 14.1% $46.87 3,127,164 1,257,500 Central Loop A 10,191,682 -219,395 -219,395 -2.2% 10.0% 12.2% $42.55 0 0 East Loop A 5,511,381 11,050 11,050 0.2% 5.4% 5.4% $43.42 0 0 North Michigan Avenue A 2,871,938 -15,783 -15,783 -0.5% 7.9% 8.2% $38.03 0 0 River North A 8,606,690 6,134 6,134 0.1% 4.0% 4.5% $44.84 0 50,000 Kennedy West A 1,072,473 -16,381 -16,381 -1.5% 5.7% 5.7% $34.48 0 0 Far West Loop A 35,462 -21,959 -21,959 -61.9% 61.9% 61.9% $32.00 0 0 Fulton Market A 852,011 3,359 3,359 0.4% 3.0% 3.0% $38.46 0 1,057,790 River West A 185,000 2,219 2,219 1.2% 7.4% 7.4% $33.00 0 0 CBD A 60,211,205 236,836 236,836 0.4% 10.2% 11.2% $45.14 3,127,164 2,365,290 Eastern East-West A 9,728,397 25,055 25,055 0.3% 12.2% 14.7% $28.63 228,000 0 Western East-West A 5,534,716 40,877 40,877 0.7% 16.9% 19.9% $27.16 0 0 North (Cook County) A 5,446,551 -3,810 -3,810 -0.1% 19.7% 20.1% $29.69 0 0 North (Lake County) A 11,300,485 -320,224 -320,224 -2.8% 26.9% 27.9% $25.50 0 0 O'Hare A 6,732,939 12,784 12,784 0.2% 13.3% 14.2% $29.57 0 0 Northwest A 16,499,980 86,854 86,854 0.5% 14.9% 15.6% $25.62 0 368,000 Suburbs A 55,243,068 -158,464 -158,464 -0.3% 17.4% 18.7% $26.86 228,000 368,000 Chicago A 115,454,273 78,372 78,372 0.1% 13.6% 14.8% $34.00 3,355,164 2,733,290 West Loop B 14,142,482 55,811 55,811 0.4% 13.3% 14.4% $35.91 0 0 Central Loop B 22,670,390 -42,426 -42,426 -0.2% 10.1% 10.5% $35.39 0 0 East Loop B 12,342,590 80,777 80,777 0.7% 13.0% 13.8% $34.87 0 0 North Michigan Avenue B 5,699,740 4,379 4,379 0.1% 12.7% 13.8% $40.08 0 0 River North B 5,896,409 -1,201 -1,201 0.0% 7.3% 8.2% $36.44 0 0 Kennedy West B 3,195,001 59,352 59,352 1.9% 12.1% 12.2% $32.29 0 0 Far West Loop B 1,230,612 6,425 6,425 0.5% 9.9% 9.9% $31.33 0 0 Fulton Market B 1,593,724 60,520 60,520 3.8% 15.6% 15.9% $32.88 0 0 River West B 370,665 -7,593 -7,593 -2.0% 4.6% 4.6% $20.00 0 0 CBD B 63,946,612 156,692 156,692 0.2% 11.5% 12.2% $35.66 0 0 Eastern East-West B 10,609,756 -56,539 -56,539 -0.5% 17.3% 19.3% $21.78 0 0 Western East-West B 8,024,928 -135,599 -135,599 -1.7% 19.4% 21.2% $21.71 0 0 North (Cook County) B 3,956,814 -30,393 -30,393 -0.8% 11.7% 11.8% $24.74 0 0 North (Lake County) B 4,351,794 -108,645 -108,645 -2.5% 24.5% 25.3% $26.38 0 0 O'Hare B 4,218,447 -8,186 -8,186 -0.2% 21.4% 21.8% $21.67 0 0 Northwest B 8,953,234 -156,790 -156,790 -1.8% 31.8% 33.8% $21.84 0 0 Suburbs B 40,114,973 -496,152 -496,152 -1.2% 21.6% 23.1% $22.69 0 0 Chicago B 104,061,585 -339,460 -339,460 -0.3% 15.4% 16.4% $28.63 0 0

- 3. Chicago | Office Statistics | Q1 2017 Class Inventory (s.f.) Total net absorption (s.f.) YTD total net absorption (s.f.) YTD total net absorption (% of stock) Direct vacancy (%) Total vacancy (%) Average direct asking rent ($ p.s.f.) YTD completions (s.f.) Under construction (s.f.) West Loop C 2,507,000 -14,623 -14,623 -0.6% 6.2% 7.4% $32.18 0 0 Central Loop C 4,298,286 -32,695 -32,695 -0.8% 10.1% 11.0% $32.21 0 0 East Loop C 6,492,424 -63,698 -63,698 -1.0% 13.4% 13.5% $30.27 0 0 South Loop C 1,163,943 7,502 7,502 0.6% 2.8% 2.8% $25.92 0 2,450,000 North Michigan Avenue C 2,573,803 83,661 83,661 3.3% 6.8% 7.2% $32.76 0 0 River North C 1,827,159 555 555 0.0% 4.0% 6.8% $31.05 0 0 Kennedy West C 1,036,824 0 0 0.0% 12.5% 12.7% $33.53 0 0 Far West Loop C 443,744 0 0 0.0% 19.9% 20.3% $31.59 0 0 Fulton Market C 502,264 0 0 0.0% 1.0% 1.0% $35.80 0 0 River West C 90,816 0 0 0.0% 39.9% 39.9% $32.33 0 0 CBD C 19,899,439 -26,800 -26,800 -0.1% 9.4% 10.1% $31.20 0 2,450,000 Eastern East-West C 2,493,132 7,169 7,169 0.3% 18.1% 18.7% $15.96 0 0 Western East-West C 1,052,042 -6,550 -6,550 -0.6% 15.0% 15.0% $15.43 0 0 North (Cook County) C 814,039 -1,449 -1,449 -0.2% 7.2% 9.4% $18.50 0 0 North (Lake County) C 279,247 -1,554 -1,554 -0.6% 2.7% 2.7% N/A 0 0 O'Hare C 1,442,541 -6,176 -6,176 -0.4% 14.4% 14.4% $15.28 0 0 Northwest C 1,714,746 -54,443 -54,443 -3.2% 26.2% 29.6% $17.83 0 0 Suburbs C 7,795,747 -63,003 -63,003 -0.8% 17.1% 18.3% $16.81 0 0 Chicago C 27,695,186 -89,803 -89,803 -0.3% 11.6% 12.4% $25.20 0 2,450,000 Hailey Harrington | Research Manager 200 E Randolph Street Chicago, IL 60601 | tel +1 312 228 3189 | hailey.harrington@am.jll.com 2017 Jones Lang LaSalle IP, Inc. All rights reserved.