2017 09-etf-securities-precious-metals-monitor-september-2017

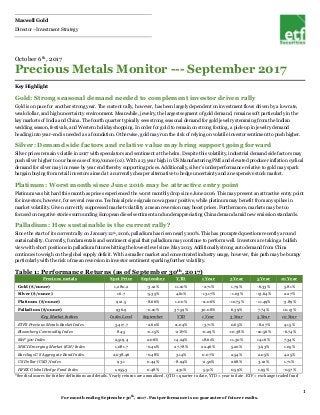

- 1. Maxwell Gold Director –Investment Strategy 1 For month ending September 30th, 2017. Past performance is no guarantee of future results. October 6th, 2017 Precious Metals Monitor --- September 2017 Key Highlight Gold: Strong seasonal demand needed to complement investor driven rally Gold is on pace for another strong year. The current rally, however, has been largely dependent on investment flows driven by a low rate, weak dollar, and high uncertainty environment. Meanwhile, jewelry, the largest segment of gold demand, remains soft particularly in the key markets of India and China. The fourth quarter typically sees strong seasonal demand for gold jewelry stemming from the Indian wedding season, festivals, and Western holiday shopping. In order for gold to remain on strong footing, a pick-up in jewelry demand heading into year-end is needed as a foundation. Otherwise, gold may run the risk of relying on volatile investor sentiment to push higher. Silver: Demand side factors and relative value may bring support going forward Silver prices remain volatile in 2017 with speculators and sentiment at the helm. Despite this volatility, industrial demand side factors may push silver higher to our base case of $19/ounce (oz). With a 13 year high in US Manufacturing PMI and elevated producer inflation cyclical demand for silver may increase by year end thereby supporting prices. Additionally, silver’s underperformance relative to gold may spark bargain buying from retail investors aimed at a currently cheaper alternative to hedge uncertainty and an expensive stock market. Platinum: Worst month since June 2016 may be attractive entry point Platinum was hit hard this month as prices experienced the worst monthly drop since June 2016. This may present an attractive entry point for investors, however, for several reasons. Technical price signals now appear positive, while platinum may benefit from any spikes in market volatility. Given currently suppressed market volatility a mean reversion may boost prices. Furthermore, markets may be too focused on negative stories surrounding European diesel sentiment and underappreciating China demand amid new emission standards. Palladium: How sustainable is the current rally? Since the start of its current rally on January 12th, 2016, palladium has risen nearly 100%. This has prompted questions recently around sustainability. Currently, fundamentals and sentiment signal that palladium may continue to perform well. Investors are taking a bullish view with short positions in palladium futures hitting the lowest level since May 2013. Additionally strong auto demand from China continues to weigh on the global supply deficit. With a smaller market and concentrated industry usage, however, this path may be bumpy particularly with the risk of mean reversion in investor sentiment sparking further volatility. Table 1: Performance Returns (as of September 30th, 2017) Precious metals Spot Price September YTD 1 Year 3 Year 5 Year 10 Year Gold ($/ounce) 1,280.2 -3.12% 11.10% -2.71% 1.79% -6.33% 5.81% Silver ($/ounce) 16.7 -5.35% 4.61% -13.17% -1.03% -13.64% 2.27% Platinum ($/ounce) 912.5 -8.66% 1.00% -11.06% -10.75% -11.49% -3.89% Palladium ($/ounce) 936.9 -0.10% 37.59% 30.08% 6.39% 7.74% 10.13% Key Market Indices Index Level September YTD 1 Year 3 Year 5 Year 10 Year ETFS Precious Metals Basket Index 3,417.7 -2.60% 11.04% -3.71% 0.65% -8.27% 4.15% Bloomberg Commodity Index 84.5 -0.15% -2.87% -0.29% -10.38% -10.56% -6.74% S&P 500 Index 2,519.4 2.06% 14.24% 18.61% 11.30% 14.16% 7.34% MSCI Emerging Market (EM) Index 1,081.7 -0.40% 27.78% 22.46% 5.20% 3.93% 1.05% Barclays US Aggregate Bond Index 2,038.46 -0.48% 3.14% 0.07% 2.54% 2.05% 4.25% US Dollar (USD) Index 93.1 0.44% -8.94% -2.50% 2.68% 3.12% 1.71% HFRX Global Hedge Fund Index 1,255.3 0.48% 4.31% 5.51% 0.59% 1.95% -0.57% *See disclosures for further definitions and details. Yearly returns are annualized. QTD = quarter to date, YTD = year to date. ETF = exchange traded fund

- 2. Gold: -3.12% (September), +3.11% (QTD), +11.10% (YTD) 2 For month ending September 30th, 2017. Past performance is no guarantee of future results. Investment Outlook August’s gains were wiped in September, with gold closing at $1280.2/ounce (oz). In our base case outlook, we see gold ending the calendar year near $1260/oz supported by upside inflation surprises before paring gains by Q2 2018 to $1230/oz. In a bullish scenario, high inflation along with a complacent Federal Reserve (Fed) waiting for further confirmation that the recovery is progressing and investor concerns of a disorderly Fed balance sheet unwind may push gold higher to $1445/oz. In a bearish scenario, the Fed may become more hawkish, driving up rates more aggressively and shrinking its balance sheet quicker may bring gold to the $1070/oz level. Gold price, daily moving average (dma), and volume Flows ETFs: In September, global physical gold ETFs saw net inflows of 53.7 metric tonnes (t) for the month raising cumulative gold ETF stock up 2.6% to 2,157t, a 10% year to date increase. Inventories: COMEX (Commodity Exchange, Inc.) gold inventories rose by 1.4t in September, while Shanghai Futures Exchange inventories remained unchanged. Futures: Investor sentiment remained steady in September as net managed money positioning only dipped 10% (as of September 29th). Investors extended gold short positions by 66% to 23,158 contracts while long positions fell by 7%. Global known ETF holdings of gold Factors Inflation: US headline consumer price index (CPI) rose in August to 1.9% from 1.7% the month prior with US core CPI remaining unchanged at 1.7% for the 4th consecutive month. Rates: The US 10yr Treasury yield closed September up at 2.33%, after hitting a year to date low of 2.12% in August. US 10Yr real interest rates were higher at 0.48% at month end. US Dollar (USD): The dollar slowed its year to date decline this month by rising 0.4%. The currency remains under pressure this year, having lost 9% through Q3 2017 as concerns for delays on pro-growth US fiscal policies weighed. Speculative positioning in gold futures by investors Fundamentals Demand: Chinese gold demand still remains soft with an evolving consumer preferences impacting its jewelry market and slowing gold imports through July 2017. Gold premiums in China averaged $6/oz compared to the YTD average of $9/0z through August. Retail investors also remain absent the gold market with limited purchases of American Gold Eagle coins. Supply: According to the Gold Focus 2017 report produced by Metals Focus, mine production in 2016 increased by only 1% while recycling supply (constituting about 1/3 of annual supply) increased 5% led primarily by higher prices last year in several key emerging market economies. Gold demand by sector (excluding ETFs and similar) $- $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $1,000 $1,050 $1,100 $1,150 $1,200 $1,250 $1,300 $1,350 $1,400 Sep-16 Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17 May-17 Jun-17 Jul-17 Aug-17 FuturesTradingVolume($mn) FrontMonthFuturesPrice Volume (rhs) Gold Price (lhs) 50 dma (lhs) 200 dma (lhs) Source: Bloomberg,ETFSecurities. Chart data from 09/30/16 to09/30/17. (300) (200) (100) - 100 200 300 400 500 - 500 1,000 1,500 2,000 2,500 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Metrictonnesofgold(bothaxes) Cumulative gold stock in ETFs (lhs) Monthly gold net flows in ETFs (rhs) Source: Bloomberg,ETFSecurities. Chart data from 12/31/07 to09/30/17. (150,000) (100,000) (50,000) - 50,000 100,000 150,000 200,000 250,000 300,000 350,000 2010 2011 2012 2013 2014 2015 2016 2017 ManagedMoneyGoldContracts Long Short Net Source: Bloomberg,ETFSecurities. Chart data from 12/31/09 to09/30/17. 55.4% 55.5% 53.5% 54.8% 54.3% 7 .8% 7 .7% 8.7 % 9.0% 8.9% 13.0% 13.3% 10.1% 9.7 % 9.4% 23.2% 24.1% 27 .7% 30.6% 31.1% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2014 2015 2016 2017F 2018F GoldDemand Physical Investment Official Sector Industrial Jewelry Source: Metals Focus, ETF Securities.Chart data as of 6/30/17.

- 3. Silver: -5.35% (September), +0.15% (QTD), +4.61% (YTD) 3 For month ending September 30th, 2017. Past performance is no guarantee of future results. Investment Outlook Silver stumbled in September, closing down 5.35% at $16.7/oz. Average daily volume in silver front month contracts fell to $7.5 billion in September from $9.7 billion the month prior. In our 2017 base case, we expect silver may trade to $19/oz by year end before easing to $18/oz by mid-2018 driven by higher inflation, improving manufacturing growth, and supply cuts. Slowing mine production may continue to be a tailwind for silver prices. As mining capital expenditure and investment continues to decline, this may further weigh on silver supply. Silver price, daily moving average (dma), and volume Flows ETFs: Profit taking ensued this month as global physically backed silver ETFs saw net outflows of 352 metric tonnes (t) nearly matching last month’s outflows. This brought cumulative holdings to 20,232t, a 1.7% drop for the month. Inventories: COMEX silver inventories rose for the 8th consecutive month by 64t in September, adding to above ground supplies. Shanghai Future Exchange silver stocks rose by 34t, less than half the increase of last month. Futures: Bullish sentiment continued despite falling prices as net speculative positioning rose 10% (as of September 29th). Short positions were reduced by 36% while long positions also dipped slightly by 1%. Global known ETF holdings of silver Factors Gold price: The gold/silver ratio hit an 18-month high as silver continued to lose ground relative to gold. The ratio, up 6% year to date, is well above its long term average of 59, highlighting silver’s attractive relative value compared to gold. Industrial Cycle: US industrial activity hit a 13-year high in September as the Manufacturing Purchasing Managers’ Index (PMI) increased from 58.8 to 60.8, the highest since June 2004. Producer Prices: In August the US producer price index (PPI) surged from 2.2% to 2.9% for finished goods indicating signs of a pick up in industrial activities and aggregate demand. Speculative positioning in silver futures by investors Fundamentals Demand: Silver demand for solar panels is a growing segment of its industrial demand with record levels expected in 2018. US saw solar capacity rise 95% in 2016. International solar usage may spur growth amid climate controls and growing energy needs in India and China. Supply: According to Metals Focus, supply from mine production fell 0.5% in 2016 after over 10 years of increased output. They estimate silver mine supply will continue to fall in 2017 by 1.7% due to cuts in by product output from gold and base metal mining operations. Silver demand by sector (excluding ETFs and similar) $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 $18,000 $20,000 $12 $13 $14 $15 $16 $17 $18 $19 $20 $21 $22 Sep-16 Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17 May-17 Jun-17 Jul-17 Aug-17 FuturesTradingVolume($mn) FrontMonthFuturesPrice Volume (rhs) Silver Price (lhs) 50 dma (lhs) 200 dma (lhs) Source: Bloomberg,ETFSecurities. Chart data from 09/30/16 to09/30/17. (1,500) (1,000) (500) - 500 1,000 1,500 2,000 2,500 - 5,000 10,000 15,000 20,000 25,000 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Metrictonnesofsilver(bothaxes) Cumulative silver stock in ETFs (lhs) Monthly silver net flows in ETFs (rhs) Source: Bloomberg,ETFSecurities. Chart data from 12/31/07 to09/30/17. (80,000) (60,000) (40,000) (20,000) - 20,000 40,000 60,000 80,000 100,000 120,000 2010 2011 2012 2013 2014 2015 2016 2017 ManagedMoneySilverContracts Long Short Net Source: Bloomberg,ETFSecurities. Chart data from 12/31/09 to09/30/17. 44.6% 43.6% 49.5% 48.9% 48.4% 4.2% 3.9% 3.9% 3.8% 3.5% 23.4% 23.8% 23.8% 24.5% 24.6% 27 .7% 29.1% 21.5% 21.6% 21.5% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2014 2015 2016 2017F 2018F SilverDemand Physical Investment Jewelry & Silverware Photography Industrial Source: Metals Focus, ETF Securities.Chart data as of 6/30/17.

- 4. Platinum: -8.66% (September), -1.62% (QTD), +1.00% (YTD) 4 For month ending September 30th, 2017. Past performance is no guarantee of future results. Investment Outlook Platinum fell 8.66% in September to $912.5/oz. Trading of platinum futures was higher this month with daily volume averaging $1.27 billion compared to $847 million in August. Our base-case scenario for platinum remains constructive with a fair value near US$1020/oz driven by defensive asset demand, emerging market growth, and industrial production. Under a bullish scenario platinum may potentially rise to $1100/oz on the heels of gold rising with geopolitical risk, while a bearish scenario may see platinum falling to $910/oz amid further weakness in the South African Rand (ZAR). Platinum price, daily moving average (dma), and volume Flows ETFs: Global physically backed platinum ETFs decreased by 0.7 metric tonnes (t) in September, a 1.0% drop, thereby bringing the cumulative platinum global ETF stock to 75.1t Inventories: NYMEX (New York Mercantile Exchange) platinum inventories fell 0.4% in September, a decrease of 788 ounces, leaving stocks totalling 6.6 metric tonnes. Futures: Net speculative positioning in platinum futures fell 63% to 7,600 contracts (as of September 29th) but remained bullish. This was driven by a 27% rise in short contracts with a 31% drop in long positions. Global known ETF holdings of platinum Factors South African Rand: The South African Rand weakened 4.1% in September versus the US Dollar reflecting on-going turmoil and scandals in the South African government. Euro Auto Sales: Western European light vehicle sales in August fell for the 2nd consecutive month, but rose 3.1% year over year. Rising sales have supported platinum demand despite growing negative European sentiment towards diesel. Chinese Consumer: Platinum imports by China fell 18% in August but was offset by jewelry sales last month recovering to 6.4% after the outlier 2.6% recorded in July. Speculative positioning in platinum futures by investors Fundamentals Demand: Autocatalyst demand for platinum is expected to fall 2% in 2017 for the first time since 2013 while jewelry demand is expected to rise 1% as Chinese demand stabilizes with gains in US and India, according to the Platinum 2017 Focus report by Metals Focus. Supply: According to Metals Focus, platinum mine production is expected to fall again in 2017 by 1% driven by higher production costs and lower output in Zimbabwe. Turning to South Africa, the world’s largest producer, a 1% drop is forecast for 2017 following a 3% decrease last year. Recycling supply is expected to increase from autocatalysts. Platinum demand by sector (excluding ETFs and similar) $- $500 $1,000 $1,500 $2,000 $2,500 $800 $850 $900 $950 $1,000 $1,050 $1,100 $1,150 $1,200 Sep-16 Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17 May-17 Jun-17 Jul-17 Aug-17 FuturesTradingVolume($mn) FrontMonthFuturesPrice Volume (rhs) Platinum Price (lhs) 50 dma (lhs) 200 dma (lhs) Source: Bloomberg, ETF Securities. Chart data from 09/30/16 to09/30/17. (8) (6) (4) (2) - 2 4 6 8 10 12 14 - 10 20 30 40 50 60 70 80 90 100 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Metrictonnesofplatinum(bothaxes) Cumulative platinum stock in ETFs (lhs) Monthly platinum net flows in ETFs (rhs) Source: Bloomberg,ETFSecurities. Chart data from 12/31/07 to09/30/17. (40,000) (30,000) (20,000) (10,000) - 10,000 20,000 30,000 40,000 50,000 2010 2011 2012 2013 2014 2015 2016 2017 ManagedMoneyPlatinumContracts Long Short Net Source: Bloomberg,ETFSecurities. Chart data from 12/31/09 to09/30/17. 41.5% 40.3% 41.8% 43.1% 42.6% 33.4% 30.2% 28.9% 30.0% 30.6% 23.4% 20.6% 21.6% 23.4% 24.1% 1.7% 9.0% 7 .9% 3.5% 2.8% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2014 2015 2016 2017F 2018F PlatinumDemand Physical Investment Industrial Jewelry Autocatalyst Source: Metals Focus, ETF Securities.Chart data as of 09/05/17.

- 5. Palladium: -0.10% (September), +10.98% (QTD), +37.59% (YTD) 5 For month ending September 30tht, 2017. Past performance is no guarantee of future results. Investment Outlook Palladium remained flat in September ending its Q3 2017 rally up 11% and closing the quarter at $936.9/oz. On September 29th, the palladium/platinum ratio hit a 16 year high of 1.027 as the rally sparked a brief premium. Daily volume in palladium front month contracts fell in September averaging $280 million compared to a daily average of $515 million in August. Given palladium’s demand is most sensitive to the industrial production cycle, palladium may see further support along with industrial metals in anticipation of a rise in US infrastructure spending and recovery in global growth. Palladium price, daily moving average (dma), and volume d Flows ETFs: Global physically backed palladium ETFs posted net inflows for the 3rd straight month of 0.3 metric tonnes (t). Cumulative palladium holdings rose 0.7% totalling 49t, but are still down 8% year to date. Inventories: NYMEX palladium inventories increased 17% this month by 7,873 ounces bringing total exchange palladium stock to 1.68t, but remains down 26% year to date. Futures: Net speculative positioning in palladium futures fell 14% in September to 21,528 contracts (as of September 29th). Long positions fell 16% while short positions were reduced by nearly half to only 798 contracts. Global known ETF holdings of palladium Factors Global Auto Sales: Chinese passenger vehicle sales rose 11% in August and 4.3% year over year, while hurricane damage helped boost September US auto sales. Market Balance: Expected continued supply deficits, stable demand, and drawdowns in above ground stocks (inventories & ETFs) may keep palladium’s market balance favorable. Industrial Metals: Palladium’s correlation to industrial metals (0.57) is the highest among precious metals. The recent rally in industrial metals, which are up 10.4% year to date, has benefitted palladium demand and performance. Speculative positioning in palladium futures by investors Fundamentals Demand: Autocatalyst demand for palladium is expected to rise 2% in 2017 after realizing a 5% increase in 2016 demand led by China, US and India, according to the Platinum 2017 Focus report by Metals Focus. Supply: Global palladium supply deficits have persisted since 2012 making palladium’s fundamentals very supportive for prices. Deficits rose to 1.17 million ounces in 2016 and are expected to persist and grow to 1.38 million ounces in 2017 according to Metals Focus, which may add further support to palladium. Palladium demand by sector (excluding ETFs and similar) $- $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $500 $550 $600 $650 $700 $750 $800 $850 $900 $950 $1,000 Sep-16 Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17 May-17 Jun-17 Jul-17 Aug-17 FuturesTradingVolume($mn) FrontMonthFuturesPrice Volume (rhs) Palladium Price (lhs) 50 dma (lhs) 200 dma (lhs) Source: Bloomberg,ETFSecurities. Chart data from 09/30/16 to09/30/17. (10) (5) - 5 10 15 20 - 20 40 60 80 100 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Metrictonnesofpalladium(bothaxes) Cumulative palladium stock in ETFs (lhs) Monthly palladium net flows in ETFs (rhs) Source: Bloomberg,ETFSecurities. Chart data from 12/31/07 to09/30/17. (15,000) (10,000) (5,000) - 5,000 10,000 15,000 20,000 25,000 30,000 2010 2011 2012 2013 2014 2015 2016 2017 ManagedMoneyPalladiumContracts Long Short Net Source: Bloomberg,ETF Securities. Chart data from 12/31/09 to09/30/17. 0.4% 0.1% 0.1% 0.1% 0.2% 7 4.5% 7 6.3% 77.4% 77.6% 7 8.3% 20.9% 20.3% 19.8% 19.6% 18.8% 4.2% 3.2% 2.7 % 2.7 % 2.7 % 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2014 2015 2016 2017F 2018F PalladiumDemand Jewelry Industrial Autocatalyst Physical Investment Source: Metals Focus, ETF Securities.Chart data as of 09/05/17.

- 6. ETF Securities (US) LLC 405 Lexington Avenue New York NY 10174 United States t +1 844 – ETFS – BUY (844 383 7289) f +1 646-921-8988 e infoUS@etfsecurities.com w etfsecurities.com Important Risks The statements and opinions expressed are those of the author and are as of the date of this report. All information is historical and not indicative of future results and subject to change. Reader should not assume that an investment in any securities and/or precious metals mentioned was or would be profitable in the future. This information is not a recommendation to buy or sell. Past performance does not guarantee future results. The ETFS Silver Trust, ETFS Gold Trust, ETFS Platinum Trust, ETFS Palladium Trust and ETFS Precious Metals Basket Trust are not investment companies registered under the Investment Company Act of 1940 or a commodity pool for purposes of the Commodity Exchange Act. Shares of the Trusts are not subject to the same regulatory requirements as mutual funds. These investments are not suitable for all investors. Trusts focusing on a single commodity generally experience greater volatility. Commodities generally are volatile and are not suitable for all investors. Trusts focusing on a single commodity generally experience greater volatility. Please refer to the prospectus for complete information regarding all risks associated with the Trusts. Shares in the Trusts are not FDIC insured and may lose value and have no bank guarantee. The value of the Shares relates directly to the value of the precious metal held by the Trust and fluctuations in the price could materially adversely affect investment in the Shares. Several factors may affect the price of precious metals, including: A change in economic conditions, such as a recession, can adversely affect the price of the precious metal held by the Trust. Some metals are used in a wide range of industrial applications, and an economic downturn could have a negative impact on its demand and, consequently, its price and the price of the Shares; Investors’ expectations with respect to the rate of inflation; Currency exchange rates; interest rates; Investment and trading activities of hedge funds and commodity funds; and Global or regional political, economic or financial events and situations. Should there be an increase in the level of hedge activity of the precious metal held by the trust or producing companies, it could cause a decline in world precious metal prices, adversely affecting the price of the Shares. Should there be an increase in the level of hedge activity of the precious metal held by the Trusts or producing companies, it could cause a decline in world precious metal prices, adversely affecting the price of the shares. Also, should the speculative community take a negative view towards the precious metal held by the Trusts, it could cause a decline in prices, negatively impacting the price of the shares. There is a risk that part or all of the Trusts’ physical precious metal could be lost, damaged or stolen. Failure by the Custodian or Sub-Custodian to exercise due care in the safekeeping of the precious metal held by the Trusts could result in a loss to the Trusts. The Trusts will not insure its precious metals and shareholders cannot be assured that the custodian will maintain adequate insurance or any insurance with respect to the precious metals held by the custodian on behalf of the Trust. Consequently, a loss may be suffered with respect to the Trust’s precious metal that is not covered by insurance. Commodities generally are volatile and are not suitable for all investors. Please refer to the prospectus for complete information regarding all risks associated with the Trust. Investors buy and sell shares on a secondary market (i.e., not directly from Trusts). Only market makers or “authorized participants” may trade directly with the Trusts, typically in blocks of 50k to 100k shares. ETFS Physical Precious Metals Basket Index reflects the daily performance of a basket with the following components and ratios: gold (0.030oz), silver (1.100oz), platinum (0.004oz) and palladium (0.006oz). Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index. Futures contract = agreement traded on an organized exchange to buy or sell assets at a fixed price but to be delivered and paid for later. Long position = buying of an asset with the expectation the asset will rise in value. Short position = sale of a borrowed asset with the expectation that the asset will fall in value. Spot price = current market price at which an asset is bought or sold for immediate payment and delivery. S&P 500 Index is a capitalization-weighted index of 500 stocks designed to represent the U.S. economy. MSCI Emerging Markets (EM) Index is an equity index that captures large and midcap representation across Emerging Markets countries. Barclays US Aggregate Bond Index is a broad-based flagship benchmark measuring investment grade, US dollar, fixed-rate taxable bond market. The US Dollar (USD) Index is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of US trade partners' currencies. The HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. Year over year = the percent change over a full calendar year. The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services; headline includes all categories while core excludes food and energy. South African Rand (ZAR) = official currency of South Africa. The ISM (Institute for Supply Management) Manufacturing Purchasing Managers’ Index (PMI) is an indicator of the economic health of the manufacturing sector. Producer Price index (PPI) measures the average change in selling prices received by domestic producers of goods and services. The Federal Reserve (Fed) is the central banking system of the United States of America. COMEX (Commodity Exchange) is the primary market for trading metals such as gold, silver, copper and aluminium. NYMEX = New York Mercantile Exchange. Correlation is a measure of fluctuation between two variables, Standard deviation is a measure of the dispersion of a set of data from its mean. European Central Bank (ECB) = central bank for the euro and administers monetary policy of the eurozone. Commodities generally are volatile and are not suitable for all investors. This material must be accompanied or preceded by the prospectus. Carefully consider each Trust’s investment objectives, risk factors, and fees and expenses before investing. Please click here to view the prospectus. ALPS Distributors, Inc. is the marketing agent for ETFS Silver Trust, ETFS Gold Trust, ETFS Platinum Trust, ETFS Palladium Trust and ETFS Precious Metals Basket Trust. Maxwell Gold is a registered representative of ALPS Distributors, Inc. ETF001221 10/31/18