A project report on customer satisfaction and credit procedure study of citifinancial personal loans BY BABASAB PATIL

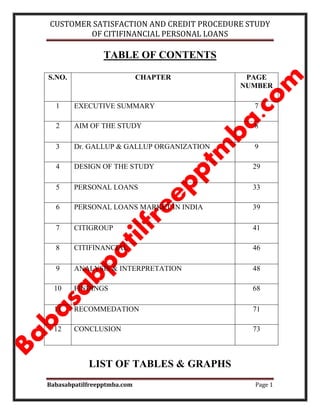

- 1. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 1 TABLE OF CONTENTS S.NO. CHAPTER PAGE NUMBER 1 EXECUTIVE SUMMARY 7 2 AIM OF THE STUDY 8 3 Dr. GALLUP & GALLUP ORGANIZATION 9 4 DESIGN OF THE STUDY 29 5 PERSONAL LOANS 33 6 PERSONAL LOANS MARKET IN INDIA 39 7 CITIGROUP 41 8 CITIFINANCIAL 46 9 ANALYSIS & INTERPRETATION 48 10 FINDINGS 68 11 RECOMMEDATION 71 12 CONCLUSION 73 LIST OF TABLES & GRAPHS

- 2. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 2 S.NO. TOPIC PAGE NUMBER 1 Customer Age Profile 2 1 Customer satisfaction regarding overall service of Citifinancial. 51 2 Customer opinion regarding Citifinancial‟s ability to keep up its promises. 53 3 Customer opinion regarding Citifinanacial‟s ability to meet its customers‟ needs. 55 4 Customer opinion regarding Citifinancial as a trustworthy bank. 57 5 Customer satisfaction regarding time taken for loan approval. 59 6 Customer satisfaction regarding EMI schemes offered by Citifinancial. 61

- 3. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 3 7 Customer satisfaction regarding interest rate charged by Citifinancial. 63 8 Customer satisfaction regarding processing fees charged by Citifinancial. 65

- 4. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 4 EXECUTIVE SUMMARY Personal Loan market in India is growing by leaps and bounds. The major players include ICICI which tops the list along with HDFC, Citibank, ABN AMRO, HSBC, all the nationalized Banks, co-operative banks, other financial institutions and unorganized money lenders. The project is a customer satisfaction study which involved city of Dharwad. The research involved studying existing customers. It covered each and every aspect of personal loan which can affect customer satisfaction. The main objective of the study was to find out areas where customers are not satisfied with the service offered by Citifinancial regarding personal loan. The study alo aimed at studying the credit procedure at citifinancial. Citifianancial mainly caters to the B and C segment of the market. The Loan amount lent is between 10,000 to 50,000. The rate of interest varies from 16% to 36% depending upon the credit procedure. The study shows that most of the customers are happy with the service given by the citifinancial. But the reason of dissatisfaction mainly lies with the interest rates and processing charges. Citifinancial can introduce schemes that can suit for premium segment too. Also ETC arrangements are better since some of the cases Cheques required are more in some cases.

- 5. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 5 OBJECTIVES OF THE STUDY 1. To study the customer profile of citifinancial The major objective of the study is to understand the profile of customer segment of citifinancial. 2. To Study the customer perception towards citifianacial consumer loans The aim of the study is to understand the customers perception about citifinancial personal loans which includes queries regarding interest rates, service, and other factors. 3. To study the personal loan market in India. With the entry of private players personal loan industry in India has expanded. Also added is the increase in the number of middle class mass in India. 4. To understand the working of citifinancial. Citifinancial is one one the flagship members of citigroup. One of the major objectives of the study is to get an insight into the world‟s largest financial company.

- 6. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 6 NEED FOR STUDY Financial Sector in India is expanding many folds. Every other day there is a new company coming up with new services. The need for study arouse with the entry of numerous institutions who came up with personal loan products. But personal loan being a unsecured loan risk is no doubt more in the business. People require immediate cash for various reasons. Increase in the avenues of spending has triggered off a good market for personal loans. There are various documents and procedures of different banks and Institutions who lend personal loans. Citifinancial being one of the pioneer lending institutions is excelling in personal loan sector. It an institutions which is catering to the most risky profiles but at the same time is expanding rapidly in the market with profits too. This study was initiated to study organization, product policy, customer profile and the personal loan market in India. The major intension is to know the customers perception towards personal loans of citifianancial.

- 7. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 7 SCOPE OF THE STUDY The study is limited to the city of Dharwad only. It is also restricted to the study of citifianancial only. Also the location being Upcountry, it does not reflects the perception of customers of metro cities where personal loan market is at hype. The study includes organization study and credit policy but excludes any financial data. The study covered each & every aspect of the customers. The study focused on customer reaction with respect to the overall service & each & every aspect of the product such as interest rate, EMI etc.

- 8. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 8 DESIGN OF THE STUDY

- 9. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 9 RESEARCH METHODOLOGY 1. Data Collection: Mainly two types of data were used for data collection viz: Secondary data: The main source was the customer data base which was obtained at Citifinancial office at Dharwad. It was used to find out all general information about the existing customers such as their names, their residential & official address & their phone numbers. Also the product policy of Citifianancial which provided major data about the product and credit policy. Also articles from the news papers, magazines and websites were used. Primary data: The main source was the questionnaire which was designed to collect all the primary data such customer reaction towards all the aspects of the product. 2. Steps involved in sampling Process: a. Defining population: Respondents are existing customers of citifianancial Dharwad b. Specifying sampling frame: Sampling frame is the database provided by citifinancial Dharwad. c. Specifying the sampling Unit:

- 10. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 10 Customers who have availed loan from citifianancial. d. Specifying the sampling method: Non-Probability Convinience sampling method was used for data collection. e. Determining sampling size: Total target respondents were 50 d. Specifying the sampling plan: Selected different category of the customers. 3. Type Of Questions: To collect the primary data, a questionnaire was devised which consisted of: Dichotomous questions: Having three options Balanced scaling questions: Having three points on which the customers were required to rate. Apart from this, Demographic based questions were there to collect data about the customers regarding their names, age, income, occupation, household income, amount of loan & the number of installments. 4. Analysis: Single Tabulation was used for arranging the collected data & for analyzing & interpretation

- 11. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 11 LIMITATIONS Though the study has covered each & every aspect of customer satisfaction but it has neglected customer-employee interaction, which contributes highly to the customer satisfaction. Due to this, though the study may help in finding out the areas where Citifinancial needs to improve with respect to product features but it will not help Citifinancial in deciding whether to train its employees or not for dealing in a better way with the customers

- 12. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 12 CONCEPTUAL FRAMEWORK

- 13. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 13 PERSONAL LOANS DEFIATIONS: Loan: A Loan is an amount of money given to the other person with or without a collateral or a guarantor for a certain period of time anticipating the repayment of lent money with certain returns. Personal Loan: “An amount of money borrowed from a bank or other lender by an individual”. It is a loan based on a consumer's income, debt and credit history. It is a loan obtained by an individual for personal (as opposed to business or investment) purposes. A personal loan is generally an unsecured loan. Personal Loan establishes consumer credit that is granted for personal use; usually unsecured and based on the borrower's integrity and ability to pay. A personal loan is a lump sum which you borrow from a bank, building society or another lender. The simplest explanation of the use of the word "personal" is to describe these types of loans is that, the money that is borrowed is to be used for personal reasons. If the aim of the loan was to finance the purchase of a home, that is a mortgage. If the purpose of the loan is to help a business to expand, that is a business loan. If you are taking out a loan to

- 14. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 14 fund something that will be for your own personal use, or to help you out with personal issues, then that is a personal loan. The best way to expand on this would be to look at what a personal loan could be used for. A personal loan is an amount of money offered, normally by lending institutions such as banks and building societies, on the condition that it will be paid back at some later date. Personal loans are available in a whole host of formats and can range from 10000 upwards. The term of the loan is often dependent on whether the lender requires security to be offered by the borrower and the size of the regular repayments you wish to make. Under most personal loan arrangements you receive a lump sum, equal to the amount of the agreed loan and in return you agree to make regular repayments. These repayments are normally monthly and cover both the interest due and the capital outstanding loan amount. If you have established the loan as a 'repayment' type loan then the repayments will include an amount to pay off some of the capital and reduce your outstanding debt. Payments are made throughout the term of the loan to ensure that the total debt is repaid to the lending institution. AMOUNT OF PERSONAL LOAN Amount wise personal loans may range from 10,000 to 10, 00,000. RATE OF INTEREST Currently, interest rates across all banks are in range of 10% to 22%. The interest rate usually depends on three factors: Amount of loan: Higher the amount lower will be the interest rate & vice verse.

- 15. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 15 Type of loan: While secured loan carries lower rate where as unsecured loan carries higher rate. Customer Segment: Rate of interest is higher in case of high risk segment and vice versa PERSONAL LOANS USES OF PERSONAL LOAN The range of uses for the money is very wide indeed. Common uses include the purchase of a new car, a holiday or the repayment (consolidation) of existing debt. Frequently the lending institution will ask for details of the reason you require the loan. Although the purpose of the loan may have little impact on their decision to grant the money, it can have some influence on the maximum term of the loan. It is more likely that larger sized loans, for purchases such as cars, home improvements etc. will result in a longer repayment term. It is not uncommon for the purchase of a car to established with a repayment term of 3 years whilst the term for home improvement loans can be for much longer terms (sometimes as long as ten years). SUITABILITY OF PERSOAL LOAN If you are looking to borrow money over a period of less than ten years, whether you need the money for a purchase or perhaps to repay existing debt, then a personal loan may be suitable for the needs

- 16. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 16 Personal loans are just another form of credit. If you are considering a personal loan to run alongside other forms of personal credit such as overdrafts and credit cards, you must give careful consideration to whether you will be able to afford the total of your regular payments. When considering the situation it is wise to take into account your ability to pay were you unable to work due to any reasons. PERSONAL LOANS ACCESSABILITY TO PERSOAL LOAN There are hundreds of potential lenders willing to offer you the opportunity to borrow from them. However the offer of finance does depend upon your ability to repay the debt and your previous credit history. Those applicants that have had credit difficulties in the past can find it more difficult to obtain access to a personal loan compared to those applicants that have a better credit history. It is normally true that the better the credit risk you are, the easier you will find it to obtain a personal loan. It is also likely that people who have the best credit histories will be offered the best deals. This normally means a lower interest rate is charged or the repayment terms are longer. DIFFERENCE BETWEEN PERSONAL LOAN AND BANK LOAN There isn't much of a difference between a bank loan and a personal loan. They are in essence the same thing. In a bank loan one can are borrow an amount of money against property or an asset or in consideration of his/her creditworthiness to repay at agreed intervals with interest added to the sum. The difference is that a bank specifically provides a bank loan. A few years ago, the bank was one of the only places a customer could get a loan, which is why people used to say they needed a good relationship with their bank manager. Obviously, this isn't the case now, as building societies and many other financial companies also offer loans.

- 17. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 17 MERITS & DEMERITS OF PERSONAL LOAN MERITS: Positive side of a personal loan is that, it is quick and easy to avail. Moreover usually a personal loanis lent without any security and guaranty PERSONAL LOANS TYPES OF PERSOAL LOAN Unsecured personal loan: Is a debt that you can acquire where you do not have to use any specific collateral to back the loan. Usually, the people who would be eligible for this type of loan would be people An unsecured loan will mean less risk to the person taking out the loan than a secured loan. This is due to the fact that a person will not have to use their home as insurance for the loan. The negative aspect of this is that due to the lack of insurance, the interest payments set will be higher, as the loan provider will need to cover the added risk of not being able to get their money back. A positive aspect of the unsecured loan could be that your application is processed a lot quicker, so you can get hold of money more rapidly. This speed is due to the fact that your home will not need to be valued to make sure your security is available. Another upshot of this is that you can submit an application, get a reply and answer very quickly to your application, and just because you have submitted does not mean you are under an obligation to take up the loan. Secured personal loan: Is a loan that is specifically assigned for home owners. This is where the home is used as collateral, which is a larger risk for a customer than an unsecured loan, because if you fall into difficulties or are unable to repay the loan for any particular reason your home is at risk. One of the most vital points to understand about a

- 18. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 18 secured loan is that it is not best used as a solution to debt problems, because it is even more important that you have budgeted properly to cover the loan payments. Many people with debt problems have them precisely because they are not good at budgeting to cover loan payments. Secured personal loans could be taken out for various reasons. You could want to make home improvements, for which you can borrow money secured on your home, as you are hopefully increasing its value. Perhaps it could be for a debt consolidation loan, where you take out a loan for an amount large enough to pay off several other debts for a longer period PERSONAL LOANS MARKET IN

- 19. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 19 INDIA PERSONAL LOANS MARKET IN INDIA In recent times, personal loans market in India is witnessing a rapid growth. Over the year 2002-03 personal loans disbursement has grown by 39%. Consumer credit in India is currently growing at around 45%-50% annually, and considering that the Indian economy is expected to grow at around 8% this year, demand for consumer loans including personal loans is expected to remain strong. The growth is high in unsecured personal loans as compared to secured personal loans. Following are some of the factors responsible for growth in personal loans market in India: Falling interest rates: Interest rates have gradually fell form above 25% to below 20% across all banks over the years. Change in consumer behavior: Once customers hesitated to take loans from banks but now they are looking at it from a positive angle. Shift in focus of banks from corporate lending towards retail lending: Banks are now concentrating more on retail loans including personal loans, home loans & auto loans due to the growth in retail loans.

- 20. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 20 Positive demographics: There is rapid growth in urban population, who are most likely to take retail loans. Apart from this middle class segment is growing, which account for about 70-80% of the total loan seekers. MAJOR PLAYERS: At preset ICICI Bank is the market leader having more than 30% market share in personal loans market, followed by HDFC Bank. Apart from this there are several other banks including Government banks, Private banks & MNC banks who are in the lead. In case of MNC banks, Citifinancial tops the list with respect to total loan disbursements & in terms of market share. It is followed by HSBC, Standard Chartered bank, ABN AMRO & others. CITIGROUP

- 21. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 21 CITIGROUP LEGACY Citigroup Inc., today's pre-eminent financial services company, with some 200 million customer accounts in more than 100 countries, dates back to the history of Citibank, which began in 1812; Travelers Life & Annuity, since 1864; Smith Barney, founded in 1873; Banamex, formed in 1884 as a result of the merger of Banco Nacional Mexicano and Banco Mercantil Mexicano; and Salomon Brothers, which dates back to 1910 and later merged with Smith Barney, a subsidiary of Travelers Group at the time. Other major brand names under Citigroup's trademark red umbrella include Citi Cards, CitiFinancial, CitiMortgage, CitiInsurance, Primerica, Diners Club, Citigroup Asset Management, The Citigroup Private Bank and CitiCapital. FAMILY TREE

- 22. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 22 Citigroup is largely organized into four groups: Citigroup Global Consumer Group, the Global Corporate and Investment Banking Group, Citigroup Global Investment Management, and Global Wealth Management. CITIGROUP PRODUCT LINES Global Consumer Group Cards o World‟s largest provider of credit cards o Third Quarter '04 Net Income of $1.267 billion Consumer Finance o World‟s consumer finance leader o Third Quarter '04 Net Income of $643 million Retail Banking

- 23. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 23 o Citibank: highest-rated, leading global brand o Third Quarter '04 Net Income of $1.225 billion Global Corporate and Investment Banking Group Capital Markets & Banking o #1 underwriter of Combined Debt and Equity and Equity-related transactions o Third Quarter '04 Net Income of $1.159 billion Global Transaction Services o Leading provider of transaction products; $7.3 trillion in assets under custody o Third Quarter '04 Net Income of $285 million CITIGROUP PRODUCT LINES Global Investment Management Life Insurance & Annuities o One of the fastest growing life insurers in the U.S with expanding international presence o Third Quarter '04 Net Income of $282 million Asset Management o A leader with $500.7 billion in assets under management o Third Quarter '04 Net Income of $84 million

- 24. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 24 Global Wealth Management Private Client Services o A leader in managed accounts with $1.087 trillion in total client assets o Third Quarter '04 Net Income of $195 million Private Bank o Offers widest range of services to more than 25,000 of the world‟s most successful and influential families o Third Quarter '04 Net Income of $136 million CITIGROUP IN INDIA Citigroup opened its first office in India in 1902 in Kolkatta. Since then they have become one of India's most diverse and recognized financial service providers operating in 450 offices and branches across India. Citigroup India has 5,000 employees nationwide. Their operations encompass a premier global corporate and investment bank and a well-established consumer business under the Citibank and CitiFinancial brands.

- 25. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 25 The global corporate and investment banking group provides a comprehensive range of financial services including treasury management, transaction services, securities custodianship, foreign exchange, fixed income and equities sales and trading, and corporate finance to corporate clients, governments and financial institutions. Citibank India is the country's leading retail bank with a history of innovation and customer service. Today we are the largest issuer of credit cards and offer mortgages, personal loans, insurance, and investment services for on-shore customers. Citibank India also provides banking services to the international Indian community in 23 cities around the World.

- 26. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 26 CITIFINANCIAL CITFINANCIAL Since 1912, CitiFinancial has been helping people realize their financial goals and dreams. Headed by CEO and President Harry D. Goff, CitiFinancial is a member of Citigroup, the world's largest financial services provider. They have more than 2000 offices in the United States and Canada. Each branch manager runs their CitiFinancial office as if it is their own business, so loan decisions are made locally.

- 27. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 27 They provide home improvement loans, bill consolidation loans, money for tuition, vacation getaways and unexpected expenses. They have a solution that helps you afford what you want or need most in life. They‟ll get you the money you need when you need it! Products & Services: Personal loans Home loans Auto loans Citifinancial personal loan: It can be used to pay off your credit card bills, meet your unexpected expenses or it can be used for education or travel purpose. At this time, CitiFinancial Personal Loans are not available for business purposes. Their specialty is extending credit for personal, family and household purposes. Qualification criteria: CitiFinancial grants personal loans to people over age 18 who have established credit and can secure the loan with personal property. Some established credit, like a gasoline or store credit card, is necessary, and employment or other steady income is required. We also make unsecured loans to homeowners. People just beginning to establish credit may be asked to have another responsible adult co-sign for the loan. The Indian middle class, which constitutes a large market, has doubled over the last decade and is set to multiply in the coming years. The Citifinancial target market falls in this category and the company is already catering to finance requirements for consumer durables, two wheelers, and automobiles to this segment. We have a customer base of over 200000 customers, of which 25% customers have more than a year‟s credit history with the Citifinancial. We are now targeting our consumer durable and two wheeler customers for providing them with Personal loans with an objective to retain performing customers build loyalty and create lasting relationships.

- 28. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 28 The middle class salaried individual segment and the small business segment have also shown an appetite for small ticket loans to meet personal needs, debt consolidation and short-term capital needs for business. Citifinancial has sought to address these financing needs by launching a personal loan program for individuals who have no prior financing relationship with us. This is referred to as the new borrower program. The existing players in the market are ICICI, Citibank, ABN Amro Bank, Standard Chartered Bank, American Express and GE Countrywide. In the last one year hectic activity to promote the product has been visible in the market. Our focus on strengthening bonds with existing customers, geographical reach and relationship-based approach will provide as a unique competitive advantage ORGANISATION STRUCTURE: Citifinancial has a flat organization structure. In fact there are only four steps between an officer and MD. The grade structure applicable to all employees on the rolls of Citifinancial Consumer Finance India Limited is:

- 29. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 29 Grade Designation 5 Vice President 4 Assistant Vice President 3 Manager / Senior Manager 2 Assistant Manager / Management Associate 1 Officer / Senior Officer / Secretary PROCESS The minimum qualification required for any employee of Citifinancial India is graduation. All hiring is executed by the Regional HR teams. A hiring request could arise from vacancies created on account of: Replacement of an employee who has left the organization or movement of an employee to a different position / location Creation of a new position Business expansion HR receives a hiring request (verbal/email) from the line manager. A hiring request should be in line with the manpower plan which is duly approved by the country business head and head of financial control. Wherever vacancies are not provided for in the manpower plan, the hiring must be approved by the country business head. The hiring request may be accompanied by specifications related to the level and profile of the incumbent HR, in conjunction with the line manager decides to source candidates through: Internal movements - Key internal movements are decided and agreed upon by business and functional heads. Movements are discussed with line managers and reported by HR every month. Databases existing with HR – These may be created through referrals and / or direct applications Empanelled recruitment consultants - HR maintains a panel of approved

- 30. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 30 recruitment agencies, along with agreements and rate lists. While the line manager or HR could interact with the agency during the course of hiring, no recruitment agency can be empanelled without the approval of HR. Recruitment advertisements on any media – These are released keeping in mind the requirement, cost and other options open for recruitment. All job advertisements should cover the following areas: 1. Brief profile of the Company 2. Level / title of the position and brief outline of responsibilities 3. Candidate qualification and experience profile 4. Response time for applications Text should be non-discriminatory in nature and should specifically avoid reference to sex, creed and religion. The content and presentation of the advertisement should be in compliance with Citigroup branding guideline. Candidates are shortlist from applications received in the following manner: Not suitable - rejected Suitable – Called for personal interview Meet minimum requirement but not suitable for immediate requirement – stored in data of short listed candidates In the process of short listing, no candidate should be discriminated against on the basis of gender, religion, ethnicity or age. Candidates short listed are called for a personal interview with the line manager, or HR PRODUCT DESCRIPTION S. NO PRODUCT PARAMETERS NEW BORROWER PROGRAM EXISTING BORROWER PROGRAM PL PLUS PROGRAM CORE PROGRAM SURROGATE PROGRAMS

- 31. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 31 1 Target Market Salaried Individuals Self employed professionals Self employed businessmen Freedom Loan- Individuals who have a repayment track with any other bank or financial institution. The loan must be running or not closed earlier than 6 months from the date of application. Debt consolidation – Individuals who hold a Classic or Gold card or its variants & the card must have been in existence for more than a year. 2 Suvidha Cross Sell: Salaried: 3 salary credits in Citibank suvidha a/c & a minimum net salary credit of Rs 3500/-pm Self- employed: monthly average balance of 3500 for the Existing Citifinancial customers with performance of: · 4 months in CD, TW and Auto (Corporate and Individual) · 9 months in PL · 14 months in Pro Credit Existing and New customers of Section A and B segment with higher Equity.

- 32. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 32 last 6 months Mobile phone subscribers- Minimum average monthly billing of Rs 1000/- in the last 3 months 2 Locations All approved locations and those which might be approved by management in future All approved locations and those which might be approved by management in future All approved locations and those which might be approved by management in future All approved locations and those which might be approved by management in future 3 Minimum Loan Amount Rs.10000 Rs.10000 Rs.10000 Rs. 75000 4 Maximum Loan amount Rs 50000 (as communicate d to the market) Rs. 200000 (as per PP) Rs 50000 (as communicate d to the market) Rs. 200000 (as per PP) Rs. 100000 (as communicat ed to the market) Rs 200000 (as per CCPP) Rs. 200000 5 Minimum Tenor 12 months 12 months 12 months 12 months 6 Maximum Tenor 48 months 48 months 48 months 48 months S. NO PRODUCT PARAMETERS NEW BORROWER PROGRAM EXISTING BORROWER PROGRAM PL PLUS PROGRAM CORE PROGRAM SURROGATE PROGRAMS*

- 33. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 33 7 Sources of Acquisition Branch walk in „s Direct selling Agencies · Direct mailing Cross sell /marketing programs Branch walk in „s Direct selling Agencies Direct mailing Cross sell /marketing programs N.A Branch walk in„s Direct selling Agencies Direct mailing Cross sell /marketing programs Tele- calling Agencies Existing borrowers 8 Restricted Profiles As per list defined and any other profiles as defined by the location 3 As per list defined and any other profiles as defined by the location 3 N.A As per list defined and any other profiles as defined by the location 3 9 Restricted Areas Restricted Area List to be based on collection and market feedback and reviewed from time to time. Restricted Area List to be based on collection and market feedback and reviewed from time to time. N.A Restricted Area List to be based on collection and market feedback and reviewed from time to time. 10 Interest rate Loans to be extended based on the grid provided, Loans to be extended based on the grid provided, Loans to be extended based on the grid provided, Loans to be extended based on the grid provided,

- 34. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 34 which will be revised/repris ed based on business requirements and approved by the Business Head which will be revised/repris ed based on business requirements and approved by the Business Head which will be revised /reprised based on business requirement s and approved by the Business Head Cross-loan recourse available which will be revised /reprised based on business requiremen ts and approved by the Business Head Cross-loan recourse available 11 Fee Typically 2% of the loan amount and as decided by Business Manager 12 Other Charges Cheque swap charges – Rs 500 Prepayment Charges - 4% Cheque returned charges - Rs 150 per instrument bounce Penal Charges - Rs 250 Any other charges as decided by the management S. NO PRODUCT PARAMETERS NEW BORROWER PROGRAM EXISTING BORROWER PROGRAM PL PLUS PROGRAM CORE PROGRAM SURROGATE PROGRAMS* 13 Credit Approvals Credit Decision to be based on the Citifinancial Underwriting Standards. All approvals to be signed off Credit Decision to be based on the Citifinancial Underwriting Standards. All approvals to be signed off by officer having As per the existing borrower qualifying grid. All approvals to be signed off by officer Credit Decision to be based on the Citifinancial Underwriting Standards. All approvals

- 35. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 35 by officer having requisite authority as per credit delegation matrix requisite authority as per credit delegation matrix having requisite authority as per credit delegation matrix. to be signed off by officer having requisite authority as per credit delegation matrix 14 Repayments Through Post dated Cheques to be collected at the time of disbursal of the Loan payable on the 5th of the month. Through ECS Through Post dated Cheques to be collected at the time of disbursal of the Loan payable on the 5th of the month Through Standing Instructions on the CITIBANK SUVIDHA a/c for SUVIDHA customers · Through ECS Through Post dated Cheques to be collected at the time of disbursal of the Loan payable on the 5th of the month. Through ECS Through Post dated Cheques to be collected at the time of disbursal of the Loan payable on the 5th of the month. Through ECS 15 Targeted IRR As decided by management 16 Collateral None. Citifinancial recourse will be based on the Loan agreement and the PDCs/ECS mandate signed by the customer UNDERWRITING STANDARDS- Principle terms and conditions

- 36. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 36 S. NO CRITERIA NEW BORROWER PROGRAM EXISTING BORROWER PROGRAM PL PLUS PROGRAM CORE PROGRAM SURROGATE PROGRAMS Income surrogate Debt consolidation Mobile phone subscribers Citibank Suvidha customers 1 Minimum Age 21 yrs 21yrs 21yrs 21yrs 2 Maximum Age on Loan Maturity 065 yrs 65 yrs 65 yrs 65 yrs 3 Income Rs 40000/- per annum Not applicable till loan amount Rs 50000 provided the following Surrogate income indicators are considered Freedom Loan –Last 6 months repayment track with another bank or financial institution with no emi bounce in last 3 months. Debt Consolidation- Last 2 months credit Card statements Mobile Phone subscriber- Minimum Not applicable for finance amount less than Rs 50000. For loan amount greater than Rs 50000, latest income proof to be taken with minimum of Rs. 40000 p.a. (Refer to section on criteria of approval for loan amounts greater than Rs 50000 without a valid income proof document for repeat customer) 1. Existing Consumer Durables customers with the following criteria are eligible Single product >Rs 30000/- Min 8 MOB Max One EMI bounce in last 8 months All EMI cleared No bounce in last 3 months · Min EMI

- 37. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 37 monthly average billing for the last 3 months to be Rs 800/- Suvidha customers- Salaried: 3 months salary credits in Suvidha a/c with minimum salary credit of Rs 3500. Self- Employed: Monthly average balance of 3500/- for the last 6 months. Rs 2000/- 2. Auto customers( of Citifinancial and other finance company) with 12 MOB record of a car (except matiz, cielo, Siena, auto taxi) with the following criteria Max 1 EMI bounce, All EMI‟s paid, No bounce in the last 3 months 3. Salaried applicants with a standard income proof above Rs 125000 4. Doctors (MBBS with running practice) with standard income proof above Rs 100000.

- 38. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 38 5. Gold Card holder with credit limit above Rs 100000 with last 3 bills paid on minimum amount due. 6. Self- employed individuals with standard income proof greater than Rs 100000 7. 12 months track on a PL with other finance company(onl y new borrowers) where minimum finance amount is Rs 75000 and minimum emi is Rs 3500 8. 9 month track on a housing loan with other finance company with maximum 1 emi bounce and no emi

- 39. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 39 bounce in last 3 months. Loan to be current as on date. Minimum housing loan amount to be Rs 500000 and minimum emi Rs 5000. Loan to be active or closed not later than 6 months from the time of loan application 9. Any other criteria as approved by Credit & Risk Director Income proof required in 100% cases. Minimum income Rs 40000 pa(where other surrogates are available) 4 Bank Statements 3 months from date of applicati on 3 months from date of application 6 months for Freedom Loan program N.A 3 months from date of application for New Customers Not required for Existing Customers

- 40. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 40 CRITERIA NEW BORROWER PROGRAM EXISTING BORROWER PROGRAM PL PLUS PROGRAM CORE PROGRAM SURROGATE PROGRAMS 5 Current employment At least 1 year At least 1 year N.A At least 1 year for new borrowers Not applicable for Existing Customers 6 Residence stability 1 year for Rented accommodati on 6 months for self owned/parent al/ company provided accommodati on 1 year for Rented accommodati on 6 months for self owned/parent al/ company provided accommodati on N.A 1 year for rented accommodatio n 6 months for self owned/parenta l/ co. provided Not applicable for Existing Customers 7 Telephone Requirement (direct contactability) Ref to Annexure IV on phone acceptability criteria. At least one direct line at residence or office At least one direct line at residence or office At least one direct line at residence or office At least one direct line at residence or office 8 CPV office Mandatory for self employed only Mandatory for self employed only Mandatory for self employed only where The previous Mandatory for all self employed new borrower cases, and for existing borrowers only

- 41. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 41 loan was a Fast track loan Was foreclosed earlier than 6 months from the date of application Change in address from previous loan Loan amount greater than Rs 75000 where The previous loan is a Fast track loan Was foreclosed earlier than 6 months from the date of application Change in address from previous loan For all self employed new borrowers 9 CPV Residence Mandatory for all cases Mandatory for all cases Mandatory for all cases where The previous loan is a Fast track loan* Was foreclosed earlier than 6 months from the date of application Change in address from previous loan Loan amount greater Mandatory for all new borrower cases and for existing customer cases where The previous loan is a Fast track loan Was foreclosed earlier than 6 months from the date of application Change in address from previous loan

- 42. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 42 than Rs 75000 10 Telephone Verification Mandatory for the applicant & one reference. Mandatory for the applicant & one reference. (Reference tvr waived where applicant has an active running repayment track for more than 6 months with another financier) Mandatory for the applicant Mandatory for the applicant in all cases. Reference tvr to be done in New borrower cases 11 De- duplication Check De-duplication check on Citifinancial database, Citibank Negative database and watch list customers (SDN & RBI watch list) mandatory for all. Note: Fast track for Sales Finance (CD/2W) - Physical verification report is not required for “Fast Track” applications where the loan amount for durables (net of advance emis) is less than Rs.30000 for individuals salaried in government/limited companies or less than Rs.20000 for self employed individuals. For two wheelers, if the LTV is below 80% (subject to finance amount net of advance EMI‟S being less than Rs.35000), the loan becomes a fast track case.

- 43. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 43 Sl. N O CRITER IA NEW BORROWER PROGRAM EXISTING BORROWER PROGRAM PL PLUS PROGRAM CORE PROGRAM SURROGATE PROGRAMS 12 Reference s Two references are mandatory. Can be friends/colleagues/relatives in the same city Two references are mandatory. Can be friends/colleagues/rel atives in the same city N.A N.A in existing borrowers Two references are mandatory for all new borrowers. Can be friends/colleagues/r elatives in the same city, for all new borrowers 13 Personal Discussio n Mandatory for all cases Refer to section on interviews Mandatory for all cases Refer to section on interviews N.A Mandatory for all cases Refer to section on interviews 14 Budget Analysis Mandatory Refer to section on Budget analysis Mandatory Refer to section on Budget analysis Mandatory for Loan amounts greater than Rs 50000. Refer to section on Budget analysis Mandatory Refer to section on Budget analysis 15 Repayment Track N.A Freedom Loan: § Minimum 6 months as evident by bank statements or Statement of account from previous financier. § Loan should be running or not closed earlier than 6 months from the date of 1. 1. Minimum 4 months for Auto/Sales Finance 2. 2. 9 months for PL 3. 3. 14 For existing borrowers: Minimum 8MOB on sales finance loan Minimum 12 MOB on auto loan from us or other finance company For new borrowers: 12months track on

- 44. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 44 application. § PDC and ECS based repayment to be considered. Debt Consolidation: § Credit card to be in existence for a minimum of 1 year. § Expiry on the card to be greater than 3 months from the date of application. § Last 2 months statements to be analyzed. Suvidha customers: § Salaried: 3 months salary credit in a/c with minimum salary credit of Rs 3500 pm. § In Self- employed: No bounce in last 6 months and monthly average balance of 3500/- in the last 6 months. Mobile phone subscribers: § Minimum 3 months billing statements with an average monthly billing of Rs 800/- months for pro credit § No EMI bounces in the last 3 months § Never beyond bucket 2 § Loan status to current at the time of new loan Mortgage customers do not fall into repeat customer bracket. They should be treated as new borrower if they come for a loan PL. 9 months track on housing loan 16 Loan emi Eligibility Between 10000& 50000(Rs 200000 as per the PP) as per budget analysis. Debt ratio is capped at 70% Freedom Loan: Max emi capped at 150% of the emi of track loan till loan amount Rs 50000. Debt burden capped at 70% for all loan amounts greater than Rs 50000. Subject to budget analysis. Debt Consolidation : Max As per the existing borrower grid, on first and second enhancemen t, for loan amount less than Rs Max emi capped at 70% of the monthly verifiable income.

- 45. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 45 30000 for classic cards and its variants .Max 50000 for Gold card and its variants . Max loan amount to be 1.5 times the credit limit or the absolute loan Cap , whichever is lesser. Emi as per the budget analysis Mobile phone subscriber: Max emi can be 300% of the average billing amount of last 3 months till loan amount Rs 50000. Subject to budget analysis Debt burden capped at 70% for all loan amounts greater than Rs 50000. Subject to budget analysis Suvidha customers: Max emi can be 70% of salary credit per month subject to budget analysis Suvidha Account holders: For salaried applicants: Last 3 months Citibank Suvidha bank statements with monthly salary credit of not less than Rs 3500 for last 3 months. Debt burden capped at 70% For self employed applicants: Last 6 months Citibank Suvidha bank statements with monthly average balance of not less than Rs 3500 . Debt Burden capped at 70% 50000,emi to be 150% of previous loan or as determined by debt ratio cap which ever is higher. · Debt ratio capped at 70% for first enhancemen t & loan amount greater than Rs50000/- · Following categories not eligible a) a) Collections foreclosed cases b) b) Write off cases with write off amount more that Rs 500 c) c) Any case beyond bucket 2 d) d) AHFS e) e) Mortgages/ Home Loan customers 17 Debt Burden Capped at 70% of applicant‟s gross disposable Not applicable till loan amount less than equal to Rs 50000 where the Not applicable till loan amount less than equal to Capped at 70% of the applicant‟s gross disposable

- 46. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 46 verifiable income emi and loan amount is calculated as per the surrogate. For all loan amounts greater than Rs 50000, debt burden capped at 70% of the monthly verifiable income. Rs 50000 where the emi and loan amount is calculated as per the Existing borrower Grid. For all loan amounts greater than Rs 50000, debt burden capped at 70% of the monthly verifiable income. Pls note: No debt burden for loan amounts greater than Rs 50000 subject to certain parameters, is detailed in separate section verifiable income 18 Corporate Lending N.A N.A · If the previous loan on Sales Finance and Auto is in the corporate name, the PL is offered only to the Partner/ Director who was the authorized signatory in the previous loan. NA 19 Guarantor N.A N.A N.A N.A

- 47. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 47 Note: Maximum finance amount till Rs. 200000 can be given subject to 70% debt burden cap, with approval from Credit & Risk Director or his designees (with relevant approval authority limits).

- 48. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 48 EXISTING BORROWER QUALIFYING GRID The finance amount an existing customer is eligible for, is worked-out based on the following grid : There should be no EMI bounces in the last 3 months and the account to be current as on date. Never beyond bucket 2 (60dpd) AHFS closures, write off cases with write off amount greater than Rs 500 and accounts beyond bucket 2 are not eligible. OLD LOAN CD/TW PL AUTO Pro-Credit N E W P E R S O N Performance (min months) - 4 9 4 14 M A X E M I Income Proof – ACTIVE 50% of monthly income OR 150% of EMI (whichever is greater) LESS current EMI 50% of monthly income OR 150% of EMI (whichever is greater) LESS current EMI Tenure <= 12 months – 50% of monthly income OR 125% of EMI (whichever is greater) LESS current EMI Tenure > 12 months – 50% of monthly income OR 150% of EMI (whichever is greater) LESS current EMI 50% of monthly income OR 150% of EMI (whichever is greater) LESS current EMI (if there are active loans)

- 49. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 49 L O A N A L L O A N Income Proof – CLOSED/ FORECLOSED 50% of monthly income OR 150% of EMI (whichever is greater) 50% of monthly income OR 150% of EMI (whichever is greater) 50% of monthly income OR 150% of EMI (whichever is greater) 50% of monthly income OR 150% of EMI (whichever is greater) No Income Proof – ACTIVE 150% of EMI LESS current EMI 150% of EMI LESS current EMI Tenure <= 12 months – 125% of EMI LESS current EMI Tenure > 12 months – 150% of EMI LESS current EMI 150% of EMI LESS current EMI No Income Proof – CLOSED/ FORECLOSED 150% of EMI 150% of EMI 150% of EMI 150% of EMI M A X A M T Loan <= 12,000 – 350% of previous finance amount OR Rs 60,000 (whichever is lesser) Loan > 12,000 – 300% of previous finance amount OR Rs 60,000 (whichever is lesser) Foreclosed after 6 months/net disbursal after 9 months – 150% of previous finance amount OR Rs 1,50,000 (whichever is lesser) Performance of 9 months – 75% of previous finance amount OR Rs 1,50,000 (whichever is lesser) Rs 1,00,000 Rs 1,00,000

- 50. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 50 Note: Existing customers who do not fall under the pre approved criteria mentioned above are referred for decision to the Credit Unit for a revised look at the case. Debt burden capped at 70% for all loan amounts greater than Rs 50000. Any finance amount deviation from the grid needs to be signed off by credit officer. Budget Analysis mandatory for all loan amounts greater than Rs50000 Any EMI deviation beyond 150% the previous emi (where no income proof is available)or 70% of Debt Burden is a credit policy deviation, which has to be signed off by Credit & Risk Director Applicants who have foreclosed the sales finance loan post 4 MOB of performance and personal loan post 6 MOB of performance only and loan not closed 6 months prior to new loan application, are eligible for PL under EB GRID

- 51. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 51 DOCUMENTS REQUIRED S. NO CRITERIA NEW BORROWER PROGRAM EXISTING BORROWER PROGRAM CORE PROGRAM and PL PLUS PROGRAM SURROGATE PROGRAM 4.1 Income proof Standard Income Tax return Form 16 Salary Certificate /slip from Government /reputed company Income tax clearance certificate Advance Tax Challan with Computation Intimation under section 143 of the IT Act Audited financials Non-Standard Pension Certificate Salary Credit in bank account other The following can be considered as surrogate income indicators § Last 6 months Bank statements/track record evidence of repayment to previous financier (Min 6month MOB) § Debt Consolidation - latest 2 months Credit Card statement & photocopy of both sides of the credit Card. § Mobile phone Subscriber-Latest 3 months mobile bill § Payroll/salary credits/ average balance in Suvidha a/c for Suvidha Latest Income proof to be obtained for Loan amount greater than Rs 50000/- (Ref to list for Core Program)

- 52. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 52 than Suvidha Account. Salary Certificate from a not very known and reputed company (Ref to Section on acceptability criteria for Income documents) customers. (Applicable for loan amounts till Rs 50000). Latest Income proof to be obtained for Loan amounts greater than Rs 50000. Refer to list for the Core program 4.2 Address proof Standard Ration Card Utility Bills not older than 90 days from application date Life insurance policy paid premium receipt of latest year Passport Voters ID Card Registered Rent deed/company lease House Allotment letter from the Government/Registered societies Property papers Property registered deed Non-Standard Latest Credit card statements (last 2 months) Bank Passbook Gas bill Declaration on company letter head for Government/Semi government undertakings and known public limited companies Latest Bank statements ( last 2 months bank statements)/Latest updated bank passbook Mobile phone bill postpaid (last 2 months bills) RC Copy of 4W in applicant‟s name Driving License

- 53. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 53 S. NO CRITERIA NEW BORROWER PROGRAM EXISTING BORROWER PROGRAM CORE PROGRAM and PL PLUS SURROGATE PROGRAM 4.3 Identity Proof Standard Passport Voters ID Driving License Photo Credit Card Pan Card Employee Identity card issued by Government/ reputed Public limited and Private limited companies Employee State insurance medical cards with photographs Medical Insurance cards from Public sector insurance companies with photographs Trade license/professional license (e.g sales tax no, importer exporter code)with applicant‟s photograph Armed Forces ID card Non-standard Photo attested from Bank School/College Certificate showing Date of Birth Form 49(a) for Pan Card application Ration card with applicant‟s photo Certified birth/marriage certificate Bank passbook with applicant‟s photograph on the same which is duly attested Property registered deed with applicant‟s photograph Employee photo ID card from recognized company(Any company which is listed with NSE/BSE or any recognized stock exchange of India) Vehicle (car) registration certificate with applicant‟s photograph 4.4 Photograph Mandatory for all applicants Mandatory for all applicants N.A 4.5 Bank Statements Bank statements for the last 3 months Bank statements for the last 3 months Not Applicable

- 54. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 54 from the date of application. Cover page of bank statements/passbook mandatory. Bank account should be in existence for minimum 06 months from the date of application from the date of application. Cover page of bank statements/passbook mandatory. Bank account should be in existence for minimum 06 months from the date of application For income surrogate program Bank statement to reflect repayment to prior lender (to be atleast 6 months on books). Not mandatory if genuine track record is provided 4.6 Loan Application & Agreement Fully completed and signed by the customer Fully completed and signed by the customer Fully completed and signed by the customer 4.7 PDCs ECS For the entire tenor of the loan To be issued from a maximum of 2 accounts Signatures to match with the Loan agreement and the application form PDCs can be provided from current account of proprietorship firm along with proprietorship declaration. PDCs can also be provided from partnership firm a/c or company a/c along with partnership deed + NOC from partners /Board resolution from company. PDCs from a joint account (applicant-father, applicant- mother, applicant-spouse) acceptable with signature verification from the bank ECS mandate to be completely filled in and signed/stamped by the bank Non-standard document and documents older than from as specified in table, can be accepted by Credit Officers with specific approval authority on Personal Loans. Documents list will be updated from time to time with Credit and Risk Director‟s approval.

- 55. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 55 ACCEPTABILITY CRITERIA FOR INCOME PROOF DOCUMENTS S.No. Documents Acceptability Criteria 1 Income Tax Return § Should be in applicant‟s name § Income tax return should be filed from the same city as of loan application § Any one of last 2 years ITR is acceptable. Only agricultural income or income from other sources is not acceptable. § Income under the head business/profession, Salary, others, property and agriculture is acceptable and can be clubbed. § Income from short term and long term gains and Interest income is not considered. § ITR should bear the ITO stamp with ward/range number and date mentioned in the same and the acknowledgement number written in hand or hard coded in black § It should have been signed by the applicant § 2 years ITR‟s can be filed on the same date in the same year 2 Form 16 § Has to be latest. § It should bear original stamp of the company and signed by the authorized signatory. § Company issuing a Form 16 should have TAN number. § It should give details on gross salary , standard deductions, investments made for tax rebate, tax deducted at source deposited in which bank on what date 3 Salary Slip § Any one of last 2 months salary slip is acceptable. § It should provide details on gross salary deductions and net salary. § Computerized /statement in standard format , does not require a signature. § Salary slip is never on a letterhead

- 56. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 56 4 Salary Certificate § Salary certificate cannot be older than 90 days from the time of loan application § It should be signed and stamped by the company. § It can be on the company letterhead or plain stationery and is always addressed to “whom so ever it may concern”. § Salary certificate of known Government/Semi Government/Public limited companies is acceptable 5 ITCC § Any one of last 2 years ITCC is acceptable. § Has to be signed and stamped by the Income tax office 6 Advance Tax Challan § It has to be the latest (Last quarter‟s). § Should have the IT seal and details of income tax paid. § Should have a computation attached 7 Intimation under Section 143 of the IT Act § Any one of last 2 years is acceptable § Should have the signature and seal of IT office 8 Audited Financials § Any one of last 2 years is acceptable § Balance sheet/Profit and loss statements along with schedules are required § Auditor‟s report and auditor‟s stamp and signature required on all statements § Corporate should have positive cash flow 9 Pension Certificate (Non- standard) § Document from the Government body from where the applicant has retired giving details on pension entitlement along with last 3 months Bank statements showing pension credit in the bank ACCEPTABILITY CRITERIA FOR IDENTITY PROOF DOCUMENTS S No Documents Acceptability criteria 1 Passport § Should be in applicant‟s name

- 57. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 57 § Should be valid for next 3 months from the date of application § Should confirm applicant‟s identity through the photograph, signature, Date of Birth and addresses. § Check for the passport number and place of issue 2 Voter‟s ID card § Should be in applicant‟s name § Photograph on the same should identify the applicant § Check for father‟s/spouse name, applicant‟s age and date of issue § Check for unique alphanumeric ID card no on top of the photograph. For all cards issued from 1996 bears the same number on the backside of the card. § Check for applicant‟s address and issuing body‟s hologram seal and signature with year of issue. § Please check that the printing has been done on the back and front of the same paper, not two papers joined together with the glue 3 Driving License § Should be in applicant‟s name, photograph on the same should validate the customer identity. § Check for the validity date, applicant‟s signature and issuing authority stamp § Check for DL no, father‟s name/spouse‟s name and Date of birth. § DL not laminated should have the photograph attested by the RTO. Laminated DL will not have the stamp 4 Photo credit card § Should be in applicant‟s name. § Check for the photo and signature which should be specific to the applicant § Check for the credit card no and validity period. § Expiry date should not be another 3 months from the loan application date. § Should have been issued at at least 1 year

- 58. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 58 from the loan app date 5 PAN card Issued by Government of India to all with taxable/non taxable income .It stands for Permanent Account number .PAN no is a unique 10 digit alphanumeric number mentioned on top of the card. The 5th character of the number is the first letter of the first name or the last name. 4th character is indicative of the kind of entity who ah been issued the card. P stands for Individual,C stands for company,H for HUF and F for partnership firm. Verify the applicant‟s photo, signature, Date of birth ,father‟s/spouse name with the information available with us 6 Employee ID card issued by Government/semi Government companies/Armed forces Check for Applicant‟s photograph, Employee Code. Company Seal And Signature with validity period. The same needs to be cross verified with application form ,cpv and tvr done at the office 7 Employee state insurance medical card with photo Check for the policy no, applicant‟s photo and validity period. 8 Medical insurance cards from Public sector insurance companies with photo Check for The policy number Applicant‟s photo should validate the individual. Validity Period. 9 Trade License/Professional license Check for License code Date of issue, Type of business whether same correlates with application form and verification, Applicant‟s photograph on the same should validate Non standard documentation 1 Ration card with photo Ration card should be at the applicant‟s current residence address as given in the application form

- 59. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 59 Photograph should validate the applicant and should be attested by gazetted officer/authorized signatory. Pls keep in mind that photograph on the ration card can only be of the Head of the Family 2 Bank passbook with applicant‟s photo attested on the same Bank passbook to be in applicant‟s name. It should give his name and account number Photograph on the same should validate applicant and have the seal and stamp of the bank. Seal stamp should partly be on the photograph and the surface 3 Property registered deed with applicant‟s photograph attested Property registration documents on the stamp papers bearing applicant‟s photograph and signature 4 Employee photo ID card from recognized company Check company status Check for applicant‟s photograph, name, designation, employee code and company name and logo. Some of the firms also mention the residence address on the backside 5 Vehicle (car) registration certificate with applicant‟s photograph RC to be in applicant‟s name and photo to validate the applicant. Please TRANSACTION PROCESS – NEW BORROWER Note: N stands for No Y stands for Yes Personal Discussion and Budget Analysis has to be done by a PL Officer/Credit Officer.

- 60. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 60 Final approval to be done by PL Officer/Credit Officer with specific approval authorities as per credit authority delegation matrix. Deviations in each credit step( negative cpv, negative tvr, negative dedupe etc) can only be signed of by a Credit officer/Manager/Credit Head

- 61. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 61

- 62. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 62 TRANSACTION PROCESS – EXISTING BORROWER

- 63. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 63

- 64. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 64 ANALYSIS & INTERPRETATION ANALYSIS & INTERPRETATION

- 65. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 65 LIMITATIONS: Analysis has been made for each & every question given in the questionnaire. Mainly analysis has been done for the sample of 50 covering Dharwad. This analysis represents only of Dharwad. Therefore the findings will show the picture of Dharwad only. To have an in-depth analysis of the sample, the sample of 50 has been classified into 3 groups by using household income as classification data. Therefore the analysis will not only show the picture of the whole sample together but it will also show the picture of each group separately within the sample. On the basis of analysis, interpretation has been made for the whole sample as well as for each group within the sample. Type of questions: Dichotomous questions: options given were: Agree (it means customer is satisfied) Don‟t agree (it means the customer is unsatisfied) Can‟t say Type of questions: Balanced scaling questions: Here the customer is required to rate on a scale of 1 to 3 including 1 & 3. Rating of 1 means that the customer is unsatisfied Rating of 2 means that the customer is neither unsatisfied nor satisfied.. Rating of 3 means that the customer is satisfied.

- 66. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 66 CLASSIFICATION OF SAMPLE (TOTAL SAMPLE:50) The whole sample of 50 has been divided into 3 groups, using household income as classification data. Following are the 3 groups: Group 1: It consists of customers having household income of less than 5000. The total strength of this group is 15. Group 2: It consists of customers having household income in the range between 5000 to 10000. The total strength of this group is 25. Group 3: It consists of customers having household income of more than 10000. The total strength of this group is 10. In the following pages you will encounter some tables & pie charts for each of the topic separately, being covered in the questionnaire. For each topic there will be one table showing responses of each group separately & combined together which forms the total sample of 50. Apart from this there will be 4 pie charts for each topic. While the first pie chart will show the responses of all groups taken together where as the other 3 will show the responses of each group separately.

- 67. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 67 1. Customers age group 0 1 2 3 4 5 6 18-25 25-35 35-45 45-55 55-65 G1 G2 G3 Maximum age group of the customers is between 25 to 35. 2. Income Group of the customers Number 0 5 10 15 20 25 30 Below 5000 5000-10000 Above 10000 Number maximum number of customers would fall in the income category of 5000-10000 p.m.

- 68. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 68 3. CUSTOMER SATISFACTION REGARDING OVERALL SERVICE OF CITIFINANCIAL. Ratings G 1 freq G 1 per G 2 freq G 2 per G 3 freq G 3 per Total freq Tot al per 1 8 53.33 3 12 1 10 12 24 2 5 33.33 10 40 2 20 17 34 3 2 13.33 12 48 7 70 21 42 Total 15 25 10 50 100 NOTE: ‘G’ means group, ‘freq’ means frequency & ‘per’ means percentage CUSTOMER SATISFACTION-TOTAL SAMPLE 24% 34% 42% 1 2 3 Only 42% of the total sample of customers is satisfied with the overall service of Citifinancial.

- 69. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 69 customer satisfaction-group 1 54%33% 13% 1 2 3 In group 1, only 13% of the customers are satisfied with the overall service of Citifinancial. customer satisfaction-group 2 12% 40% 48% 1 2 3 In group 2, the situation is somehow better than group 1 as here, about 48% of the customers are satisfied with the overall service of Citifinancial. customer satisfaction-group 3 10% 20% 70% 1 2 3 In group 3, about 70% of the customers are satisfied. This shows the higher income customers are much more satisfied than the lower end customers as group 3 denotes higher end whereas group 1 denotes lower ed customers.

- 70. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 70 4. CUSTOMER OPINION REGARDING CITIFINANCIAL’S ABILITY TO KEEP UP ITS PROMISES CUSTOMER OPINION-TOTAL SAMPLE 74% 24% 2% 1 2 3 It shows that about 74% of the total sample of customers agrees with the fact that citifinancial was able to keep up its promises. STATEMENT G 1 freq G 1 per G 2 freq G 2 per G 3 freq G 3 per Total freq Total per Agree(1) 6 40 22 88 9 90 37 74 Don’t (2) agree 8 53.33 3 12 1 10 12 24 Can’t (3) say 1 6.66 - 0 - 0 1 2 Total 15 25 10 50

- 71. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 71 customer opinion-group 1 40% 53% 7% 1 2 3 In group 1, only 40 % customers agree with the fact that citifinancial was able to keep up its promises. customer opinion-group 2 88% 12% 0% 1 2 3 In group 2, as against group 1, a staggering 88% customers agree with the fact that citifinancial was able to keep up its promises. customer opinion-group 3 90% 10% 0% 1 2 3 I group 3, about 90% customers agree with the fact that citifinancial was able to keep up its promises. This again shows that high income group customers (group 3) are much

- 72. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 72 more satisfied with Citifinancial than the low income group customers (group 1), as 90% customers of group 3 support the above statement as against a mere 40% customers of group 1 who support the above statement. 5. CUSTOMER OPINION REGARDING CITIFINANCIAL’S ABILITY TO MEET ITS CUSTOMERS’ NEEDS CUSTOMER OPINION-TOTAL SAMPLE 70% 28% 2% 1 2 3 STATEMENT G 1 freq G 1 per G 2 freq G 2 per G 3 freq G 3 per Total freq Total per Agree(1) 5 33.33 21 84 9 90 35 70 Don’t (2) Agree 9 60 4 16 1 10 14 28 Can’t (3) Say 1 6.66 - 0 - 0 1 2 Total 15 25 10 50

- 73. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 73 It shows that about 70% of the total sample of customers agrees with the fact that Citifiancial was able to meet their personal needs. customer opinion-group 1 33% 60% 7% 1 2 3 In group 1, only 33% of the customers agree with the fact that Citifinancial was able to meet their personal needs. customer opinion-group 2 84% 16% 0% 1 2 3 In group 2, as against group 1, a staggering 84% of the customers agree with the fact that Citifinancial was able to meet their personal needs. customer opinion-group 3 90% 10% 0% 1 2 3 In group 3, about 90% customers agree with the fact that citifinancial was able to meet their personal needs. This again shows that high income group customers (group 3) are

- 74. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 74 much more satisfied with Citifinancial than the low income group customers (group 1), as 90% customers of group 3 support the above statement as against a mere 33% customers of group 1 who support the above statement. 6. CUSTOMER OPINION REGARDING CITIFINANCIAL AS A TRUST WORTHY BANK CUSTOMER OPINION-TOTAL SAMPLE 74% 24% 2% 1 2 3 It shows that about 74% of the total sample of customers agrees that Citifinancial is a trustworthy bank. STATEMENT G 1 freq G 1 per G 2 freq G 2 per G 3 freq G 3 per Total freq Total per Agree(1) 6 40 22 88 9 90 37 74 Don’t (2) agree 8 53.33 3 12 1 10 12 24 Can’t (3) Say 1 6.66 - 0 - 0 1 2 Total 15 25 10 50

- 75. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 75 customer opinion-group 1 40% 53% 7% 1 2 3 In group 1, only 40 % customers agree with the fact that Citifinancial is a trustworthy bank. customer opinion-group 2 88% 12% 0% 1 2 3 In group 2, as against group 1, 88% customers agree with the fact that Citifinancial is a trustworthy bank. customer opinion-group 3 90% 10% 0% 1 2 3

- 76. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 76 I group 3, about 90% customers agree with the fact that citifinancial is a trustworthy bank. This again shows that high income group customers (group 3) are much more satisfied with Citifinancial than the low income group customers (group 1), as 90% customers of group 3 support the above statement as against a mere 40% customers of group 1 who support the above statement. 7. CUSTOMER SATISFACTION REGARDING TIME TAKEN FOR LOAN APPROVAL Ratings G 1 freq G 1 per G 2 freq G 2 per G 3 freq G 3 per Total freq Total per 1 - 0 - 0 - 0 - 0 2 3 20 5 20 - 0 8 16 3 12 80 20 80 10 100 42 84 Total 15 25 10 50

- 77. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 77 CUSTOMER SATISFACTION-TOTAL SAMPLE 0% 16% 84% 1 2 3 It shows that 84% of the total sample customers are satisfied with the time taken for loan approval by Citifinancial. customer satisfaction-group 1 0% 20% 80% 1 2 3 About 80% customers of both groups 1 & 2 are satisfied with the total time taken by Citifinancial for loan approval.

- 78. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 78 customer satisfaction-group 3 0% 0% 100% 1 2 3 As against group 1 & 2, 100% customers of group 3 are satisfied with the total time taken by Citifinancial for loan approval. 8. CUSTOMER SATISFACTION REGARDING EMI SCHEMES OFFERED BY CITIFINANCIAL Ratings G 1 freq G 1 per G 2 freq G 2 per G 3 freq G 3 per Total freq Total per 1 2 13.33 2 8 - 0 4 8 2 3 20 8 32 2 20 13 26 3 10 66.66 15 60 8 80 33 66 Total 15 25 10 50

- 79. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 79 CUSTOMER SATISFACTION-TOTAL SAMPLE 8% 26% 66% 1 2 3 It shows that about 66% of the total sample customers are satisfied with the EMI schemes offered by Citifinancial. customer satisfaction-group 1 13% 20% 67% 1 2 3 In group 1, about 67% customers are satisfied with the EMI schemes offered by Citifinancial. customer satisfaction-group 2 8% 32% 60% 1 2 3 In group 2, about 60% customers are satisfied with the EMI schemes offered by Citifinancial.

- 80. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 80 customer satisfaction-group 3 0% 20% 80% 1 2 3 As against group 1 & 2, about 80% customers of group 3 satisfied with the EMI schemes offered by Citifinancial, indicating that they are the most satisfied among all groups, with Citifinancial. 9. CUSTOMER SATISFACTION REGARDING INTEREST RATE CHARGED BY CITIFINACIAL Ratings G 1 freq G 1 per G 2 freq G 2 per G 3 freq G 3 per Total freq Total per 1 10 66.66 14 56 3 30 27 54 2 5 33.33 8 32 6 60 19 38 3 - 0 3 12 1 10 4 8 Total 15 25 10 50

- 81. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 81 CUSTOMER SATISFACTION-TOTAL SAMPLE 54%38% 8% 1 2 3 It shows a mere 8% of the total sample customers are satisfied with the interest rate being charged by Citifinancial. & about 54% customers are unsatisfied with it. customer satisfaction-group 1 67% 33% 0% 1 2 3 In group 1, a high of 67% customers are dissatisfied with the interest rate being charged by Citifinancial. The interesting thing is that not even a single customer is satisfied. customer satisfaction-group 2 56%32% 12% 1 2 3

- 82. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 82 Here also the scene is not so good as 56% customers of group 2 are dissatisfied with the interest rate being charged by Citifinancial. customer satisfaction-group 3 30% 60% 10% 1 2 3 In group 3, though only 30% customers are dissatisfied but on the other had only 10% are satisfied with the interest rate being charged by Citifinancial. This shows that majority of the customers across all groups are dissatisfied with the interest rate being charged by Citifinancial. 10. CUSTOMER SATISFACTION REGARDING PROCESSING FEES CHARGED BY CITIFINANCIAL Ratings G 1 freq G 1 per G 2 freq G 2 per G 3 freq G 3 per Total freq Total per 1 10 66.66 14 56 3 30 27 54 2 5 33.33 8 32 6 60 19 38 3 - 0 3 12 1 10 4 8 Total 15 25 10 50

- 83. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 83 CUSTOMER SATISFACTION-TOTAL SAMPLE 54%38% 8% 1 2 3 It shows a mere 8% of the total sample customers are satisfied with the processing fees being charged by Citifinancial. & about 54% customers are dissatisfied with it. customer satisfaction-group 1 67% 33% 0% 1 2 3 In group 1, a high of 67% customers are dissatisfied with the processing fees being charged by Citifinancial. The interesting thing is that not even a single customer is satisfied.

- 84. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 84 customer satisfaction-group 2 56%32% 12% 1 2 3 In group 2 also 56% customers are dissatisfied with the processing fees being charged by Citifinancial. customer satisfaction-group 3 30% 60% 10% 1 2 3 In group 3, though only 30% customers are dissatisfied but on the other had only 10% are satisfied with the processing fees being charged by Citifinancial. This shows that majority of the customers across all groups are unsatisfied with the interest rate being charged by Citifinancial.

- 85. CUSTOMER SATISFACTION AND CREDIT PROCEDURE STUDY OF CITIFINANCIAL PERSONAL LOANS Babasabpatilfreepptmba.com Page 85 11. NUMBER OF CUSTOMERS WHO FACED ANY INCONVENIENCE FOR GETTIG IN TOUCH WITH ANY CITIFIANCIAL PERSOAL LOAN OFFICER OR THE CONCERNED AGENT FOR ENQUIRY REGARDING STATUS OF PROCESSING OF LOAN Out of a sample of 50, not even a single customer faced any inconvenience In getting in touch with any Citifinancial personal officer or the concerned agent.